Sunday Feb 15, 2026

Sunday Feb 15, 2026

Tuesday, 25 May 2021 00:46 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

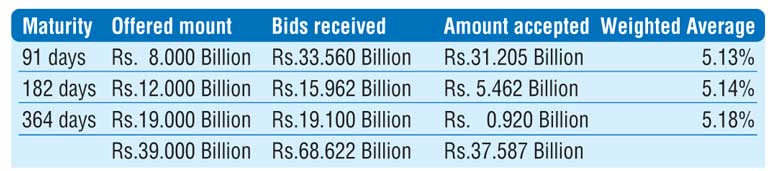

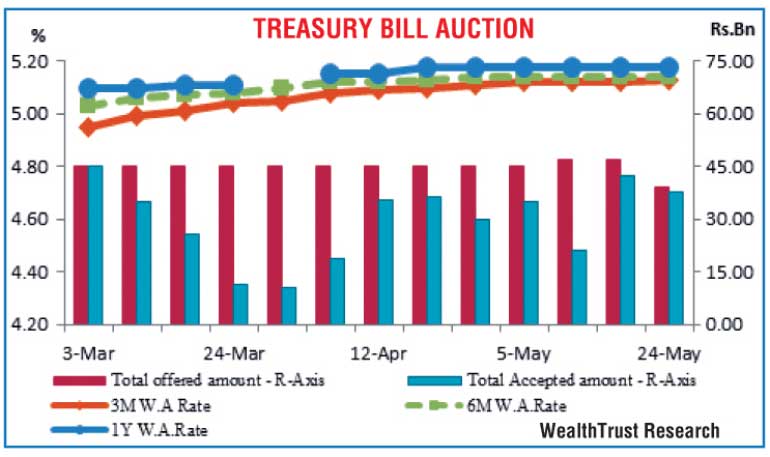

The positive sentiment at the weekly Treasury bill auctions continued yesterday as well, with the total accepted volume increasing to 96.38% of its total offered volume against its previous weeks 90.28%.

The 91-day bill continued to lead the way with an accepted volume of Rs. 31.20 billion or 83.02% of the total accepted volume. The weighted average rate on the 91-day maturity increased by one basis point to 5.13%, while the weighted averages on the 182-day and 364-day bills remained steady at 5.14% and 5.18% respectively. The bids-to-offer ratio increased further to 1.76:1.

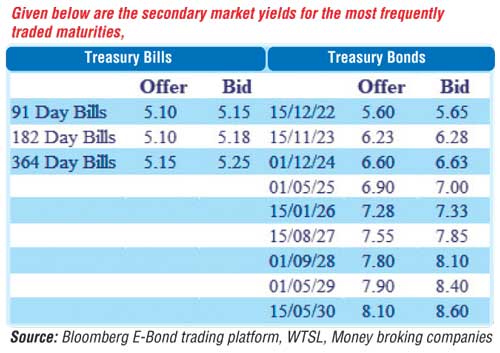

In the secondary bond market, activity remained moderated yesterday with only the 15.11.22 and 15.11.23 maturities changing hands at levels of 5.63% and 6.25% respectively. In secondary market bills, 20 August 2021 changed hands at a level of 5.10%.

The total secondary market Treasury bond/bill transacted volume for 21 May was Rs. 2 billion.

In the money market, the overnight net surplus liquidity was registered at Rs. 120.57 billion yesterday, while the weighted average rates on overnight call money and repo was recorded at 4.67% and 4.72% respectively.

USD/LKR

In Forex markets, the overall market continued to remain inactive. The total USD/LKR traded volume for 21 May was $ 80 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)