Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 8 November 2021 02:10 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

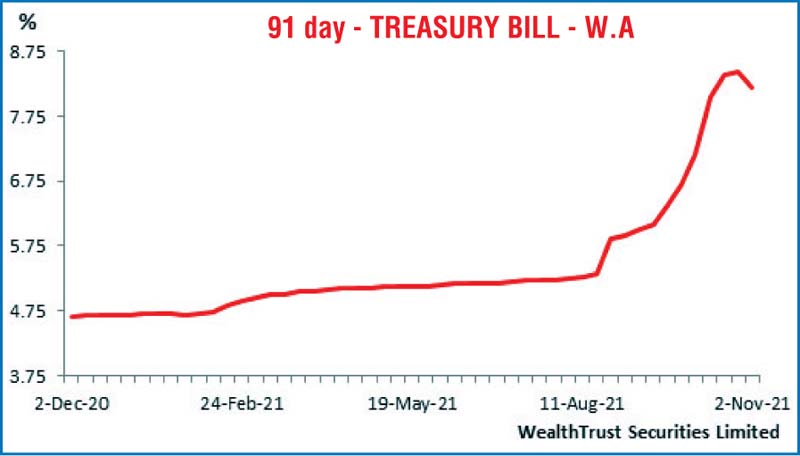

The positive sentiment in the primary Treasury bill market continued for a second consecutive week ending 5 November as the 91-day bill weighted average rate at the weekly Treasury bill auction was seen declining for the first time in 40 weeks, recording a considerable drop of 25 basis points to 8.18%.

The positive sentiment in the primary Treasury bill market continued for a second consecutive week ending 5 November as the 91-day bill weighted average rate at the weekly Treasury bill auction was seen declining for the first time in 40 weeks, recording a considerable drop of 25 basis points to 8.18%.

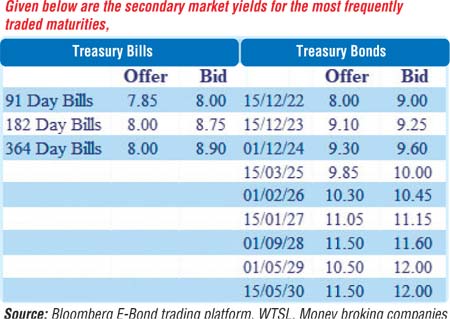

The demand was also witnessed in the secondary bill market with early to late January 2022 maturities along with the latest 91-day bill changings hands at lows of 7.55%, 7.75% and 7.78% respectively during the week.

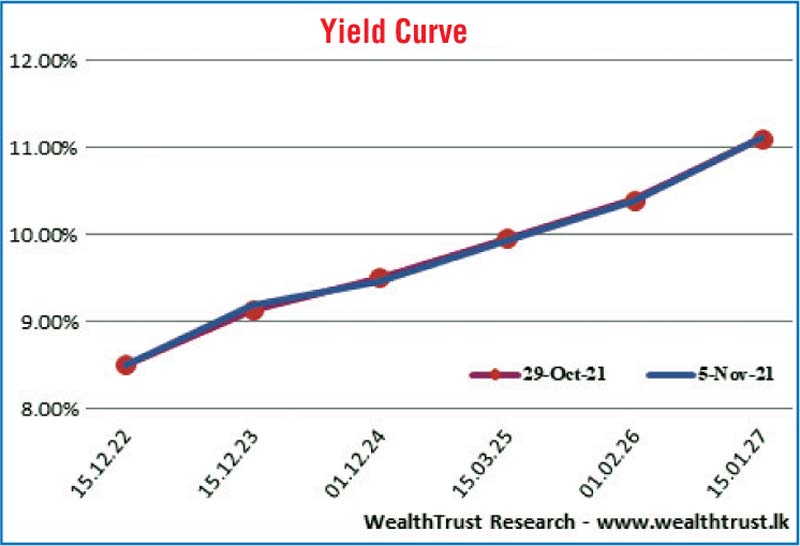

Nevertheless, activity in the secondary bond market moderated during the week as most market participants continued to be on the sidelines. Limited activity was witnessed on the maturities of 15.01.27, 01.09.28 and 15.05.30 at levels of 11.09% to 11.13%, 11.55% to 11.65% and 11.75% to 11.76% respectively.

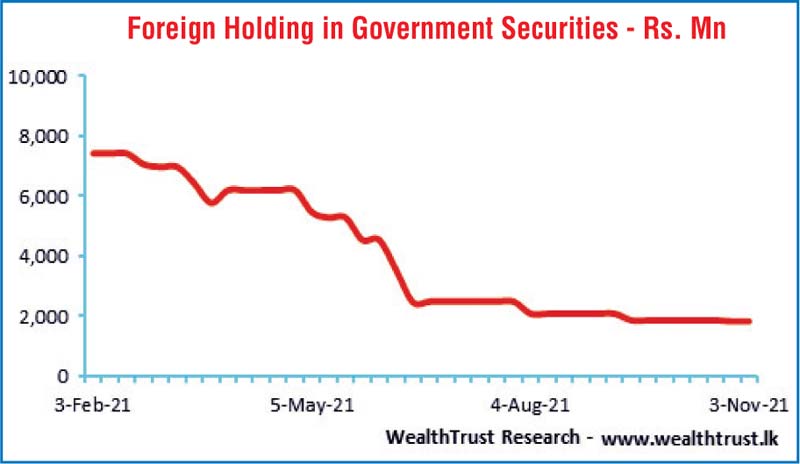

The foreign holding in rupee bonds remained mostly unchanged at Rs. 1.83 billion for the week ending 3 November while the daily secondary market Treasury bond/bill transacted volumes for the first two trading days of the week averaged Rs. 4.65 billion.

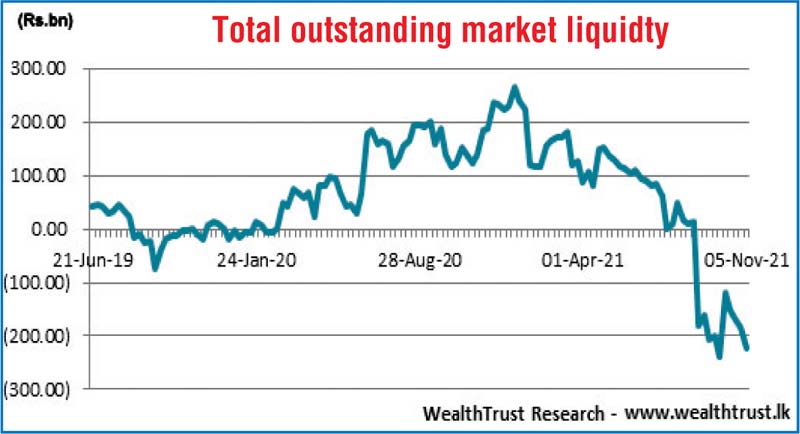

In money markets, The Domestic Operations Department (DOD) of Central Bank drained out liquidity during the week by way of overnight to seven day repo auctions at weighted average yields ranging from 5.95% to 6% while the total outstanding liquidity shortage at the end of the week stood at Rs. 222.50 billion against its previous weeks Rs. 183.95 billion.

The weighted average rates on overnight call money and repo was 5.93% and 5.96% respectively for the week while CBSL’s holding of Government securities decreased marginally to Rs. 1,460.55 billion.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts continued to trade at Rs. 202.97 to Rs. 203 during the week while overall activity remained moderate.

The daily USD/LKR average traded volume for the first three trading days of the week stood at $ 58.18 million.

(References: Central Bank of Sri Lanka, Bloomberg e-bond trading platform, money broking companies)