Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 1 June 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The positive momentum in the secondary bond market continued during the week ending 29 May as the weekly Treasury bill auction produced steady outcomes.

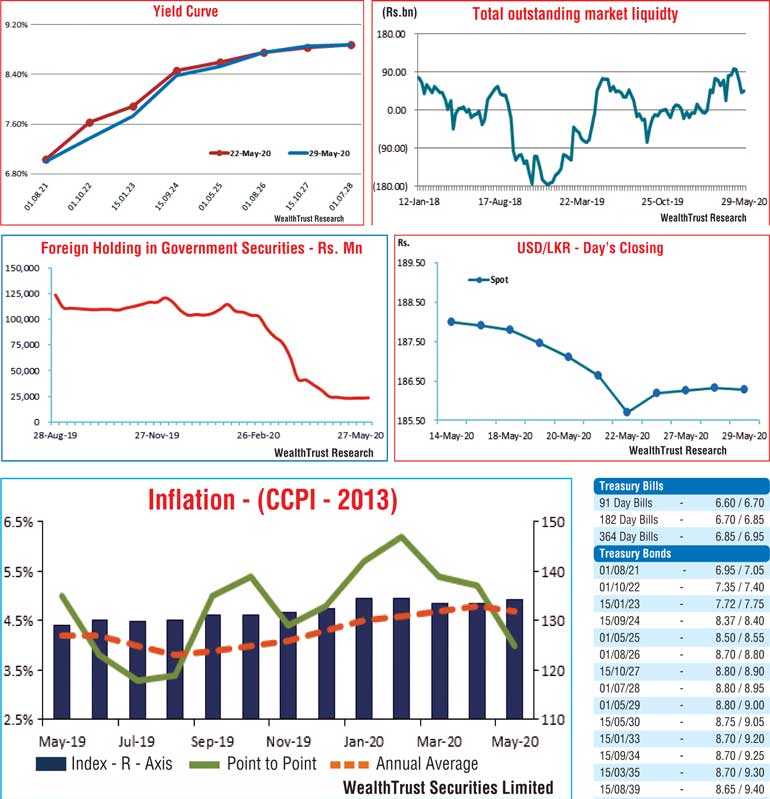

Yields were seen closing the week lower in comparison to its previous week’s closings, subsequent to fluctuating during the week. Buying interest mainly centred on the very short end of the curve, consisting of the liquid maturities of 01.10.22 and 15.01.23, as its yields dipped to weekly lows of 7.38% and 7.75%, respectively, against its week’s highs of 7.60% and 7.90%. Furthermore, liquid maturities of 2024’s (i.e. 15.06.24 & 15.09.24), 01.05.25 and 15.10.27 were seen changing hands within weekly highs of 8.45%, 8.47%, 8.55% and 8.90%, respectively, to lows of 8.35% each, 8.48% and 8.80%. In addition, maturities of 2021’s (i.e. 01.05.21, 01.08.21, 15.10.21 &15.12.21), 01.07.22, 2023’s (i.e. 15.03.23, 15.07.23, 01.09.23 & 15.12.23), 2024’s (i.e. 01.01.24 & 01.08.24) and 2025’s (i.e. 15.03.25 & 01.08.25) traded at levels of 6.92% to 7.20%, 7.40% to 7.42%, 7.85% to 8.10%, 8.26% to 8.45% and 8.56% to 8.63%, respectively.

In the bill market, July to December maturities were seen changing hands at levels of 6.62% to 6.85% while January 2021 and May 2021 maturities changed hands at levels of 6.86% and 6.90%, respectively.

The foreign holding in rupee bonds recorded an marginal inflow of Rs. 0.3 billion for the week ending 27 May while the Colombo Consumer Price Index (CCPI) for the month of May decreased for a third consecutive month to 4.0% on its point to point, when compared against its previous month’s figures of 5.2%. Its annual average decreased as well to 4.7% from 4.8%.

The daily secondary market Treasury bond/bill transacted volumes for the first three days of the week averaged Rs. 12.15 billion.

In money markets, the Domestic Operations Department (DOD) of the Central Bank refrained from conducting any auction during the week expect for Friday where it injected an amount of Rs. 5 billion for Standalone Primary Dealers by way of a six-day reverse repo auction at a weighted average rate of 6.43%.

The overall money market liquidity increased to record a surplus of Rs. 45.27 billion against its previous week’s surplus of Rs. 40.93 billion. The weighted average yields on overnight call money and repo rates averaged 5.87% and 5.92%, respectively, for the week.

Rupee loses during the week

In the Forex market, the USD/LKR rate on spot contracts were seen deprecating during the week to hit a weekly low of Rs. 186.35 before closing the week at levels of Rs. 186.20/35 and against its previous weeks closing levels of Rs. 185.60/80 on the back of buying interest by banks. The daily USD/LKR average traded volume for the first three days of the week stood at $ 62.50 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)