Saturday Feb 21, 2026

Saturday Feb 21, 2026

Wednesday, 30 May 2018 01:14 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The positive outcome of the Treasury bond auctions held on Monday reflected favourably on the secondary bond market, as activity picked up following the auction outcome. The 4 year 9 month maturity of 15.03.2023 and the 9 year 9 month maturity of 15.03.2028 recorded weighted averages of 10.51% and 10.72% respectively against its pre-auction secondary market yields of 10.40/46 and 10.70/85. The total offered amount of Rs. 90 billion was fully accepted with the bids to offer ratio recording at 2.43:1.

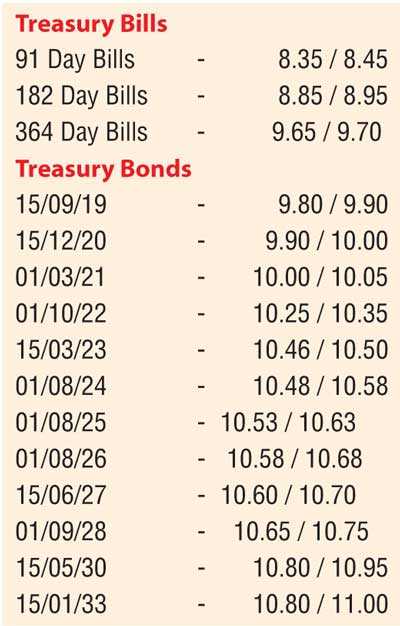

In the secondary bond market, activity increased with the two 2021 maturities (i.e. 01.08.21 and 15.12.21) and the 15.03.23 maturity changing hands at levels of 10.10% to 10.15% and 10.46% to 10.53% respectively pre-auction and post auction.

Today’s, weekly Treasury bill auction, will have on offer a total amount of Rs. 12 billion consisting of Rs. 3 billion on the 91 day, Rs. 4 billion on the 182 day and Rs. 5 billion on the 364 day maturities. At last week’s auction, the weighted averages increased across the board to 8.37%, 8.94% and 9.73% respectively on the 91, 182 and 364 day maturities.

The total secondary market Treasury bond transacted volume for 25 May 2018 was Rs. 1.17 billion.

In money markets, the OMO (Open Market Operations) Department of the Central Bank of Sri Lanka was seen draining out an amount of Rs. 5 billion on an overnight basis by way of a Repo auction at a weighted average of 7.40% as the net liquidity surplus in the system increased to Rs. 6.04 billion. The overnight call money and repo rates averaged 7.93% and 7.88% respectively.

Rupee appreciates marginally

In the Forex market, the USD/LKR rate on the spot contract appreciated marginally to close the day at Rs. 157.95/00 against its previous day’s closing levels of Rs. 158.10/20 on the back of selling interest by banks.

The total USD/LKR traded volume for 25 May 2018 was $ 68.75 million.

Some of the forward USD/LKR rates that prevailed in the market were one month – 158.70/90; three months – 160.25/35 and six months – 162.40/55.