Saturday Feb 21, 2026

Saturday Feb 21, 2026

Friday, 21 May 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The trading day commenced with the Central Bank of Sri Lanka continuing its accommodative monetary policy stance by holding its policy rates of Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) steady at 4.50% and 5.50% respectively for a seventh consecutive announcement yesterday. Following the announcement, continued selling interest led to secondary market bond yields increasing for a second consecutive day on the back of moderate activity yesterday.

4.50% and 5.50% respectively for a seventh consecutive announcement yesterday. Following the announcement, continued selling interest led to secondary market bond yields increasing for a second consecutive day on the back of moderate activity yesterday.

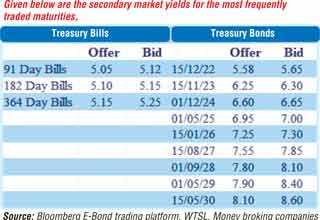

The liquid maturities of 15.05.23, 15.11.23 and 01.12.24 saw its yields hit intraday highs of 6.06%, 6.27% and 6.64% respectively against its previous day’s closing levels of 6.05/10, 6.25/27 and 6.58/63. In addition, 01.02.26, 01.07.28 and 15.05.30 maturities changed hands at level of 7.25% to 7.32%, 7.97% and 8.10% respectively as well. Meanwhile in secondary market bills, durations centering August and October 2021 maturities changed hands at levels of 5.00% to 5.12% and 5.15% respectively.

The total secondary market Treasury bond/bill transacted volume for 19 May was Rs. 36.49 billion.

In the money market, weighted average rates on overnight call money and repo remained steady at 4.67% and 4.68% respectively, while the overnight surplus liquidity was registered at Rs. 126.95 billion yesterday.

USD/LKR

In Forex markets, the overall market continued to remain inactive. The total USD/LKR traded volume for 19 May was $ 61.25 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)