Sunday Feb 15, 2026

Sunday Feb 15, 2026

Monday, 6 April 2020 02:14 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

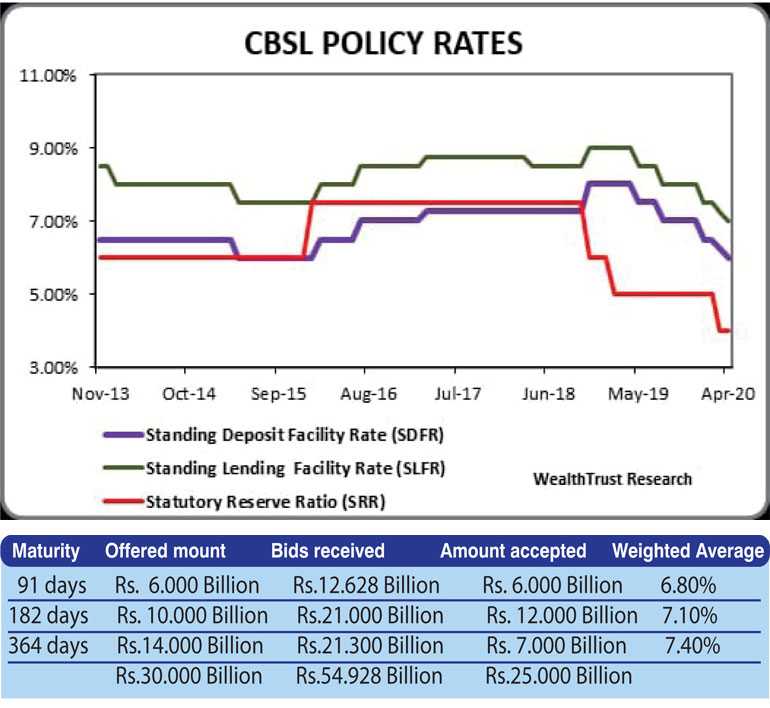

The Central Bank of Sri Lanka cut its policy rates by 25 basis points at an announcement made on 3 April. This led to its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility (SLFR) dropping to 6.00% and 7.00% respectively, effective from the close of business on 3 April.

Meanwhile, the overall activity in the secondary bond market continued in moderate pace during the week ending 3 April as yields were seen increasing week on week for the first time in three weeks on the back of foreign selling interest.

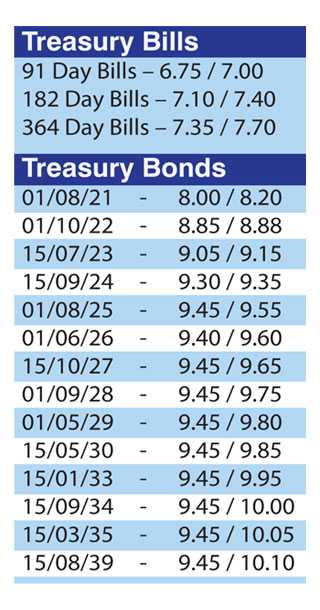

The limited activity centred on the 2023s (i.e. 15.07.23 and 15.12.23) and 2024s (i.e. 15.03.24, 15.06.24 and 15.09.24) as its yields were seen increasing to weekly highs of 9.40%, 9.45%, 9.60%, 9.40% and 9.45% respectively against its previous weeks closing levels of 8.90/00, 8.95/10, 9.10/15 and 9.12/18 each.

However, buying interest at these levels curtailed any further upward movement. In addition, the maturities of 2021s (i.e. 01.05.21 and 15.10.21), 01.10.22, 01.08.25 and 15.10.27 were traded at levels of 8.25% to 8.50%, 8.85% to 8.90%, 9.70% to 9.85% and 9.55% respectively as well to record a parallel shift upwards of the yield curve, week on week.

Nevertheless the weighted averages of the weekly Treasury bill auction decreased across the board for a third consecutive week by 20, 15 and 10 basis points on the 91-day, 182-day and 364-day maturities respectively to 6.80%, 7.10% and 7.40%. The continued demand was also witnessed in the secondary bill market with October to December 2020 bills and January 2021 bills changings hands at levels of 7.46% to 7.65% and 7.65% to 7.76% respectively during the week.

This was ahead of today’s (6 April) weekly Treasury bill auction, where a total amount of Rs. 30 billion will be on offer consisting of Rs. 7 billion of the 91-day maturity, Rs. 9 billion of the -day maturity and further Rs. 14 billion of the 364-day maturity.

The foreign outflows in rupee bonds were witnessed for a 10th consecutive week but at a slower pace to record Rs.0.59 billion for the week ending 01st April 2020. Furthermore, the CCPI’s (Colombo Consumer Price Index) Point to Point inflation for the month of March decreased for the first time in four months to register 5.4% against 6.2% recorded in February while its annual average increased to 4.7% from 4.6%.

In money markets, the overall money market liquidity in the system increased during the week to Rs. 69.14 billion against its previous week of Rs. 57.85 billion.

The DOD (Domestic operations Department) of Central Bank injected liquidity during the week by way of overnight, two-day, 15-day and 88-day reverse repo auctions at weighted average yields ranging from of 6.76% to 7.31%.

The Weighted average rates on the overnight call money and repo rates averaged at 6.76% and 6.83% respectively for the week.

Rupee trades on spot contracts

In the Forex market, the USD/LKR rate on spot contracts was traded within the range of Rs. 188.50 to Rs. 190.75 during the week.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 63.95 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)