Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 25 February 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The Central Bank was seen holding its policy rates steady at 8% and 9% at its first monetary policy announcement for the year 2019, released last Friday. However, in order to ease the prevailing liquidity shortfall in the system, it was seen reducing its Statutory Reserve Ratio (SRR) applicable for all licensed commercial banks by a further 100 basis points to 5% from its previous 6%. The previous change was at its November 2018 announcement where the SRR was reduced by 150 basis points.

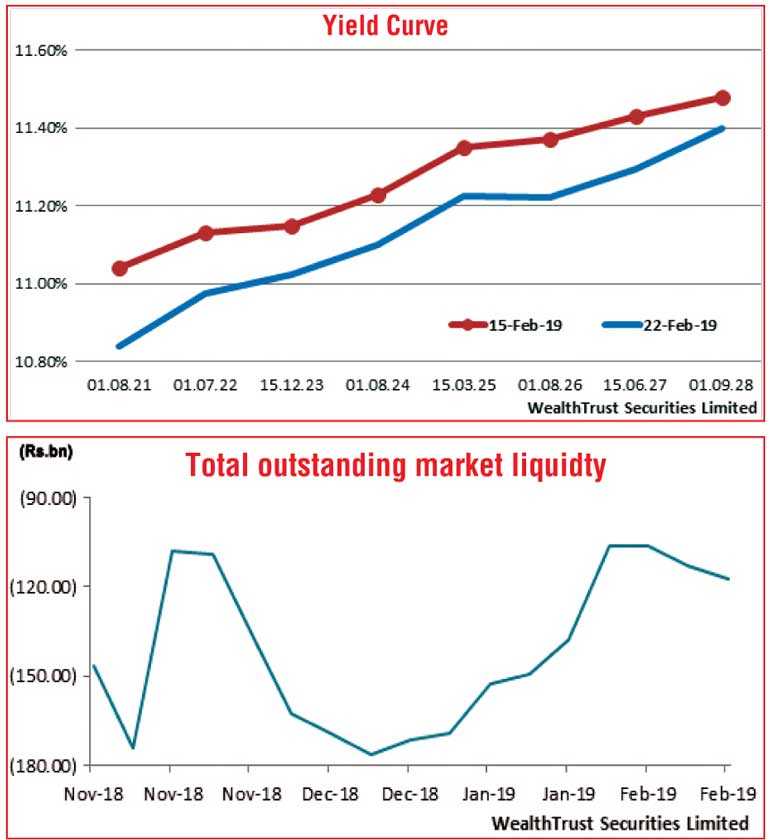

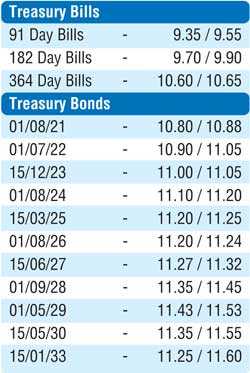

The secondary bond market gathered momentum during the week, as yields decreased on the back of fresh buying interest to reflect a parallel shift down for the first-time in three weeks. The yields of the liquid maturities of two 2021’s (i.e. 01.08.21 and 15.12.21), 15.12.23, 01.08.26 and two 2027’s (i.e. 15.01.27 and 15.06.27) were seen declining to intraweek low of 10.80%, 10.83%, 11.02%, 11.20%, 11.27% and 11.25% respectively against its previous weeks closing level of 11/07, 11/10, 11.10/20, 11.33/40, 11.38/45 and 11.41/45. In the secondary bill market, considerable buying interest following the SRR cut saw yields dip on November 2018 and January to February maturities to change hands within the range of 10.35% to 10.65%.

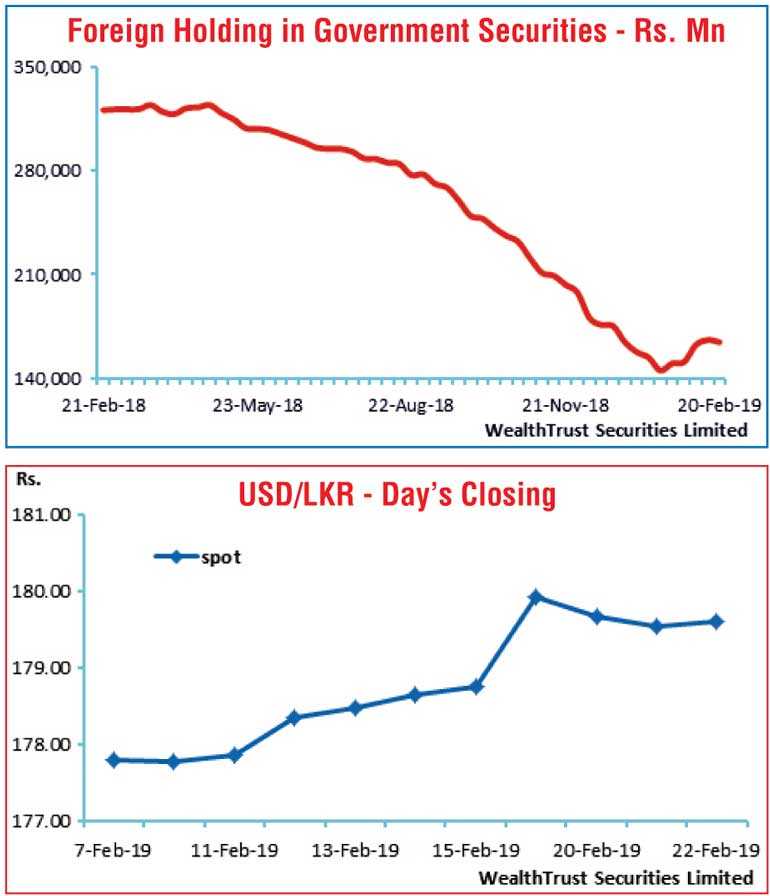

The positive momentum in the secondary bond market was despite the foreign holding in rupee bonds turning negative for the first time in five weeks recording an outflow of Rs. 1.45 billion for the week ending 20 February. The daily secondary market Treasury bond/bill transacted volume for the first three days of the week averaged Rs. 6.98 billion.

In money markets, the overnight call money and repo rates remained mostly unchanged to average at 8.98% and 9%, respectively, during the week, as the Open Market Operations (OMO) Department was seen injecting liquidity throughout the week on an overnight basis at weighted average ranging from 8.92% to 8.97%. In addition, it injected a further Rs. 27.4 billion by way of a seven-day reverse repo auctions at weighted averages ranging from 8.92% to 8.96%. The total outstanding market liquidity shortfall stood at 117.35 billion.

Rupee fluctuates during the week

The USD/LKR rate on spot contracts were seen trading within the range of Rs. 178.85 to Rs.180 during the week before closing the week lower at Rs. 179.55/65 against its previous week’s closing levels of Rs. 178.70/80.

The daily USD/LKR average traded volume for the three days of the week stood at $ 58.19 million. Some of the forward dollar rates that prevailed in the market were 1 month – 180.40/60, 3 months – 182.30/60, and 6 months – 185.10/40.