Sunday Feb 22, 2026

Sunday Feb 22, 2026

Tuesday, 23 November 2021 04:25 - - {{hitsCtrl.values.hits}}

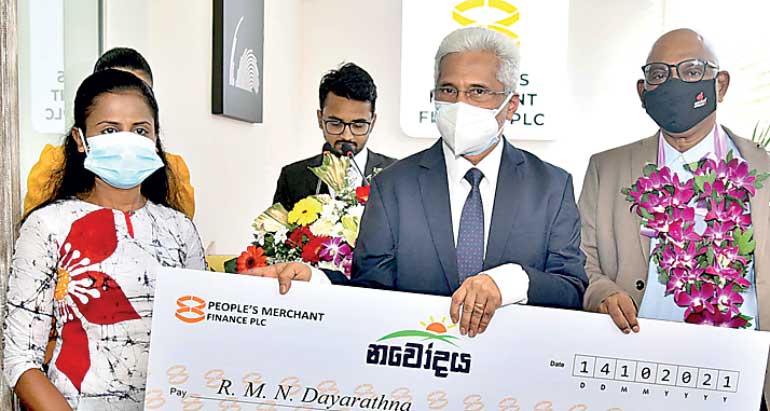

The inaugural Navodhaya entrepreneurship loan being handed over to R.M.N. Dayarathna (left) by PMF Chairman Chandula Abeywickrema (right) and PMF CEO Nalin Wijekoon (centre)

|

| The Batik project financed by PMF |

|

| The Water Lily project financed by PMF

|

People’s Merchant Finance PLC (PMF) aligned to its new turnaround strategy and to continue its vision of catering to the diverse financial needs of all Sri Lankans, launched the Navodhaya entrepreneurship loan scheme on 15 October, taking a responsible approach by holding hands with MSME entrepreneurs to empower them to scale up their enterprises while work towards making them commercially viable to have a positive impact on the development and economic transformation of Sri Lanka.

PMF has since mid-2020 traversed a path of revitalising its business. As part of its new business direction, the company is focused on a long-term agenda to benefit all stakeholders and the national economy. Accordingly, PMF is building a portfolio of loan products to suit the changing economic climate and cater to the needs of its chosen market space. Furthermore, as a responsible Sri Lanka corporate citizen, PMF is building financial products to support the Sri Lankan Government’s Economic Development Agenda.

PMF Chairman Chandula Abeywickrema stated: “Economic revival at the rural and regional level can be triggered by driving a sustainable entrepreneurship strategy across all the economic frontiers and segments. This is beyond trying to evoke a self-employment mechanism, which has indeed certain room in the space. At PMF through Navodhaya we are working on a transformative agenda to graduate to more commercially viable, sustainable in the long journey and scalable to reach more people in more place on more often with their enterprise solutions. It is based on this belief that PMF’s primary shareholder, Sterling Capital Investments Ltd. (SCIL) came on-board to drive and support the long-term agenda being developed by PMF. It is this underlying vision which drives the company’s turnaround strategy and motivates employees and customers alike to remain faithful to; and place their trust in PMF.”

Navodhaya entrepreneurship loan scheme

PMF has adopted a three-stage growth strategy, which drives its New Product Development (NPD) initiatives—assessments, growth, and expansion.

Currently in the assessment stage, the company has recently launched its first new product of the future. The Navodhaya entrepreneurship loan scheme with several unique features is not a simple financial product. The company has spent months researching and identifying the needs of emerging entrepreneurs and has created a product which will offer them a turnkey customised solution from offering a competitively priced loan product, educating entrepreneurs on handling financial and business matters, to guiding and supporting them on their business journey.

A separate unit has been tasked with overlooking this product and is responsible to provide personalised services to individual entrepreneurs based on their distinct needs. This product is being targeted predominantly at the upper end of the microfinance sector and the lower end of the SME sector as the opportunity for growth and expansion for emerging Sri Lankan entrepreneurs is vast with great rewards to be gained.

“It is our belief that as new enterprises emerge from the SME sector and PMF helps them to develop their ideas to a productive business, these entrepreneurs will become a key target clientele for PMF in the future. They will support the growth of PMF and become an important and intrinsic part of the sustainable growth journey PMF has embarked on,” said PMF CEO Nalin Wijekoon.

This entrepreneurship loan scheme is designed to be commercially viable and sustainable, growing and changing aligned to the development of the client’s business needs. Considering the importance of technology in this digital age, PMF will provide tech support in partnership with emerging technology companies. Also included as part of the product is training and development to build individuals’ business and financial skills, knowledge on laws and regulations, and best practices to adopt to for business success.

Key differentiating features

The scheme is customisable to meet the different needs of different entrepreneurs; Scalable – to grow along with the entrepreneur’s business needs and growth plans; provides access to expert business and financial advice starting at the point of loan application; offers education on financial and business skills such as handling taxation matters, adhering to labour laws and practices, etc.; provides access to market linkages; and provides technology support.

Timely initiative to accelerate rural economic development

The Navodhaya entrepreneurship loan scheme product is the very first, one of its kind product being introduced to the market by a non-banking financial institution in Sri Lanka. PMF is proud to have achieved this milestone, which will become a long-term accomplishment for the company.

The company foresees a demand for this product arising from the rural communities across the nation. Therefore, supporting this development not only enables PMF to achieve its goals but also promotes the upliftment of rural communities as well as driving the economic development and GDP value of the country.

To ensure their product reaching the right target market with the right needs, PMF plans to work with the Ceylon Chamber of Commerce, other district-wise chambers, the Microfinance Institution, and the Women’s Chamber, as well as farmers and traders associations, among others.

PMF intends to establish strategic partnerships with large corporates to provide finance and related services within their value chains. These value chain partners including suppliers may not be well served by the formal financial sectors mainly due to the lack of expertise. Financial products and services such as the Navodhaya entrepreneurship loan scheme that flow through the value chain will increase not only the partner’s return and growth but also enhance the competitiveness of the value chain for all parties concerned.

From all accounts, the Navodhaya Entrepreneurship Loan Scheme is just the first dip in the vast ocean of emerging opportunities which PMF foresees arising as the Sri Lankan economy revives from the pandemic impacts and prospers from ongoing developments such as the Port City. These new products will enable the company to pursue its growth stage plans and then seamlessly move to its expansion plans which is focused on offering financial services to selected markets in the region.

PMF has identified several key industry and service sectors connected to agriculture and rural economic segments as the ideal target market for their Navodhaya product through intensive internal studies conducted in the last six months. These prospective clients have been clearly mapped out, and will be approached by fully-trained entrepreneur development officers now placed at every PMF branch offices across the country.

Furthermore, the leadership group of experts at the head office will drive the Navodhaya product dispersion to its full potential enabling PMF to nurture entrepreneurial growth and to make a positive impact on their transformative journey on the Sri Lankan economy.

Transformation at its best

PMF’s transformative journey is a story of change and challenge. “This is the nature of business. We must take up the many challenges and turn them around to sustainable business advantages which also gives back noteworthy returns in terms of community development and economic growth,” states the CEO.

The path taken by PMF should be considered as one of the best as it incorporates changes as they emerge making the ambitious route to success even stronger. As the company continues with this new business focus, they will bring about many changes, both internally and externally.

The Sri Lankan financing landscape is bound to be impacted as PMF’s new product development initiatives converge the needs of SME and entrepreneurs with the possibilities that can be gained by innovative and differentiating financial products being offered in the marketplace.