Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 1 February 2021 00:08 - - {{hitsCtrl.values.hits}}

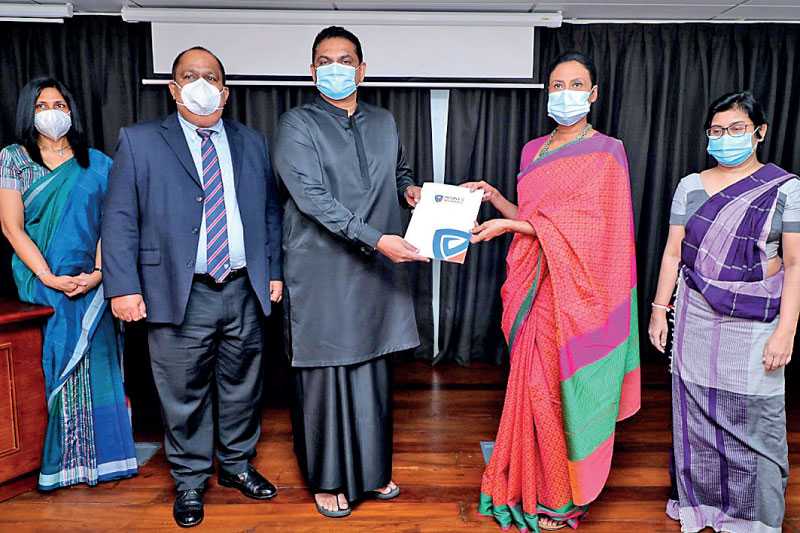

Handing over of the agreement from Sri Lanka Tourism to People’s Insurance

As Sri Lanka opens its doors to the world once more, Sri Lanka Tourism has implemented several measures to ensure that the island getaway is as safe as possible for international guests. A medical insurance scheme is a key element of the many safety nets put in place.

In order to provide this service, People’s Insurance, a part of Sri Lanka’s largest financial services groups has entered into an agreement with Sri Lanka Tourism to be the exclusive insurance provider for all inbound tourists.

In accordance with the guidelines set by Sri Lanka Tourism, this mandatory insurance scheme is offered to international tourists applying for online tourist visas, non-Sri Lankan passport holders, dual citizen passport holders, Sri Lankan citizens travelling with foreign or dual passport holders, as well as business visa holders.

People’s Insurance will provide a medical cover for a period of 30 days for international visitors with effect from the day of arrival, with the provision to extend the validity period of the policy for the next 60 days with an additional premium. Adding to the convenience of visitors, extensions, claims and settlements can be initiated through an online portal.

The policy covers hospitalisation, quarantine hotel charges and expenses for procedures which will prevent the spread of COVID-19 if the individual becomes infected with COVID-19 or becomes a close contact of an infected patient during their stay in Sri Lanka. As an added safety blanket, this insurance cover from People’s Insurance is supported by strong reinsurers from the Lloyd’s reinsurance market.

In light of this development, People’s Insurance Chairman Isuru Balapatabendi said: “Considering the impacts of the COVID-19 pandemic, People’s Insurance takes great pride in being the service provider to facilitate the medical insurance scheme. This partnership means much more than becoming just an exclusive insurer, as the past year has had a significant impact on the economy of Sri Lanka. People’s Insurance views this as our national duty towards empowering the economic mechanism of the nation at a difficult time.”

Sri Lanka Tourism Chairperson Kimarli Fernando said: “Following the tourism pilot project which we conducted over the past few months, we learnt that it is vital to have a strong State-backed insurance company to handle the insurance requirements of inbound visitors. Having a local insurer partner with us ensures that the processes involved are streamlined and efficient, adding convenience to the experiences of our guests. I am grateful to the entire team at People’s Insurance for working together with us to implement this program. Because of this, Sri Lanka is on its way to becoming one of the safest destinations, despite the ongoing pandemic.”

As a fast-growing general insurance company, People’s Insurance has become a strong player in the general insurance industry with more than Rs. 6 billion annual premium income, Rs. 10 billion assets and ‘A+’ Fitch Rating.

People’s Insurance is authorised by The Department of Public Finance to provide insurance cover for esteemed Government institutions. As expressed by their vision, the insurer will continue to lead in value growth in general insurance through innovation and service excellence.