Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 23 April 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

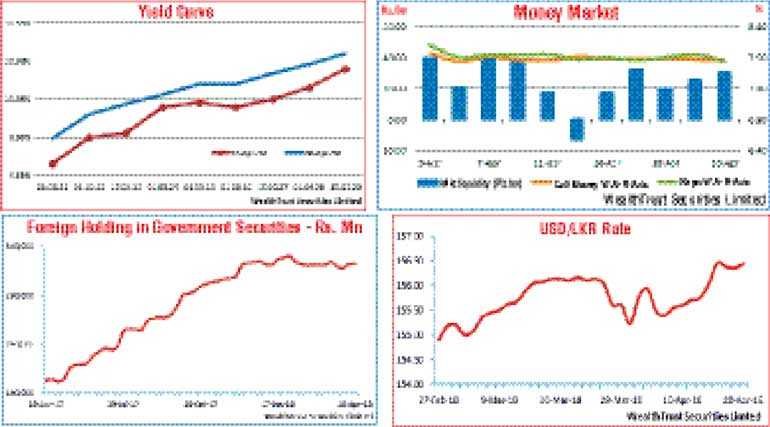

The bullish sentiment that prevailed in the secondary bond market was seen turning bearish during the week ending 20 April as selling interest and profit-taking across the yield curve saw yields pick up on moderate volumes.

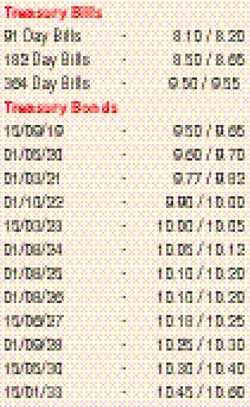

The liquid maturities of 15.03.23, 01.09.28 and 15.05.30 saw their yields increase to weekly highs of 10.00%, 10.30% and 10.45% respectively against their previous week’s closing levels of 9.83%, 10.13% and 10.25% while two-way quotes on the rest of the curve increased as well, reflecting a parallel shift upwards of the overall yield curve.

However, this was despite the averages at the weekly Treasury bill auction decreasing for a second consecutive week and foreign buying in rupee bonds continuing for a second consecutive week as well, to the tune of Rs. 0.595 billion for the week ending 18 April 2018.

Furthermore, continued buying interest in the secondary bill market led to February/March 2019 maturities changing hands within the range of 9.30% to 9.40% and one year bills within the range of 9.50% to 9.60%.

The daily secondary market Treasury bond/bill transacted volumes for the first four days of the week averaged Rs. 9.08 billion.

In money markets, overnight call money and repo rates remained broadly steady to average 7.88% and 7.90% respectively as liquidity averaged a surplus of Rs. 24.95 billion for the week. The Open Market Operations (OMO) Department of the Central Bank was seen injecting liquidity on a term basis for an amount of Rs. 15 billion at a weighted average of 8.26% for a period of eight days.

Rupee dips during the week

The USD/LKR rate on spot contracts was seen depreciating during the week to a weekly low of Rs. 156.50 against its previous week’s closing of Rs. 155.70/80 and closed at Rs. 156.40/48 led by importer demand and a lack of export conversions.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 46.32 million.

Some of the forward dollar rates that prevailed in the market were one month - 157.05/15; three months - 158.50/65 and six months - 160.70/90.