Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 30 March 2020 00:58 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

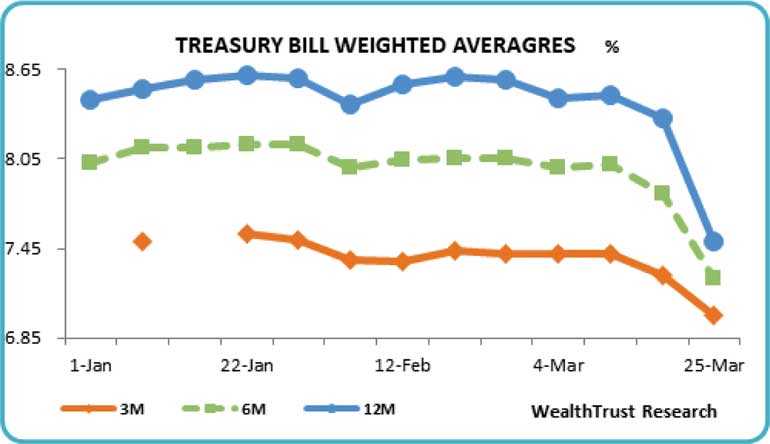

The sharp decrease in the weekly Treasury bill weighted averages coupled with the prevailing high liquidity in the system led to secondary market bond yields decreasing considerably during the week ending 27 March on the back of aggressive buying interest by local market participants.

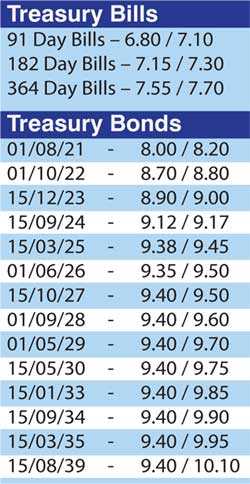

The four year maturity of 15.09.24 was the most actively traded during the week with its yield decreasing by 60 basis points week on week to a low of 9.10%. Furthermore, maturities of 15.03.24 and 15.06.24 were also taken down to lows of 9.12% and 9.10%, respectively, against its previous weeks closing levels of 9.65/70 and 9.65/75.

In addition, 01.10.22, 2023’s (i.e. 15.07.23, 01.09.23 & 15.12.23), 15.03.25, and 15.10.27 were seen hitting lows of 8.75%, 8.95%, 9.00% each, 9.40% and 9.37%, respectively, as well during the week, reflecting a parallel shift downward of the overall yield curve.

Furthermore, renewed buying interest in the secondary bill market resulted in the maturities of September 2020, November 2020 and March 2021 changing hands at levels of 7.10% to 7.25%, 7.40% to 7.48% and 7.60%, respectively.

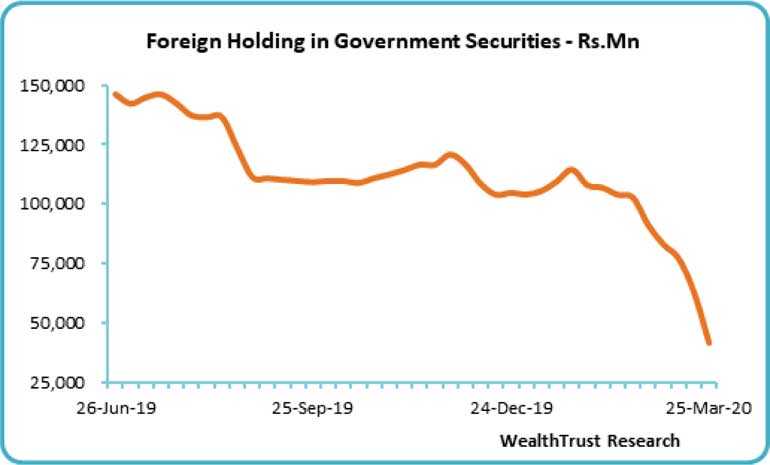

The foreign component in rupee bonds decreased for a ninth consecutive week to register an outflow of Rs. 21.48 billion for the week ending 25 March, reducing its total holding to Rs. 41.65 billion.

In money markets, the overall money market liquidity in the system was seen reducing during the week to Rs. 57.85 billion against its previous week of Rs. 69.66 billion. Overnight call money and repo averaged 6.76% and 6.80%, respectively, on Friday.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)