Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 13 August 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

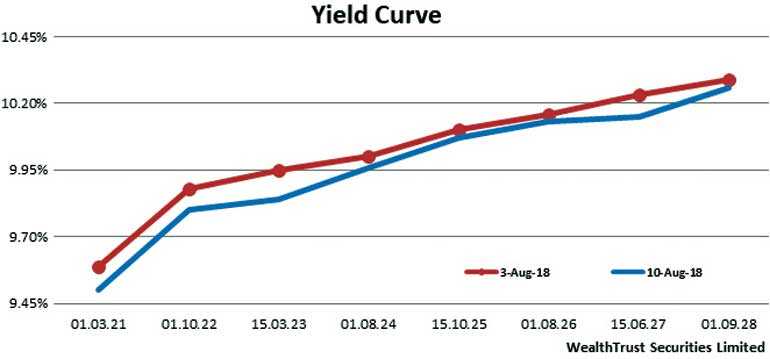

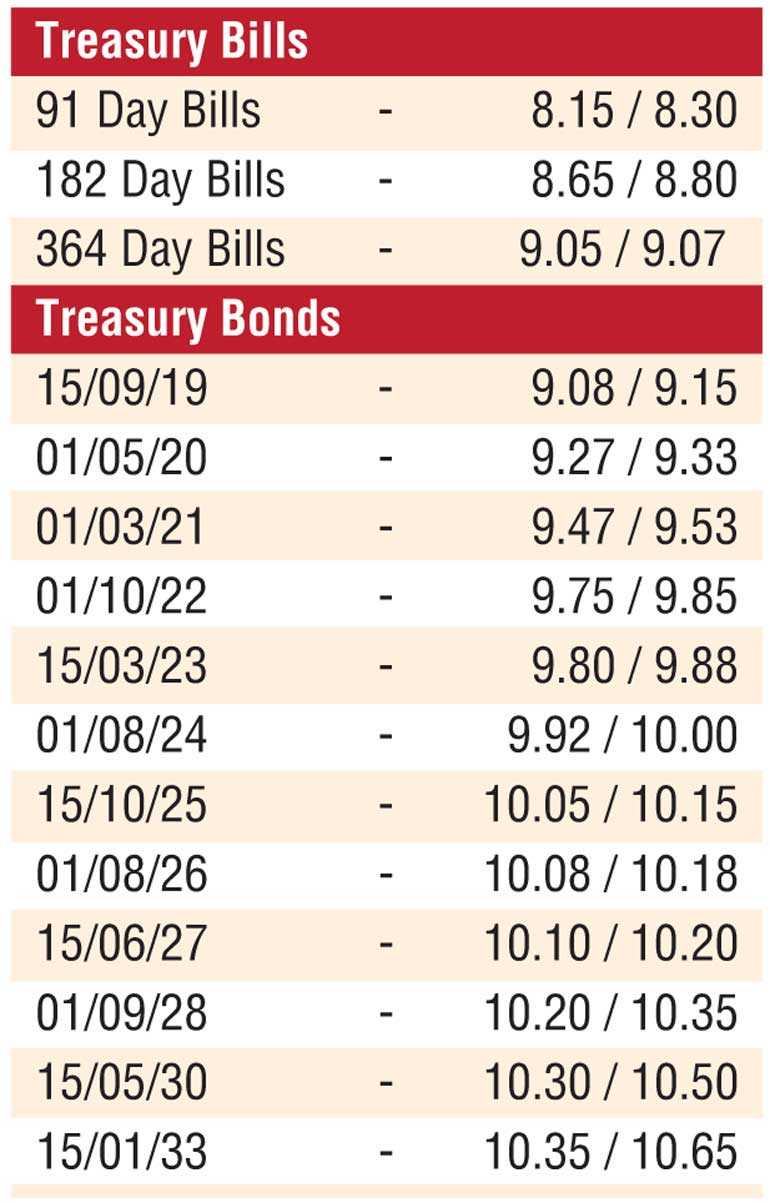

The downward trend in secondary market bond and bill yields previously witnessed continued during the week ending 10 August as well. The market favoured maturities of 01.03.21, 15.03.23 and 01.08.24 decreased to weekly lows of 9.47%, 9.77% and 9.85% respectively when compared against the previous week’s closing levels of 9.55/62, 9.93/96 and 9.98/02.

Furthermore, the 01.10.22, 01.08.26 and 01.09.28 maturities dipped to lows of 9.78%, 10.05% and 10.20% respectively, while on the shorter end, the two 2019 maturities (i.e. 01.7.19 and 15.09.19) and 01.05.20 were seen dipping to lows of 9.02%, 9.13% and 9.30%.

In the secondary bill market, continued buying interest resulted in yields of bills maturing in August 2018, dipping to a low of 9.05%, while at the weekly primary auction, the weighted average yields of all three maturities decreased.

However, activity in the secondary market moderated towards the end of the week with yields edging up marginally ahead of Monday’s Treasury bond auction, where a total amount of Rs. 98 billion will be on offer consisting of Rs. 45 billion of a four-year 11-month maturity and Rs. 53 billion of a nine-year and seven-month maturity. This is in lieu of a Treasury bond maturity of Rs. 97.8 billion due on 15 August 2018. The weighted average yields at the bond auction conducted on 12 July 2018 for the maturities of 15.10.2025 and 15.01.2033 stood at 10.53% and 10.88% respectively.

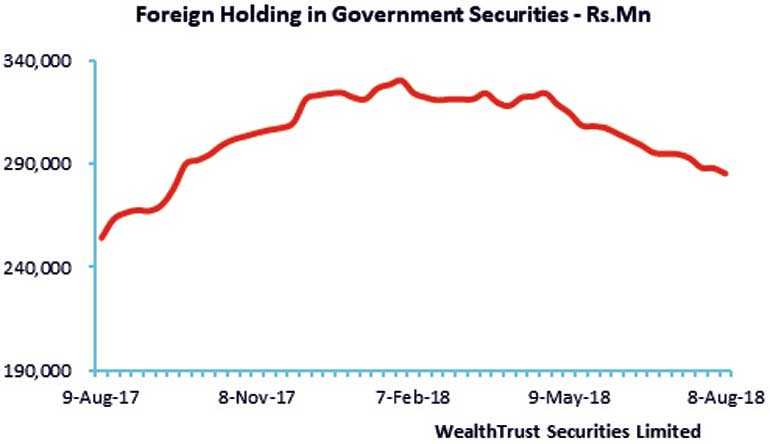

Meanwhile, the foreign holding in rupee bonds continued to decrease, recording an outflow of Rs. 2.55 billion for the week ending 8 August 2018 with its total outstanding decreasing to Rs. 285.25 billion.

The daily secondary market Treasury bond/bill transacted volume during the first four days of the week averaged Rs. 7.89 billion.

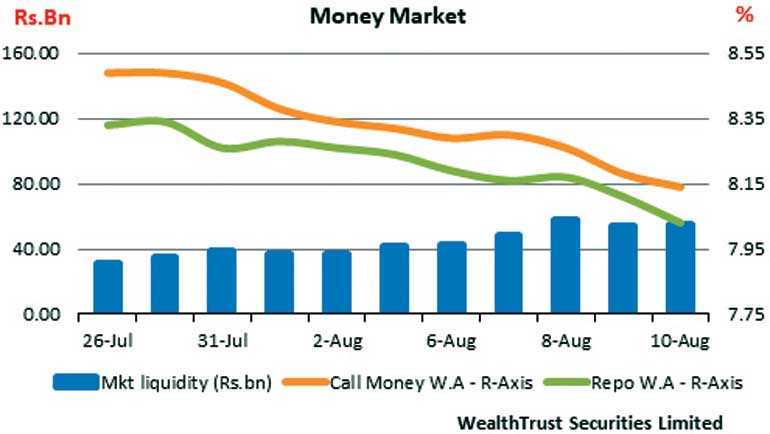

In the money market, despite the net liquidity surplus in the system increasing further to Rs. 51.92 billion on average per day, the Open Market Operations (OMO) Department of the Central Bank refrained from conducting any repo auctions in order to drain out excess liquidity. This resulted in overnight call money and repo rates decreasing further during the week to average 8.23% and 8.13% respectively against its previous week’s average of 8.40% and 8.28%.

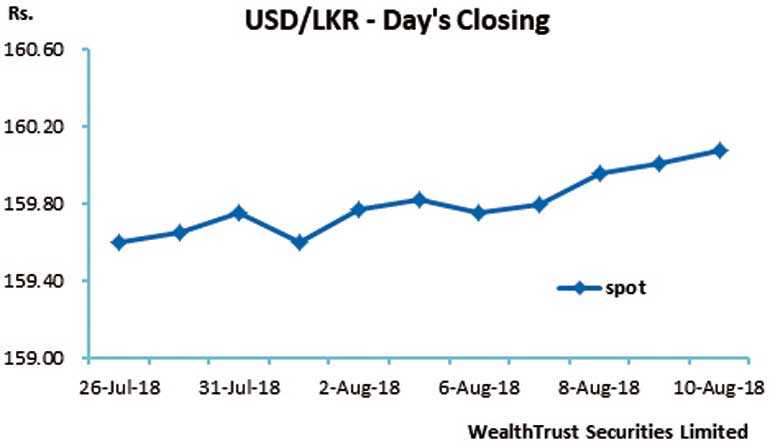

Rupee depreciates further to close above Rs. 160

The rupee on active spot contracts depreciated further during the week to close at Rs. 160.05/10 against its previous week’s level of Rs. 159.75/90 on the back of continued importer demand. The daily USD/LKR average traded volume for the first four days of the week stood at $ 71.28 million. Some of the forward dollar rates that prevailed in the market were one month - 160.85/00; three months - 162.40/65 and six months - 164.75/95.