Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 22 February 2022 03:07 - - {{hitsCtrl.values.hits}}

Chairman Jayantha S.B. Rangamuwa (left) and MD and CEO Nimal Tillekeratne

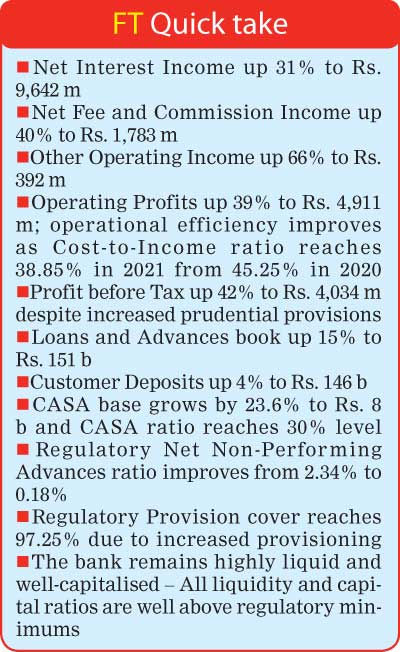

Pan Asia Banking Corporation PLC yesterday reported what it described as “remarkable performance” for 2021 with a Pre-Tax Profit of Rs. 4,034 million and a Post-Tax Profit of Rs. 3,075 million reflecting growth rates of 42% and 50% respectively, demonstrating the resilience amidst challenging macroeconomic conditions.

The bank’s performance was characterised by strength and resilience, despite the heightened uncertainty due to the impact of the COVID-19 pandemic.

Against the backdrop of the COVID-19 impact on the Sri Lankan economy, the bank’s Operating Profit before VAT on Financial Services reached Rs. 4,911 million with an increase of 39%, reflecting the excellence in core banking performance and the success of cost containment measures evidenced by improvement in all key profitability matrices which now rank among industry bests. This feat was achieved even after setting aside sizable provision buffers for the probable deterioration in credit quality due to COVID-19 pandemic. The bank increased its provision buffers for loan losses during the year, sensibly taking into consideration increased risks and uncertainties due to the COVID-19 pandemic through management overlays.

The management also increased the impairment provisions made on foreign currency exposures to the Government of Sri Lanka significantly by Rs. 719 million, taking into consideration elevation of default risk associated with the Sri Lankan sovereign as a result of downgrading the sovereign credit rating of Sri Lanka by international credit rating agencies. As a result, total impairment charge for the year 2021 witnessed an increase of 49%.

Interest income accounted for 89.08% of the bank’s gross revenue in 2021 despite interest income declining to Rs. 18.80 billion in 2021 from Rs. 18.82 billion recorded in 2020. The re-pricing effect of lending book responding to market conditions, as well as the continuation of regulatory directives on interest rate caps for certain lending products introduced during mid-2020, granting of new credit facilities and making of new investments at interest rates lower than in previous year hindered the interest income on loans and advances and other interest-earning assets during the year under consideration. This led to a reduction in the average interest yield by over 200 bps. Remarkable credit growth was achieved in all three segments, namely, Retail, Corporate and SMEs, of Rs. 20 billion (approx.), which offset the pressure on interest income to a greater extent.

Under the prevailing low interest cost regime, the bank managed to reduce the interest expenses by 20.04% to Rs. 9.16 billion in 2021, at a pace faster than the drop-in yields on interest-earning assets. Funding the lending book mainly from short-term deposits and liabilities, increase in CASA base to 29.94% in 2021 from 25.16% in 2020 and monetary policy decisions taken by the Central Bank of Sri Lanka since emergence of the COVID-19 pandemic have resulted in the interest cost of deposits and other interest-bearing liabilities continuously declining despite the increase in liability base.

9.16 billion in 2021, at a pace faster than the drop-in yields on interest-earning assets. Funding the lending book mainly from short-term deposits and liabilities, increase in CASA base to 29.94% in 2021 from 25.16% in 2020 and monetary policy decisions taken by the Central Bank of Sri Lanka since emergence of the COVID-19 pandemic have resulted in the interest cost of deposits and other interest-bearing liabilities continuously declining despite the increase in liability base.

Accordingly, the bank’s funding cost, which was above the industry average at the beginning of the year, improved substantially during the year 2021 and is well-anchored to compete with peer banks by offering lending products at competitive rates. Consequently, the bank’s Net Interest Income grew by a remarkable 30.83% to Rs. 9.64 billion in 2021 from Rs. 7.37 billion in 2020.

The bank’s Net Fee and Commission Income recorded a growth of 40% with the rebound in demand for credit due to revival of economic activities during 2021 with the accelerated island-wide vaccination rollout by the Government, amidst the low interest rate regime, despite the adverse impact of lock downs had, and waiver of fees and charges mandated by the industry regulator. Meanwhile, the volatility in foreign exchange rates enabled the bank to increase its Foreign Exchange Revaluation Gains substantially as reflected in Other Operating Income increase of 66% in 2021 compared to the previous year.

On the other hand, the aforementioned currency volatility had a negative impact on the bank’s Net Trading Income due to mark-to-market losses on forward foreign exchange contracts and currency swap agreements arose from high discounts with the interest rate differential and drop in trade volumes by inactive Forex markets with lack of foreign currency availability. As a result, Net Gains from Trading witnessed a dip of 81% in 2021 to Rs. 92.26 million from Rs. 478.88 million reported in 2020.

The bank strived for earnings maximisation through portfolio re-alignment and cost management despite sector vulnerabilities that prevailed since last year. The bank’s Cost-to-Income Ratio improved from 45.25% to 38.85% during the year under review owing to the excellence in core banking performance which is reflected in noteworthy growth in key revenue lines and various strategies and measures taken to contain the increase in overhead costs. In fact, the bank managed to contain the increase in Other Operating Expenses at 3% in 2021 compared to the previous year.

The increased allocation for staff performance bonuses led to an increase in Personnel Expenses during the year under review despite the reduction in number of staff.

The bank’s Profit after Tax gained to an extent due to application of lower Corporate Income Tax Rate of 24% for tax provisioning in accordance with the Inland Revenue (Amendment) Act passed in Parliament on 4 May 2021 and certified by the Speaker on 13 May 2021, which had impacted provisions to compute tax liabilities on a retrospective basis from taxable year 2020/21.

The related adjustments positively impacted the bank’s bottom line by Rs. 90 million on net basis.

The bank’s contribution to the government income taxes and the deferred tax effect increased by 21.30% due to application of reduced corporate income tax rate of 24% and other concessions with retrospective effect, despite the higher growth in operating profits. As a result of the above, the bank’s effective income tax rate improved from 27.16% to 23.68% within 12 months while the total effective tax rate also improved to 37.38% in 2021 from 41.95% in 2020 simultaneously.

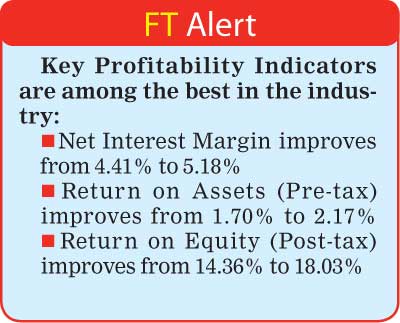

The bank continues to report solid key profitability indicators which rank among the highest in the industry. The bank’s Pre-Tax Return on Assets also improved to 2.17% in 2021 from 1.70% in 2020.Further, the bank reported a stunning Return on Equity of 18.03% during the year under review (2020-14.36%) which stands among the industry best. The bank’s Earnings per Share (EPS) for the year rose to Rs. 6.95 from Rs. 4.63 driven by the excellent overall performance. Meanwhile, the bank’s Net Asset Value per Share appreciated by 20% during the year, to reach Rs. 41.92 as at 31 December 2021.

The bank’s Total Assets base stood at Rs. 189.51 billion as at 31 December 2021 after posting a growth of 7% (approx.) during the year supported by the expansion in the loan book. The Bank’s Gross Loans and Advances book recorded a growth of 15% (approx.) to reach Rs. 150.68 billion due to overall excellence in Corporate, Retail and SME segments. The main lending products that drove the growth in 2021 were pawning and ran loans, loans backed by State sector salaries and pensions and loans to corporates.

During the year under review, the bank did not lend vigorously to sectors that exhibited high stress as a measure of the bank’s prudential lending decisions. Meanwhile, the bank extended further payment deferrals for borrowers who applied for debt moratorium under various schemes.

The Customer Deposits recorded a growth of 4% to reach Rs. 146.43 billion as at 31 December 2021. Supported by contributions from Corporate, Retail and SME segments, the bank attracted more low-cost Current and Savings (CASA) Deposits, as almost all the deposits it raised during the year were low-cost. The bank’s CASA Ratio improved by 478 bps to reach 29.94% at the end of 2021 from 25.16% by the end of 2020, which is one of the reasons for the reduction in financial cost of funds in 2021.

The bank’s regulatory Gross Non-Performing Loan Ratio improved from 6.73% to 6.48% during the year due to improvement in underwriting standards of the bank amidst tough macroeconomic conditions. The bank’s Net Non-Performing Loan Ratio also improved from 2.34% to 0.18% due to prudent provisioning for possible credit losses. The bank continued its focused actions towards managing the quality of its loan book by containing NPLs amidst the weakened economic landscape.

The bank’s Impaired Loans (Stage 3) Ratio, which is a key indicator of a bank’s credit quality improved by 137 bps to reach 3.04% at the end of 2021 from 4.41% by the end of 2020 due to the aforementioned improved underwritings standards, concerted efforts for collection and recoveries and improved proactive prudential provisioning policies of the bank.

The bank’s Impaired Loans (Stage 3) Ratio, which is a key indicator of a bank’s credit quality improved by 137 bps to reach 3.04% at the end of 2021 from 4.41% by the end of 2020 due to the aforementioned improved underwritings standards, concerted efforts for collection and recoveries and improved proactive prudential provisioning policies of the bank.

The bank’s Stage 3 Impairment Provision Coverage increased by 318 bps to reach 51.23% in 2021 from 48.05% in 2020, while the bank’s Total Impairment Provision Coverage, that is, Total Loan Impairment Provision divided by Stage 3 Loans increased by approximately by 10% during the year to reach 78.39% by end of 2021 from 68.45% in 2020, due to prudent provisioning.

MD/CEO Nimal Tillekeratne said: “We are extremely proud and pleased to deliver such an excellent performance under the challenging conditions created by the COVID-19 pandemic. This performance has been hard-won on account of a proactive approach to business while leveraging on emerging opportunities in the market in a prudent manner. Despite the losses due to extension of debt moratoriums and prudential risk-based impairment provisioning, the bank has successfully recorded profitability while consolidating customer and investor confidence.”

The bank maintains all its Capital and Liquidity Ratios well above the regulatory minimum standards. The bank’s Tier 1 Capital Ratio and Total Capital Ratio as at 31 December 2021 stood at 13.82% and 15.97% respectively. The bank’s Statutory Liquid Assets Ratio (SLAR) as at 31 December 2021 stood at 24.18% and 58.42% for Domestic Banking Unit and Off-Shore Banking Unit respectively. Meanwhile, the bank’s Liquidity Coverage Ratio (LCR) under BASEL III stood well above the statutory minimums. The bank maintained an LCR of 146.83% and 135.47% for All Currencies and LKR respectively.