Tuesday Feb 24, 2026

Tuesday Feb 24, 2026

Tuesday, 2 November 2021 02:55 - - {{hitsCtrl.values.hits}}

Chairman Jayantha S.B. Rangamuwa

CEO Nimal Tillekeratne

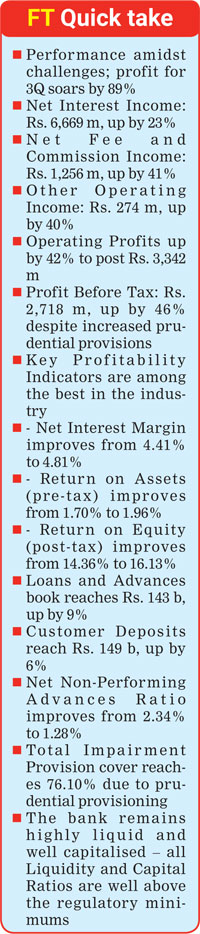

Pan Asia Banking Corporation PLC yesterday reported an impressive performance for the nine-month period ended 30 September 2021 to report a pre-tax profit of Rs. 2,718 million and a post-tax profit of Rs. 2,008 million with growth rates of 46% and 61% respectively, while demonstrating its resilience amid challenging macro-economic conditions.

Pan Asia Banking Corporation PLC yesterday reported an impressive performance for the nine-month period ended 30 September 2021 to report a pre-tax profit of Rs. 2,718 million and a post-tax profit of Rs. 2,008 million with growth rates of 46% and 61% respectively, while demonstrating its resilience amid challenging macro-economic conditions.

The bank’s performance was characterised by strength and resilience despite the heightened uncertainty due to the impact of the COVID-19 pandemic.

Against the backdrop of the COVID-19 impact on the Sri Lankan economy, the bank’s Operating Profit Before VAT on Financial Services reached Rs. 3,342 million with an increase of 42%, reflecting the excellence in core banking performance and the success of cost containment measures evidenced by improvement in all key profitability matrices which now rank among the industry bests. This feat was achieved even after setting aside sizable provision buffers for the probable deterioration in credit quality due to COVID-19 pandemic.

The bank increased its provision buffers for loan losses during the nine-month period sensibly, taking into consideration of increased risks and uncertainties due to COVID-19 pandemic through experience adjustments and management overlays. As a result, total impairment charge for the nine-month period ended 30 September increased by 17%.

The bank’s Net Interest Income (NII) for the period witnessed an increase of 23% due to significant reduction in financial cost of funds at a rate faster than the drop in interest yields of interest earning assets although extension of debt moratoriums to sectors affected by the COVID-19 pandemic had an adverse impact on NII. Consequently, the bank’s Net Interest Margin for the period improved to 4.81% from 4.41% reported nine months ago.

In the meantime, the bank’s Net Fee and Commission Income recorded a growth of 41% with the rebound in demand for credit due to revival of economic activities during the nine-month period amidst the low interest rate regime despite the adverse impact of lockdowns had and waiver of fees and charges mandated by the industry regulator. Meanwhile, the volatility in foreign exchange rates enabled the bank to increase its Foreign Exchange Income substantially as reflected in Other Operating Income. On the other hand, the aforementioned currency volatility had a negative impact on the Bank’s Net Trading Income due to mark-to-market losses on forward foreign exchange contracts and currency swaps.

The bank is committed to revenue maximisation and cost management despite sector vulnerabilities that prevailed since last year. The bank’s Cost-to-Income Ratio improved from 45.66% to 42.19% within the nine-month period owing to the excellence in core banking performance which is reflected in the noteworthy overall growth in key revenue lines and various strategies and measures taken to contain the increase in overhead costs. The cost management culture embedded across the bank assisted curtailing Other Operating Expenses by 8%. Meanwhile, increased allocations for staff performance bonuses, spending on development of human capital and staff welfare led to an increase in personnel costs during the reporting period compared to previous period despite the reduction in number of staff.

The bank’s post-tax profits for the nine-month period also gained to an extent due to application of lower Corporate Income Tax Rate of 24% for tax provisioning in accordance with the guideline issued by CA Sri Lanka on 23 April.

The bank continues to report solid Key Profitability Indicators which rank among the highest in the industry. The Bank’s pre-tax Return on Assets also improved to 1.96% from 1.70%. Further, the bank reported a stunning Return on Equity (ROE) of 16.13% during the period under review which stands among the industry best. The bank’s Earnings per Share (EPS) for the nine-month period rose to Rs. 4.54 from Rs. 2.83 driven by the excellent overall performance. Meanwhile, the bank’s Net Asset Value per Share (NAPS) appreciated by 13% during the nine-month period to reach Rs. 39.44 as of 30 September.

The bank’s Total Asset Base stood at Rs. 188.97 billion as of 30 September after posting a growth of 7% during the period supported by the expansion in the loan book. The bank’s Gross Loans and Advances Book recorded a growth of 9% to reach Rs. 143 billion due to overall excellence in Corporate, Retail and SME segments.

The Customer Deposits recorded a growth of 6% to reach Rs. 149 billion as of 30 September. The bank also attracted more low-cost current and savings deposits during the period, as out of the Rs. 8 billion total deposits it raised during the period, over 86% were low-cost deposits. The bank’s CASA Ratio improved to by 350 basis points (bps) to reach 28.5% as at the end of the 3Q, which is one of the reasons for the reduction in financial cost of funds during the period under review.

The bank’s regulatory Gross Non-Performing Loan Ratio improved from 6.73% to 6.06% during the nine-month period amidst tough macro-economic conditions whilst the bank’s Net Non-Performing Loan Ratio improved from 2.34% to 1.28% due to prudent provisioning. The bank continued its focused actions towards managing the quality of its loan book by containing NPLs amidst the weakened economic landscape.

The bank’s Stage 3 loan ratio as of 30 September stood at 3.2%. The bank’s Stage 3 impairment to Stage 3 loans ratio as of the quarter end stood at 50.99%, while the bank’s Total Impairment Provision cover ratio – i.e., total loan impairment divided by Stage 3 loans at the quarter end stood at 76.10%.

Commenting on the financial performance, the bank’s MD/CEO Nimal Tillekeratne said: “We are extremely proud and pleased to deliver such an excellent performance under the extreme conditions created by the COVID-19 pandemic. This performance has been hard-won on account of a proactive approach to business while leveraging on emerging opportunities in the market in a prudent manner.

“Despite the moratoriums and provisioning that had to be provided for, the bank has successfully recorded profitability while consolidating customer and investor confidence”.

The bank maintains all its Capital and Liquidity Ratios well above the regulatory minimum standards. The bank’s Tier 1 Capital Ratio and Total Capital Ratio as of 30 September stood at 12.36% and 14.63% respectively. The Bank’s Statutory Liquid Asset Ratios (SLAR) as of 30 September stood at 28.76% and 50.25% for Domestic Banking Unit and Off-Shore Banking Unit respectively. Meanwhile, the bank’s Liquidity Coverage Ratio (LCR) under BASEL III stood well above the statutory minimums. The bank maintained LCR Ratios of 207.38% and 180.01% for all currencies and LKR respectively.