Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Monday, 21 June 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

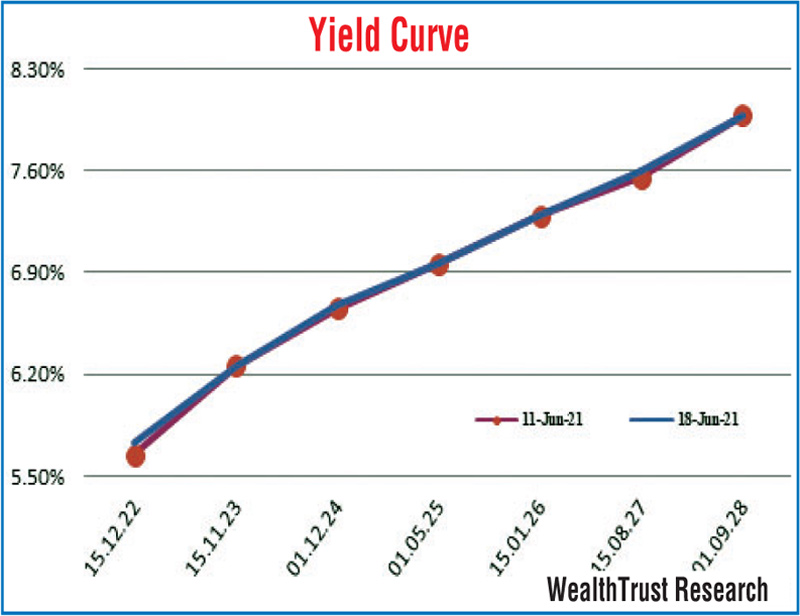

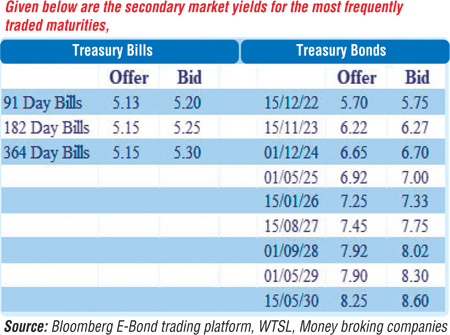

The overall activity in the secondary bond market moderated during the week ending 18 June as most market participants opted to be on the sidelines. Nevertheless, yields of the 2023’s (i.e. 15.01.23, 15.03.23, 15.07.23, 01.09.23 and 15.11.23) and 15.01.26 maturities were seen decreasing marginally during the week to hit lows of 5.79%, 5.85%, 6.08%, 6.12%, 6.20%, and 7.27% respectively.

The overall activity in the secondary bond market moderated during the week ending 18 June as most market participants opted to be on the sidelines. Nevertheless, yields of the 2023’s (i.e. 15.01.23, 15.03.23, 15.07.23, 01.09.23 and 15.11.23) and 15.01.26 maturities were seen decreasing marginally during the week to hit lows of 5.79%, 5.85%, 6.08%, 6.12%, 6.20%, and 7.27% respectively.

In addition, maturities of 01.08.21, 01.10.22, 15.12.22 and 01.05.28 changed hands at levels of 5.05%, 5.67% to 5.70%, 5.70% to 5.74% and 8.00% respectively as well.

However, the total accepted amount at the weekly Treasury bill auction decreased considerably to an 11-week low of 39.76% of its total offered amount. Limited trades were also witnessed in the secondary bill market with June to July maturities, September and December maturities changing hands at levels of 4.95% to 5.00%, 5.00% to 5.10% and 5.18% respectively. The foreign holding in rupee bonds decreased further during the week ending 16 June to record an outflow of Rs. 1.07 billion while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 7.67 billion.

In money markets, weighted average rates on overnight call money and repo were seen increasing to over 11-month highs of 4.84% and 4.87% respectively while its weekly averages too increased to 4.82% and 4.84% respectively as the total outstanding liquidity surplus decreased to a nine-week low of Rs. 94.09 billion against its previous weeks Rs. 110 billion. Meanwhile, CBSL’s holding of Government Securities increased further to Rs. 896.24 billion against its previous weeks of Rs. 874.34 billion.

USD/LKR

The Forex market continued to remain inactive during the week.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 69.25 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)