Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 2 February 2023 01:56 - - {{hitsCtrl.values.hits}}

By Sandun Hapugoda

By Sandun Hapugoda

Major cities across the world are seen as hubs of activity, which in turn becomes the driving force behind a nation’s economic growth. Employment, education, retail environments, art, culture and entertainment experiences offered by capital cities have led to a rapid rise in urbanisation. Some global predictions point to 70% of the world population living in urban areas by 2050.

This presents a problem to the established transport infrastructure contained within a city, and Colombo for example, is no different. A majority of Sri Lankans heavily rely on public transport to facilitate their daily commutes, and this number is constantly on the rise. This is especially true for those living in urban city areas.

Therefore, public transport systems would only get busier over time and in the case of Sri Lanka where the system is reliant purely on cash transactions for payments, a shift toward digital payments in this regard is deemed to be essential.

As the industry continues to debate where the future of transit and mobility payments lies, most global transit operators agree that cash is no longer king. Expensive to handle and process, transaction times are slow, and this leads to long dwell times and station congestion and boarding bottlenecks.

For years, achieving a scenario where contactless payments displace cash in public transit, bringing convenience and ultra-fast transaction speeds has been the goal of many cities. They can be processed more efficiently than cash and transactions are traceable, reducing the burden on customer service centres.

One way to achieve this goal of a streamlined public transportation system is through the use of open loop transit systems, something that has proven to become successful in the South Asian region. For more than 10 years, teams of technologists and transit agency experts have saved cities millions of dollars per year—while transforming the rider experience for residents and visitors alike.

What is an open loop system?

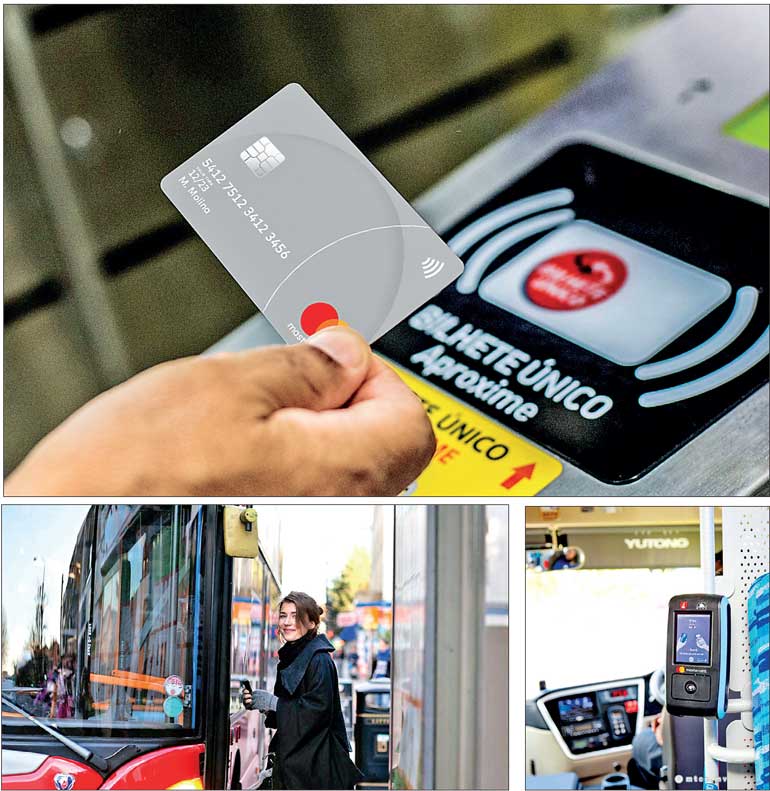

In open loop fare collection systems, passengers can use their bank-issued contactless credit or debit card to pay for journeys. This means there are no costs associated with issuing or replacing cards, as this is handled by banks.

Open loop payment methods can be used to pay within many different systems, and are funded by a centralised payment source, such as a bank or credit card account. Unlike closed loop cards, they don’t require a prepaid amount to exist in the system.

Passengers tap their contactless card on a payment reader to validate it and access transit services. That tap is processed by a back office, which handles aggregation, fare calculation and settlement through the banking network. Depending on the fare rules configured by the transit operator, taps may be aggregated over a given period and fare caps applied, so passengers automatically pay the best value fare.

Few of the benefits of the utilisation of an open loop system are as follows:

Eliminates smart card issuance, infrastructure and lifecycle costs – EMV cards are issued by banks and not transit operators, so issuance and replacement costs are nil. In systems where closed loop infrastructure is being phased out, the cost of maintaining ticketing kiosks and of handling cash can be greatly reduced.

Convenience, same card to pay for transit and retail purchases – Passengers can use the bank card they carry everywhere to pay for public transit trips. For low-income riders in particular, it can be a benefit to pay-as-they-go using their bank card, rather than locking funds into prepaid smart cards. Given that every Sri Lankan bank has the capability to issue contactless debit or credit cards, consumers will see this as an added convenience.

Better security – With the digitisation of payment it has become easier to track fraudulent payments or fraudulent claims for compensation relating to system malfunction, route schedule delay or unsatisfactory service. In addition, most open-loop contactless solutions use EMV technology, which improves transaction security for the end user.

Scalability – Open-loop technology enables transport service operators or city service providers to integrate with new partners and enrol additional customers, as the bank card is already a popular widespread means of payment. This facilitates scaling on many levels from additional routes or extension of the fleet to expanding to new locations or creating a unified ticketing platform for an entire country.

Tangible cost savings – Open-loop technology allows payment using NFC, bank cards, digital wallets, QR codes, RFID or other modern technology devices, shifting the consumer’s preference to cashless economy and contactless payments. Owners of the technology save on operational costs, such as hiring additional cashiers to handle cash or purchasing ticket machines to print paper tickets for customers. Digital ticketing can also reduce the cost of fare collection (COFC). By outsourcing the management and distribution of fares, transit agencies can focus on improving customer experience.

More transparency – The technology allows all operations made through contactless means to be digitised, allowing the service provider and user to track transactions, changes, balances and rates. For users it represents an improvement in safety and transparency of transactions, while for service providers it is a significant cost-saving mechanism, allowing them to reduce cash processing expenditure.

A better experience for tourists – For infrequent users and tourists, there will be no barriers of use or confusion with new systems in unfamiliar locations. The elimination of currency challenges, long lines at booths or kiosks, language barriers and the ability to use the card they already carry add to a seamless experience.

Big data and its benefits to the Government

Open-loop technology is a step towards big data, where everything and everyone is interconnected in a single unified ecosystem. In this scenario data is exchanged between stakeholders and analysed for customising and personalising products for consumers.

For example, in Sri Lanka, this would mean that the Government and relevant authorities would be able to analyse the numbers and make decisions to improve the public transportation network. With the current cash-based system and issuance of physical tickets, if the state wanted to find out how many passengers travelled on a particular bus route on a given day that number would only be an educated guess.

With a proper digital system however, authorities will be able to analyse accurate data down to the last digit, before making a decision towards something through the use of this data. From analysing dips and peaks in passenger demands to deploying more buses or trains accordingly, the data derived from open loop transit systems can make the entire transportation network of a country more efficient.

The open loop success stories of contemporary cities: Male, Singapore, Nairobi, London

Several cities both from within the South Asian region and continental Europe have successfully implemented open loop transit systems, all of which are examples that Sri Lanka can follow in the footsteps of.

The Bank of Maldives recently announced a collaboration with Mastercard to implement its proprietary integrated transit solution towards the vision of the Government of Maldives. Since its launch, the system has served as a method to provide real time data to authorities on passenger numbers and other key performance indicators while optimising the public transport system. During the first phase of the project launched recently, 14 islands within the Haa Dhaalu Atoll were connected to the open loop technology.

As the connectivity progresses to completion, a total of 41 islands will be connected through this transit solution. The Maldivian authorities hope that open loop technology will be expanded to include bus and ferry services in the area of Malé and Hulhumale which accounts for the majority of passenger movement in the country in the next phase.

Singapore is a world-leading example of the benefits of open-loop technology, with passengers with Mastercard or Visa contactless bank cards able to use them to pay for public transport rather than using physical travel cards. Fares for each journey are reflected in end-user credit or debit card bills as they would be for retail purchases.

According to a 2018 report from Deloitte, most of Nairobi’s population depends on Matatu buses – vehicles owned by individuals who transport commuters independently. Transportation was therefore chaotic until the partial introduction of an open-loop system that allows owners to track their operations, reduces fraud and theft risk and improves transparency for the users. The introduction of this technology has made Nairobi more attractive for business.

Transport for London (TfL) has been using open loop systems since 2011. Partnering with Mastercard, TfL’s Oyster card wallet is distributed with all new cards issued and is available from tube and rail stations and Travel Information Centres.

What does the future hold for transport payments in Sri Lanka?

We can see a tomorrow not far off when the transit payments landscape could look simpler. One payment method for all your travel, shopping and other spending – the bank card or mobile wallet you carry everywhere.

Needless to say, the benefits to both the commuter and the Government of Sri Lanka can be immensely beneficial, if the system is adapted in an all-encompassing manner.

(The writer is Country Manager, Sri Lanka and Maldives at Mastercard with over two decades of expertise, developing the digital payments landscape.)