Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 4 January 2022 01:46 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

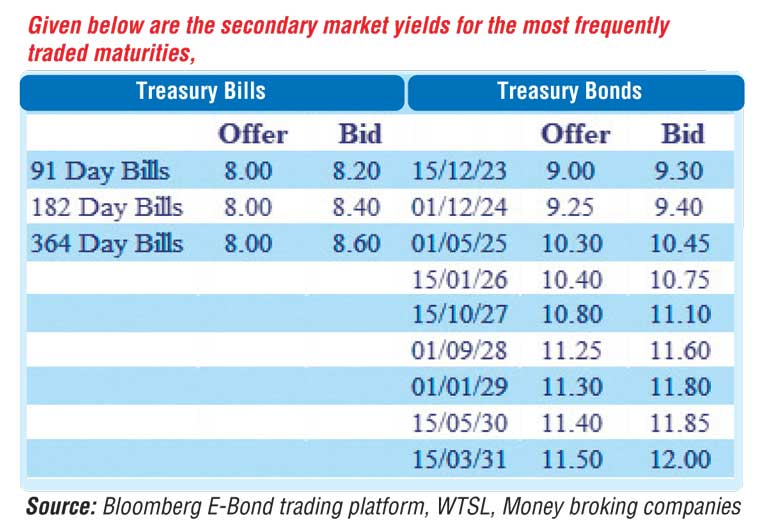

The new trading year commenced on a dull note as activity in the secondary bond market was at a standstill yesterday with a majority of market participants opting to be on the side-lines. Only the 01.05.25 maturity was seen changing hands at a level of 10.40%.

The total secondary market Treasury bond/bill transacted volume for 31 December 2021 was Rs. 4.76 billion.

In money markets, the weighted average rates on call money and repo remained mostly unchanged at 5.94% and 5.95% respectively as an amount of Rs. 436.76 billion was withdrawn from Central Bank’s Standard Lending Facility Rate (SLFR) of 6.00%. The net liquidity deficit decreased to Rs. 335.75 billion yesterday with an amount of Rs. 101.01 billion been deposited at Central Bank’s Standard Deposit Facility Rate (SDFR) of 5.00%.

USD/LKR

In the Forex market, the overall market remained inactive yesterday.

No trading was recorded for 31 December 2021.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)