Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 17 January 2023 00:44 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

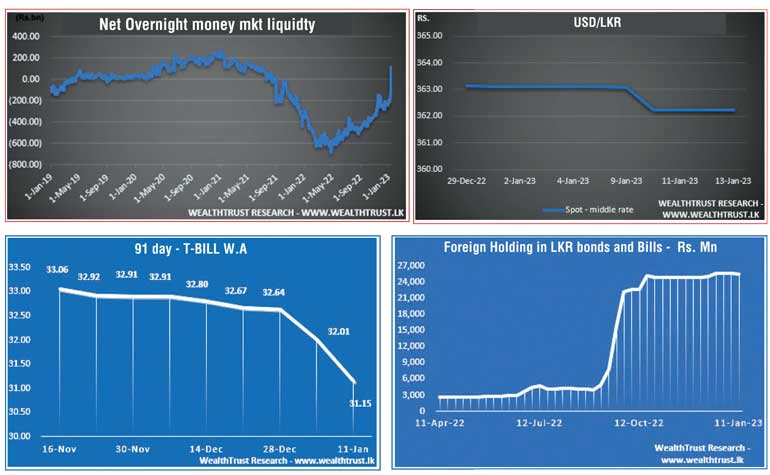

The overnight liquidity in money markets turned positive for the first time since 27 August 2021 during the trading week ending 13 January, driving yields down in turn.

The week closed with a surplus of Rs. 117.04 billion while interbank money markets were active during the week as call money and repo recorded weighted averages of 15.49% and 15.50% respectively.

The Domestic Operations Department (DOD) of Central Bank infused liquidity during the week on a term basis while CBSL’s holding of Government Securities decreased to Rs. 2,594.32 billion from its previous week’s Rs. 2,602.38 billion. The total outstanding liquidity deficit was registered at Rs. 322.96 billion by the end of the week against its previous week’s of Rs. 321.19 billion.

The significant improvement in liquidity augured well for the weekly Treasury bill auction as it was fully subscribed for a fifth consecutive week while weighted average yields decreased by 86, 65 and 12 basis points on the 91-day, 182-day and 364-day maturities respectively to 31.15%, 31.37% and 29.04%. The secondary market yield on the April 2023 bills hit a low of 29.00% as well.

Furthermore, the two Treasury bond auctions conducted during the week drew Rs. 149.5 billion in successful bids at its 1st and 2nd Phases of the auctions against its initial total offered amount of Rs. 160 billion. The auctioned maturities of 15.05.26 and 15.09.27 recorded impressive weighted averages rates of 30.85% and 29.79% respectively.

In the secondary bond market, a majority of activity was witnessed on the maturities of 01.05.24, 15.01.25 and 15.05.26 as it was seen changing hands within the range of 31.70% to 32.00%, 30.75% to 31.20% and 30.50% to 31.00% respectively.

The foreign holding in rupee bonds decreased marginally to Rs. 25.42 billion for the week ending 11 January while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 33.40 billion.

USD/LKR

In the forex market, the middle rate for USD/LKR spot contracts appreciated during the week to close the week at Rs. 362.24 against its previous week’s closing of Rs. 363.11. The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 54.85 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)