Monday Feb 16, 2026

Monday Feb 16, 2026

Thursday, 19 May 2022 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The fourth monetary policy announcement for the year 2022 is due today at 7.30 a.m. At its previous announcement on 08 April, a jumbo hike of 700 basis points was applied by the Central Bank of Sri Lanka, taking its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) to 13.50% and 14.50%, respectively.

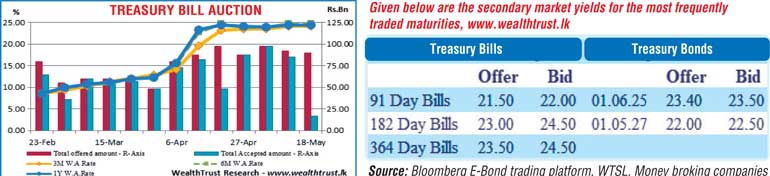

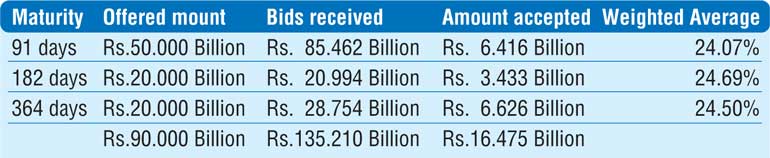

The total accepted amount at yesterday’s Treasury bill auction decreased sharply to over a 19-month low of 18.31% of its total offered amount as only Rs. 16.48 billion was successfully taken up against its offered amount of Rs. 90 billion.

The weighted average rates remained unchanged across the board at 24.07%, 24.69% and 24.50% on the 91-day, 182-day and 364-day maturities respectively. The bids to offer ratio decreased to 1.5:1.

In the secondary bill market, 12 August 2022 bill maturity was seen changing hands at a low of 21.80% following the auction outcome while in the bond market, 01.06.25 maturity changed hands at 23.50%.

The total secondary market Treasury bond/bill transacted volume for 17 May 2022 was Rs. 3.91 billion. In money markets, the net liquidity deficit stood at Rs. 588.75 billion yesterday as an amount of Rs. 176.92 billion was deposited at Central Banks SDFR (Standard Deposit Facility Rate) of 13.50% against an amount of Rs. 765.67 billion withdrawn from Central Banks SLFR (Standard Deposit Facility Rate) of 14.50%. The weighted average rates on overnight Call money and REPO stood at 14.50% each.

Forex Market

In the Forex market, the middle rate for USD/LKR spot contracts appreciated marginally yesterday to Rs. 359.65 against its previous day’s Rs. 359.75. The total USD/LKR traded volume for 17 May was $ 11.56 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)