Wednesday Mar 11, 2026

Wednesday Mar 11, 2026

Monday, 22 March 2021 02:35 - - {{hitsCtrl.values.hits}}

The global shift towards a cashless society created a huge space for mobile wallets as a safer and more convenient way of managing money. As the COVID-19 continues driving a digital transformation of payments, the entire segment witnessed impressive growth in the last year, both in the number of users and transaction value.

According to data presented by Finaria.it, mobile wallets are set to become a $ 2.4 trillion worth industry this year, growing by a massive 24% year-on-year. The strong rising trend is forecast to continue in the following years, with the unified market reaching $ 3.5 trillion value by 2023.

Transaction value doubled amid COVID-19 outbreak

Mobile wallets wiped out the need for carrying money while reducing the chances of theft or losing currency. They allow payments by passing a smartphone app over a merchant’s payment terminal. Data transfers are made via wireless standard Near Field Communication (NFC) or by scanning a Quick Response (QR) code to trigger an online bank transfer. ApplePay, Google Wallet, WeChat Pay, and AliPay lead this market.

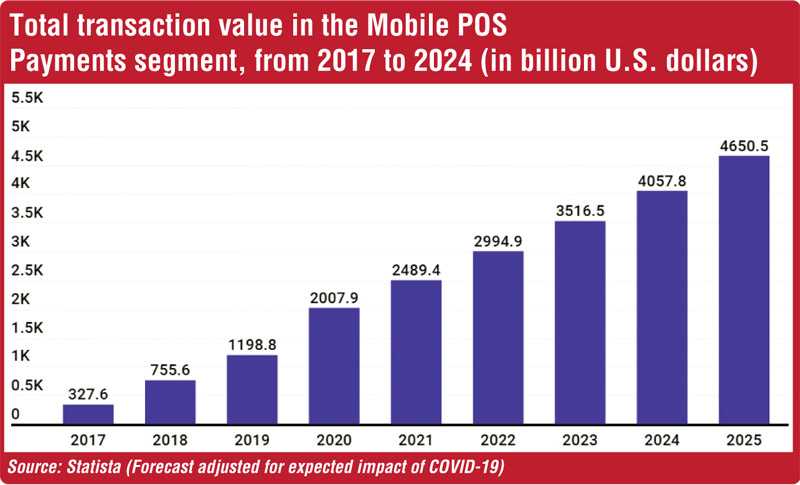

In 2018, the global mobile wallets market was worth $ 755.6 billion, revealed the Statista survey. In the next 12 months, the value surged by 90% to almost $ 1.2 trillion.

In 2020, the mobile POS payments market hit a $ 2 trillion benchmark, driven by a surge in digital payments amid the COVID-19 outbreak. Statistics indicate transaction value is expected to jump by half a billion in 2021, showing a 107% growth in two years. By 2023, mobile POS payments are forecast to grow by another 40%, and by 2025, the unified market is set to reach $ 4.6 trillion value.

The average transaction value per user in the mobile point of sale payments segment amounts to $ 1,670 in 2021, representing a 25% increase compared to the 2019 value. This amount is expected to jump by 22% in the next two years and reach $ 2,051.

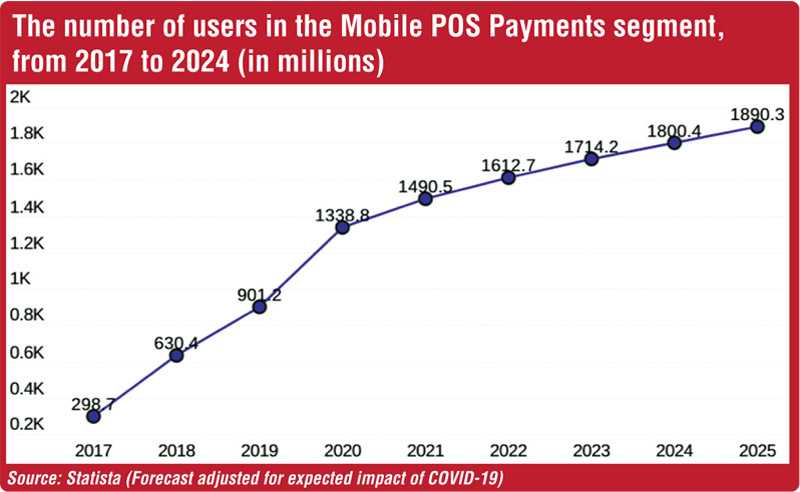

The number of people choosing mobile wallets to manage their payments also witnessed a huge increase in recent years. In 2019, 901 million people globally had been using this method of making payments.

According to a Statista survey, the number of users is expected to jump to almost 1.5 billion in 2021, growing by 11% year-on-year. By 2023, the total number of people using mobile wallets is expected to jump to 1.7 billion worldwide.

China to generate half of all mobile payments by 2023, US market to grow by 49%

Generally, the mobile wallets market is dominated by Asian countries, spearheaded by China as the global leader. Market conditions in China played a huge role in mobile wallets becoming so popular. The infrastructure for mobile payments was already in place. Moreover, credit cards never gained the popularity they have elsewhere in the world.

According to the Statista survey, the Chinese market’s transaction value is forecast to reach $ 1.3 trillion in 2021. By 2023, the country is expected to generate more than 50% of all mobile wallet payments.

Western countries are far behind in terms of usage, with most people still preferring cash, credit, and debit cards. The US ranks as the world’s second-largest mobile payments market, with $ 465.1 billion worth of transactions or nearly three times less compared to China. However, statistics show the US market is set to witness impressive growth in the following years, with transaction value growing by 49% to almost $ 698 billion in 2023.

The UK is the third-largest mobile wallets industry, expected to reach $ 98.5 billion transaction value in 2021, a 195% jump in two years. By 2023, mobile POS payments in the UK are expected to grow by another 60% and hit a $ 157.8 billion value.