Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Wednesday, 13 May 2020 01:13 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

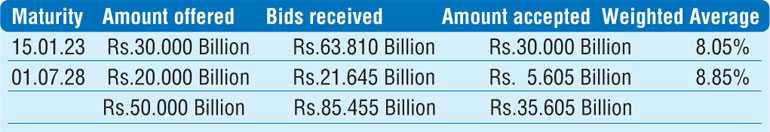

The Treasury bond auctions conducted yesterday reflected mixed outcomes as the weighted average rate on the two-year and eight-month maturity of 15.01.2023 was recorded at 8.05%, above its pre-auction rate of 7.95/00 but below the Central Bank’s stipulated cut off rate of 8.10%, while its total offered amount of Rs.30 billion was accepted at its first phase.

The Treasury bond auctions conducted yesterday reflected mixed outcomes as the weighted average rate on the two-year and eight-month maturity of 15.01.2023 was recorded at 8.05%, above its pre-auction rate of 7.95/00 but below the Central Bank’s stipulated cut off rate of 8.10%, while its total offered amount of Rs.30 billion was accepted at its first phase.

However, the eight-year and two-month maturity of 01.07.2028 recorded a weighted average rate of 8.85%, in line with the Central Bank’s stipulated cut off of 8.85%, while only an amount of Rs.5.6 billion was accepted against its offered amount of Rs. 20 billion, which led to its second phase of the auction in the absence of its third phase.

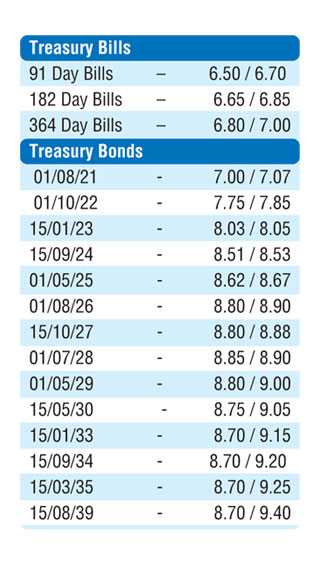

The secondary bond market was seen trading within a narrow range yesterday as the liquid maturities of 2024s (i.e. 15.03.24, 15.06.24 and 15.09.24) and 01.05.25 changed hands at levels of 8.50%, 8.52% to 8.53%, 8.50% to 8.54% and 8.59% to 8.65% respectively. In addition maturities of 2021s (i.e. 01.03.21 and 01.08.21) and further 2025s (i.e. 15.03.25 and 01.08.25) traded at levels of 7.00%, 7.00% to 7.07%, 8.65% and 8.75% respectively.

Today’s bill auction will have on offer a total amount of Rs. 30 billion consisting of Rs. 7 billion of the 91-day maturity, Rs. 9 billion of the 182-day maturity and further Rs. 14 billion of the 364-day maturity.

At last week’s auction, the weighted average yields increased to 6.84% and 6.90% respectively on the 91-day and 182-day maturities while the weighted average yield on the 364-day maturity remained steady at 7.00%. In secondary bills, June, October and November 2020 maturities changed hands at levels of 6.55%, 6.77% and 6.82% respectively.

In money markets, The Domestic Operations Department (DOD) of the Central Bank of Sri Lanka refrained from conducting any auction yesterday as the overnight net liquidity surplus in the system stood at a high of Rs. 136.19 billion. The weighted average rates on overnight call money and repo decreased marginally to 5.94% and 6.06% respectively.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts was traded within the range of Rs. 188.20 to Rs. 188.55 yesterday against its previous days of Rs.188.00 to Rs.188.50. The total USD/LKR traded volume for 11 April was $ 86.75 million.