Thursday Feb 19, 2026

Thursday Feb 19, 2026

Monday, 16 July 2018 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The bearish sentiment that prevailed in the secondary bond market over the past couple of weeks was seen turning positive towards the latter part of the week ending 13 July following the impressive outcome of the Treasury bond auctions conducted last Thursday.

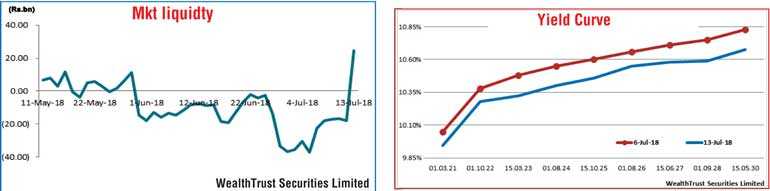

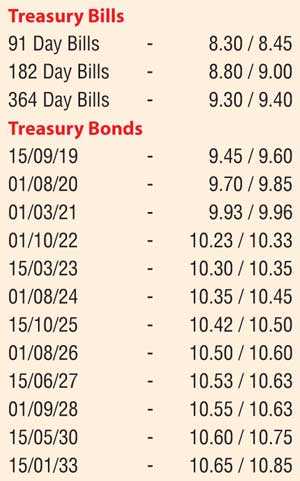

The two bond auctions fetched inspiring weighted averages of 10.53% and 10.88%, respectively, on the 7-year and 3-month maturity of 15.10.2025, and the 14-year and 6-month maturity of 15.01.2033. Yields on the 15.03.23, 15.10.25, 01.08.26 and 01.09.28 were seen decreasing to intraweek lows of 10.34%, 10.50%, 10.52% and 10.60%, respectively, as activity picked up while two-way quotes on the rest of the yield curve were seen reducing as well, reflecting in an parallel shift downwards of the overall yield curve week on week.

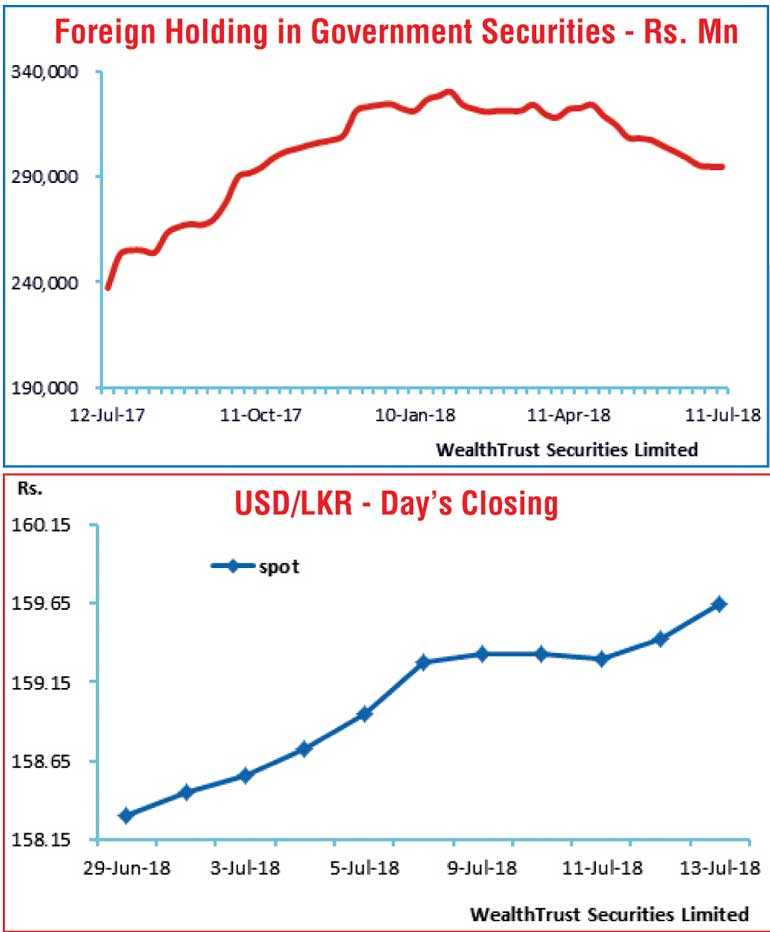

The said sentiment was further supported by the outcome of the weekly Treasury bill auction which saw the weighted average on the 364-day bill hold steady at 9.43%, following two consecutive weeks of increases. Furthermore, foreign selling in rupee bonds reduced to a near zero level, recording a meagre Rs. 9 million for the week ending 11 July following 10 consecutive weeks of outflows of Rs. 450 million and above.

The daily secondary market Treasury bond/bill transacted volume for the first four days of the week averaged Rs. 2.89 billion.

The money market liquidity was seen turning positive for the first time in over six weeks to end the week at a net surplus of Rs. 24.77 billion with the repo average for the week easing to 8.37% against its previous week of 8.43%. However, call money remained steady to average 8.48%. The OMO Department of Central Bank continued to conduct overnight Reverse Repo auctions throughout the week in order to infuse liquidity at weighted averages ranging from 8.41% and 8.49%.

Rupee dips during the week

The USD/LKR rate on spot contracts closed the week lower at Rs. 159.60/70 in comparison to its previous weeks closing levels of Rs. 159.20/35 on the back of continued importer dollar demand outweighing dollar inflows and export conversions.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 51.59 million.

Some of the forward dollar rates that prevailed in the market were 1 Month - 160.45/60; 3 Months - 162.00/30 and 6 Months - 164.50/80.