Saturday Feb 21, 2026

Saturday Feb 21, 2026

Thursday, 7 October 2021 02:46 - - {{hitsCtrl.values.hits}}

By CT CLSA Securities

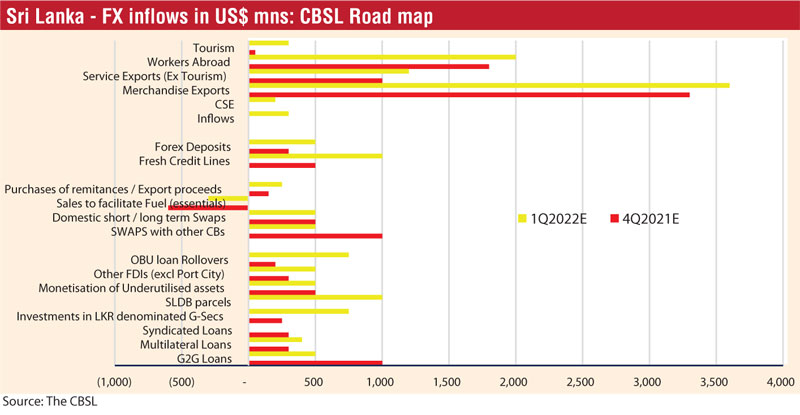

The Central Bank of Sri Lanka (CBSL) unveiled its near-term (six-month) policy Road Map as the first phase of a three-year Road Map on 1 October. Following is an analysis of the same on how it could impact key macro variables based on its current policy path.

The Central Bank of Sri Lanka (CBSL) unveiled its near-term (six-month) policy Road Map as the first phase of a three-year Road Map on 1 October. Following is an analysis of the same on how it could impact key macro variables based on its current policy path.

A) Interest rates likely to be allowed to move northbound

The CBSL expects to implement an independent monetary policy by allowing interest rates to move up in the near term to counter overheating signals of the economy amid private credit growth surpassing 15% YoY in August, with the headline (CCPI) inflation touching the upper operational band of the CBSL. This has been complimented by the CBSL’s recent tight monetary policy actions (w.e.f. mid-August) and removal of price caps at the weekly T-bill/bond auctions since late.

Although Sri Lanka’s international credit ratings are likely to remain a hindrance in the near term, the CBSL expects increased participation of foreigners in LKR-denominated Treasury bills and bonds with the CBSL providing a FX hedge for these investors. Although this could pose a risk to the CBSL in the case of big chunks of hot money, the monetary authority is only expected to increase the maximum foreign participation to a certain limit as witnessed during previous instances in order to manage the aforementioned risk.

B) Exporter receipt conversions to remain key in removing the grey market for FX in the ST

The CBSL indicates a relatively fixed exchange rate regime in the near term by removing grey market activity especially via directives targeted at the export-oriented businesses with increased foreign currency conversions amid reduced stocking up of foreign currency reserves by these businesses abroad. Exporters who comply with CBSL’s anticipated near term directives (likely to be closely screened through the ITRS – International Transaction Reporting System, of the CBSL from 1 January 2022E) are likely to continue to enjoy a 14% income tax rate whilst others may be taxed at 28%.

Although the CBSL is likely to depend upon significant excessive export receipt conversions (since 2020 and allied deposits within the banking sector) in the near term in order to stabilise the LKR, apparel manufacturers with foreign buying offices may require a high percentage of alleged hoarded dollar receipts as their regular working capital, which the CBSL is willing to permit as “allowed debits”.

Although there could be certain near-term hiccups, we believe that stricter implementation of these policies could assist the CBSL to wipe out the prevalent grey market to a significant extent, in turn allowing a stable near-term exchange rate given the anticipated G2G bilateral near-term loan arrangements and sale of underutilised assets (non-debt creating inflows).

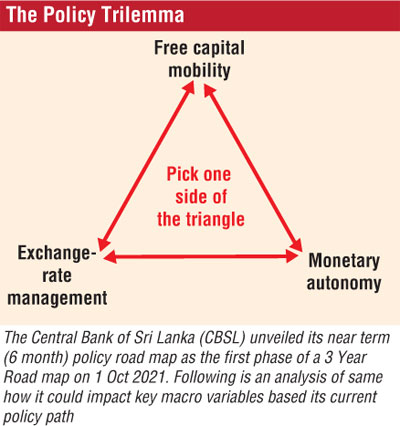

C) Capital controls could be gradually removed if objectives under A) and B) are met

With the external capital account cushion, tourism revenue declining since the Easter Sunday attacks and then due to the ongoing pandemic, the local authorities pursued a defensive approach by introducing various capital controls, in order to preserve the external value of the LKR.

Whilst free capital movement is likely to remain a key feature in a competitive market, if Sri Lanka could meet the objectives indicated by above A) and B), then the economy could be likely opened for imports (although with special clauses for high valued imports such as vehicles still in place as per the policy road map) with already removed cash margin requirements on nonessential and non-urgent imports and other capital flows allowing the CBSL and the Government to meet their targeted macro-economic objectives in the near to medium term.

Although fiscal policy does not fall under the CBSL’s purview, it is likely to remain a key deterrent of macro stability of the economy in the near to medium term, as repayment of non-negotiable sovereign foreign debt obligations are likely to remain a key drain on Sri Lanka’s external account.