Saturday Feb 21, 2026

Saturday Feb 21, 2026

Tuesday, 4 September 2018 00:00 - - {{hitsCtrl.values.hits}}

The International Accounting Standards Board (IASB) has published the new accounting standard for insurance contracts, IFRS 17, which comes into effect from 1 January 2021. As the new standard requires prior-year comparative reporting, companies have little time to start the impact assessment.

As many people understand it to impact life insurance contracts in a significant way Suren Rajakarier, Head of Insurance Practice at KPMG, alerts the industry of the key changes to the recognition, identification of onerous contracts and valuation of insurance contracts that will affect general insurance business as well.

Rajakarier who also leads the task force for the implementation of IFRS 17 in Sri Lanka at the Institute of Chartered Accountants, at a recent discussion indicated, “IFRS 17 will open up the ‘black box’ of current insurance accounting. Analysts currently have to adjust insurance companies’ financial positions and performance to be able to compare them. But IFRS 17 will bring in better universal comparability.”

IFRS 17 increases transparency about profitability and will add comparability which will eliminate the difficulty in comparing financials across different industries, products, companies and jurisdictions, as well.

Rajakarier believes, one of the biggest concerns should be the potential impact of IFRS 17 on future available capital. Depending on the linkage between financial reporting and prudential regulation in Sri Lanka, the new standard could, alter the available capital, which in turn, impacts the amount of free capital that is available to support new growth opportunities and payment of dividends.

General measurement model

The general measurement model for liabilities under IFRS 17 is known as the building block approach (BBA). Under this all insurance (and reinsurance) contracts will be measured as the sum of:

– The present value of probability-weighted expected cash flows plus

– An explicit risk adjustment for insurance risk

Information will be disclosed at a level of granularity that helps users assess the effects contracts have on financial position, financial performance as well as cash flows. The principles in the standard will be applied at a portfolio level, where portfolio is defined as a group of contracts with similar risks which are managed together.

Simplification approach – Premium Allocation Approach

One of the decisions general insurers need to make will be whether to use a simplification option known as the Premium Allocation Approach (PAA). This is an alternative to the BBA.

This simplification is only permitted in certain circumstances and is only applicable to unexpired risks, but the incurred claims liabilities must still follow the BBA model. Under this, the CSM is not required. Instead, at the beginning, the liability for unexpired risks, is calculated as the premiums received minus associated acquisition costs.

Over time, the liability for remaining coverage (unexpired risks) is updated to reflect additional premiums received and any profit that is recognised in the income statement for the coverage that was provided up to that date. IFRS 17 limits offsetting of onerous contracts against profitable ones.

The PAA will be permitted for contracts where the period of cover is one year or less, or where the measurement of the liability for remaining coverage would not differ materially from that estimated using the BBA. However, if at inception of the policy, there is expected to be significant variability in the fulfilment cash flows affecting the measurement of the liability for remaining coverage during the period before a claim is incurred, the PAA eligibility criteria may not be met.

Therefore, multi-year policies covering risks such as construction, engineering, accident and health, directors and officers and mortgage indemnity business may not meet the PAA eligibility criteria.

When using the PAA it should be assumed that no contracts in the portfolio are onerous at initial recognition, unless facts and circumstances indicate otherwise.

The discount rate

There are two ways to calculate the discount rate. It can be determined using either a top-down (starting with an actual or expected reference portfolio rate) or a bottom-up (starting with a risk free rate of return) methodology.

IFRS 17 provides insurers two options. The company may choose to take the volatility due to changes in discount rates straight to profit and loss or through other comprehensive income (OCI). This accounting policy choice is connected to the classification of financial instruments in IFRS 9 (many insurers will have the option to defer the implementation of IFRS 9 from 2018 to 2021, such that IFRS 9 applies at the same time at which IFRS 17 becomes effective).

The treatment of changes in current discount rates in IFRS 17 for insurance contracts creates a potential opportunity to reduce accounting mismatches.

Disclosures

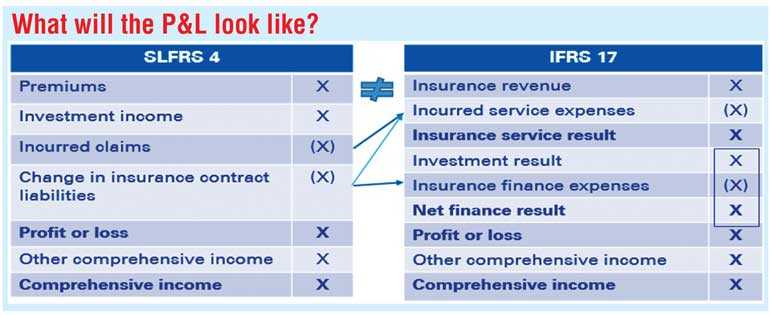

Financial statements will look different under IFRS 17. The biggest change will be to the income statement, which will no longer show written premiums (these will be disclosed in the notes instead) and revenue and expense will be recognised as earned (not received) or incurred (not paid). Because it does not allow to realise profits immediately when the premium is written, the entire expected profit is deferred through CSM and released over time as the insurance service is performed.

Disclosures will be complex under IFRS 17 and in particular will involve detailed reconciliations between opening and closing balances as well as disclosure of the confidence level of the insurance liabilities.

Implementing the new standard will require substantial effort, and new or upgraded systems, processes and controls. The task will be even more challenging given the long time horizons over which many insurance companies operate and the legacy systems that many still use.

While IFRS 17 represents the biggest accounting change for insurers in many years, the impacts will be felt far beyond accounting, in areas such as finance, actuarial, IT and even the regulatory departments. The effective date for IFRS 17 of January 2021 may seem a long way off, but the timescale will be a challenge for many. A coordinated response between Finance, Actuarial and IT functions will be essential, like never before.

Rajakarier says “KPMG has begun a process of engaging with insurance companies in Sri Lanka to convince them to engage with their key stakeholders, establish timelines to perform impact analyses and make plans for implementation well before 2021.”