Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 28 June 2019 00:00 - - {{hitsCtrl.values.hits}}

Slowdown due to slower motor insurance

premiums but says long-term fundamentals intact

Sri Lanka’s insurance industry expansion is likely to moderate in the near term, based on Fitch Ratings’ expectations of slower motor-insurance premium growth due to sustained tax rises on imported vehicles, intense price competition in the non-life market and a slower recovery in economic activity.

However, long-term momentum should be helped by Sri Lanka’s low insurance penetration, rising awareness of insurance and a gradual increase in the contribution from non-motor lines, such as property, health and micro insurance.

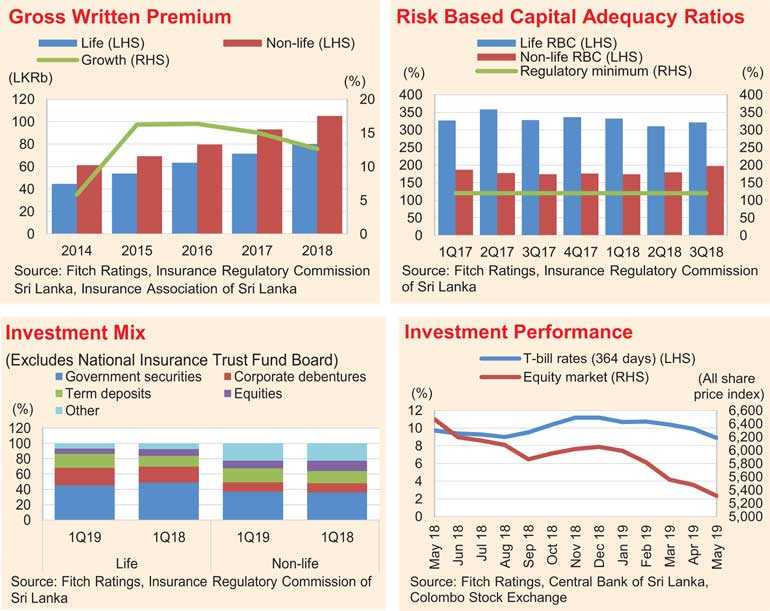

Industry premiums rose by 13% in 2018, moderating from 15% in 2017, due to the slower growth of motor premiums, delays in renewing the state-sponsored health insurance policy for school children and subdued consumer affordability affecting life-insurance growth.

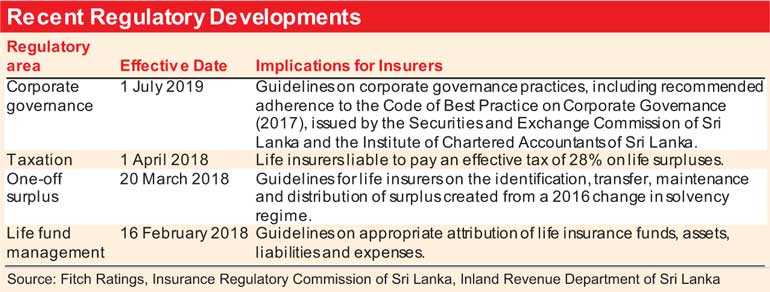

Fitch expects Sri Lanka’s weakened currency and the higher tax liabilities of life insurers to cut insurers’ net profit in the near term. The rupee depreciated by around 19% against the US dollar in 2018, which increased the claims paid by non-life insurers, particularly in relation to the higher cost of imported automotive components. In addition, life insurance surpluses were taxed at an effective rate of 28% from April 2018; most life insurers paid lower taxes under the previous tax regime due to a lower tax base.

Fitch expects the increased frequency of weather-related events to remain the main source of long-term risk to non-life insurers’ capital. However, most non-life insurers continue to moderate volatility in their profitability by using reinsurance protection and maintaining risk-based capitalisation ratios above the 120% regulatory minimum.

The Central Bank of Sri Lanka imposed an interest-rate cap on bank deposits in April 2019. This was followed by a 50bp cut in policy rates in May 2019 to stimulate economic growth. Fitch expects this to somewhat increase insurers’ reinvestment risk, especially for non-life insurers with short portfolio duration.

Fitch regards Sri Lanka’s non-life market as crowded and ripe for consolidation due to intense price competition, which has kept the industry’s combined ratio high at around 100% in recent years. There have been four M&A’s since 2014.

Neutral

Fitch expects the credit profiles of rated insurers to remain stable in the near term, supported by sustained capitalisation and financial performance.