Saturday Feb 21, 2026

Saturday Feb 21, 2026

Thursday, 9 January 2020 00:24 - - {{hitsCtrl.values.hits}}

The Insurance Regulatory Commission of Sri Lanka yesterday released the industry performance for the third quarter of 2019 which reflects growth though at a lower rate in comparison to a year earlier.

Following are the key highlights.

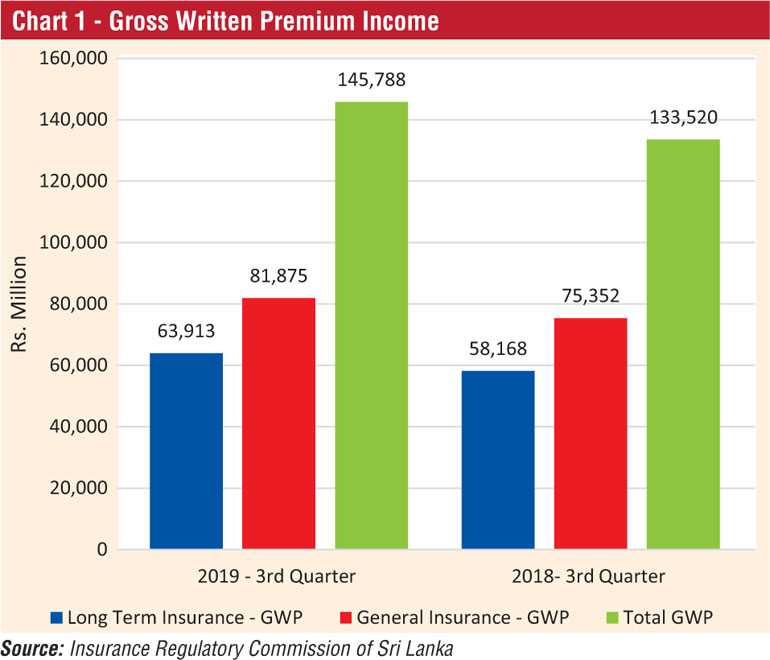

Gross Written Premium

The insurance industry achieved a growth of 9.19% (Q3, 2018: 13.14%) in terms of overall Gross Written Premium (GWP), during the Third Quarter of 2019, recording an increase of Rs. 12,268 million when compared to the same period in the year 2018. The total GWP for the period was Rs. 145,788 million compared to Rs. 133,520 million recorded in 2018.

The GWP of Long Term Insurance Business amounted to Rs. 63,913 million (Q3, 2018: Rs. 58,168 million) recording a growth of 9.88% (Q3, 2018: 12.09%). The GWP of General Insurance Business amounted to Rs. 81,875 million (Q3, 2018: Rs. 75,352 million) recording a growth of 8.66% (Q3, 2018: 13.96%).

(Refer chart 1)

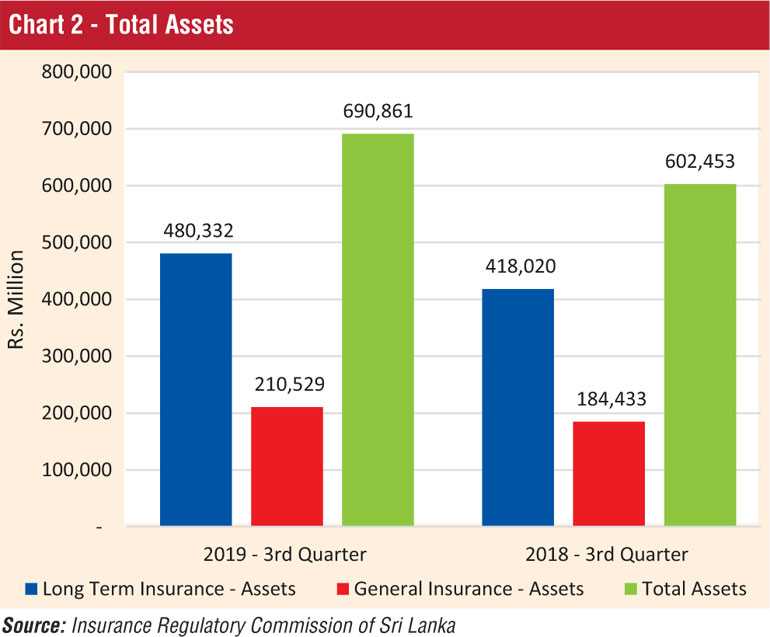

Total Assets

The value of total assets of insurance companies has increased to Rs. 690,861 million as at 30 September 2019, when compared to Rs. 602,453 million recorded as at end of 30 September 2018, reflecting a growth of 14.67% (Q3, 2018: 9.86%). The assets of Long Term Insurance Business amounted to Rs. 480,332 million (Q3, 2018: Rs. 418,020 million) indicating a growth rate of 14.91% year-on-year.

Thus, growth of assets of long term insurance business has significantly increased compared to 7.89% growth recorded during the third quarter of 2018. The assets of General Insurance Business amounted to Rs. 210,529 million (Q3, 2018: Rs. 184,433 million) depicting a growth rate of 14.15% (Q3, 2018: 14.63%) at the end of the third quarter 2019. Accordingly, the growth of assets of general insurance business has shown a slight decrease compared to the same period of 2018.

(Refer chart 2)

Investment in Government Securities

At the end of the third quarter 2019, investment in Government Debt Securities amounted to Rs. 205,202 million representing 48.03% (Q3, 2018: Rs. 163,219; 43.37%) of the total investments of Long Term Insurance Business, while such investments of the total investment of General Insurance Business amounted to Rs. 55,072 million representing 42.27% (Q3, 2018: Rs. 51,705; 42.30%).

Accordingly, the total investment of both Long Term Insurance Business and General Insurance Business in Government Securities amounted to Rs. 260,274 million (Q3, 2018: Rs. 214,923 million). Thus, the investment in Government Debt Securities of Long Term Insurance Business and General Insurance Business has increased by 25.72% and by 6.51% respectively.

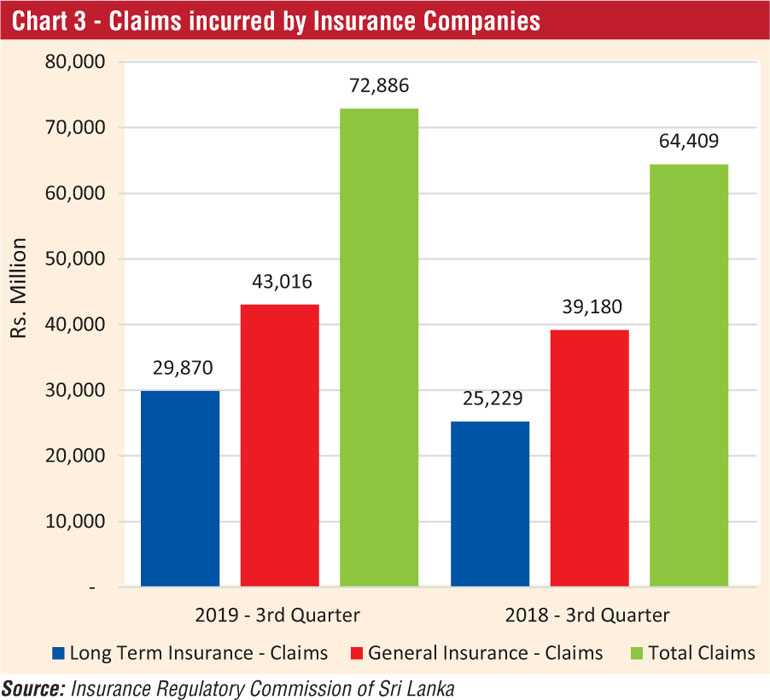

Claims incurred by Insurance Companies

The claims incurred by insurance companies during the Third Quarter of 2019 in both Long Term Insurance Business and General Insurance Business was Rs. 72,886 million (Q3, 2018: Rs. 64,409 million) showing an increase in total claims amount by 13.16% year-on-year. The Long Term Insurance claims, including maturity and death benefits, amounted to Rs. 29,870 million (Q3, 2018: Rs. 25,229 million).

The claims incurred in General Insurance Business, including Motor, Fire, Marine and other categories, amounted to Rs. 43,016 million (Q3, 2018: Rs. 39,180 million). Accordingly, there has been an increase in claims incurred by 18.40% and 9.79% for Long Term Insurance and General Insurance Businesses respectively, when compared to the same period in 2018.

(Refer chart 3)

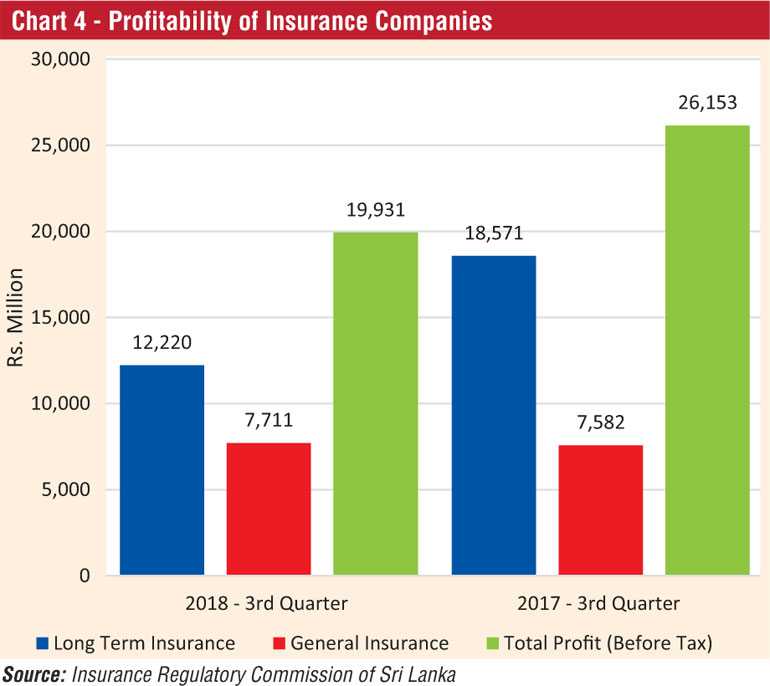

Profit (Before Tax) of Insurance Companies

The profit (before tax) of insurance companies as at end of the third quarter 2019 in both Long Term Insurance Business and General Insurance Business amounted to Rs. 19,931 million (Q3, 2018: Rs. 26,153 million) showing a decrease in total profit amount by 23.79%.

The profit (before tax) of Long Term Insurance Business amounted to Rs. 12,220 million (Q3, 2018: Rs. 18,571 million) while the profit (before tax) of General Insurance Business amounted to Rs. 7,711 million (Q3, 2018: Rs. 7,582 million). Thus, profit (before tax) of Long Term Insurance Business has decreased by 34.20% and profit (before tax) of General Insurance Business has marginally increased by 1.71% respectively.

(Refer chart 4)

Number of Insurance Companies

Out of 27 insurance companies in operation as at 30 September 2019, 13 are engaged in Long Term (Life) Insurance Business, 12 companies are carrying out only General Insurance Business and two are composite companies (dealing in both Long Term and General Insurance Businesses).

Insurance Brokering Companies

66 insurance brokering companies, registered with the Commission as at 30 September 2019, mainly concentrate in General Insurance Business. The premium income generated through insurance brokering companies in the third quarter 2019 with respect to General Insurance Business amounted to Rs. 21,650 million, 14.85% of total GWP (Q3, 2018: Rs. 17,570 million; 13.16% of total GWP) while the premium income generated with respect to Long Term Insurance Business amounted to Rs. 859 million, 0.59% of total GWP. (Q3, 2018: Rs. 484 million; 0.36% of total GWP).

The total premium income generated through insurance brokering companies with respect to General and Long Term Insurance Businesses, and Reinsurance Business amounted to Rs. 24,048 million, 16.50% of total GWP, during the third quarter 2019, compared to Rs. 19,248 million, 14.42% of total GWP during the third quarter of previous year. Thus, the total premium income generated through insurance brokering companies witnessed a growth of 24.94% during the third quarter of 2019 when compared to the third quarter of 2018. Certain Insurance Brokers are also authorised to act as intermediaries in selling foreign health insurance products.