Sunday Feb 15, 2026

Sunday Feb 15, 2026

Tuesday, 28 August 2018 00:00 - - {{hitsCtrl.values.hits}}

It is a little over a year since the ‘IFRS 17 Standard on Insurance Contracts’was published and the clock began ticking towards implementation in 2021. Many insurers have selected the option to implement IFRS 9 at the same time. Two quarters into2018 has already slipped away. The changes that need to be made are truly significant. Indeed, for most insurers adopting IFRS 17 for the first time will have a bigger impact and be a greater challenge than adopting a new accountingstandard in the first place.

IFRS 17 will give users of financial statements a whole new perspective. For the first time, insurers will be on a level footing internationally. It will open up the ‘black box’ of current insurance accounting. Analysts currently have to adjust insurance companies’ financial positions and performance to be able to compare them.IFRS 17 increases transparency about profitability and will add comparability. As quoted by Joachim Kolschbach, KPMG’s global IFRS Insurance leader, “The ways in which analysts interpret and compare companies will change. Increased transparency will give users more insight into an insurer’s financial health than ever before.”

In essence, insurers will need to account for their business performance at a more granular level. Information should be disclosed at a level of granularity that helps users assess the effects contracts have on financial position, financial performance as well as cash flows.

IFRS 17 limits offsetting of onerous contracts against profitable ones.Separate presentation of underwriting and finance results will provide added transparency about the sources of profits and quality of earnings.

The impact of the new standard will vary significantly between insurance companies. Implementing it will require substantial effort, and new or upgraded systems, processes and controls. The task will be even more challenging given the long-time horizons over which many insurance companies operate and the legacy systems that many still use.

While IFRS 17 represents the biggest accounting change for insurers in many years, the impacts will be felt far beyond accounting, in areas such as finance, actuarial, IT and even the regulatory departments.IFRS 17 takes effect in January 2021. That may seem a long way off, but the timescale will be a challenge for many. A coordinated response will be essential. Finance, Actuarial and IT functions will need to work closely together like never before.

“You need to begin the implementation process immediately. Companies should start with an initial impact assessment, then move onto analysing their insurance contracts for product-by-product impacts,” says Suren Rajakarier, Partner, Head of Insurance, KPMG Sri Lanka.

KPMG International conducted an extensive survey this year to gauge the preparedness of the industry, covering 160 insurers from over 30 countries – including the10 largest insurers of the Forbes Global 500 that reportusing IFRS.These were a few interesting findings from the survey.

1. Most foresee difficulties in securing sufficient skilled people to address the new challenges and feel it would be an expensive exercise overall.

2. Majority of respondents are targeting 1 year of parallel running prior to going live.

3. Majority of respondents who plan to buy an IT system to identify coverage units for CSM allocation have not selected a vendor yet.

4. The popular belief is that clear vision towards the business objective and rigorous project management would be required to prevent the IFRS program becoming so big that people lose sight of its objective.

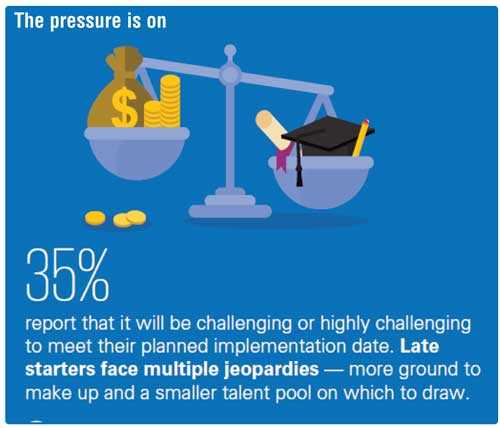

Any delay in commencing this journey would exacerbate the issue as the talent pool is limited as it is and the cost of implementation would rise as the deadline grows near.

This September a specialist KPMG team headed by Erik Bleekrode, Asia Pacific Insurance Accounting Change Lead Partner, would be in Sri Lanka to work with KPMG Sri Lanka team to assist their clients to navigate the IFRS 17 landscape successfully.