Sunday Feb 15, 2026

Sunday Feb 15, 2026

Monday, 1 August 2022 01:43 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The primary Treasury bill and bond auctions conducted during the week ending 29 July 2022 produced impressive outcomes as all auctions were fully subscribed while continued demand led to additional amounts been taken up at its phase II and direct issuance window.

The primary Treasury bill and bond auctions conducted during the week ending 29 July 2022 produced impressive outcomes as all auctions were fully subscribed while continued demand led to additional amounts been taken up at its phase II and direct issuance window.

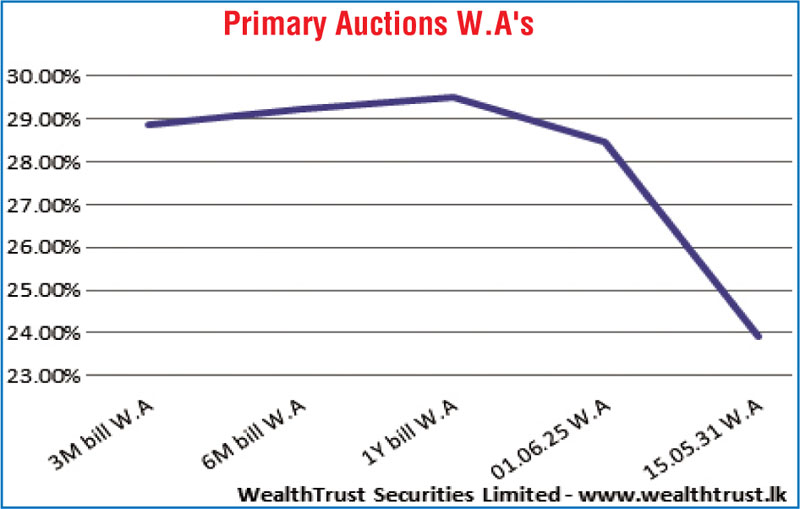

At the weekly Treasury bill auction, the weighted average rates on all three maturities decreased for a second consecutive week by 264, 73 and 29 basis points on the 91 day, 182 day and 364 day maturities respectively to 28.86%, 29.24% and 29.53% while a further Rs. 21.25 billion was taken up on the 182 day 364 day maturities at its phase II option.

At the Treasury bond auctions, the three year maturity of 01.06.25 and the nine year maturity of 15.05.2031 recorded weighted averages of 28.45% and 23.91% respectively, leading to a steep inversion of the yield curve while the auctions were fully subscribed once again.

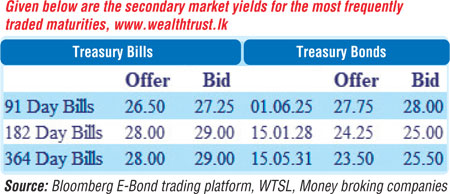

In the secondary bond market, activity picked up subsequent to the bond auction outcomes with the 01.06.2025 maturity changing hands at level of 27.90% to 28.31%.

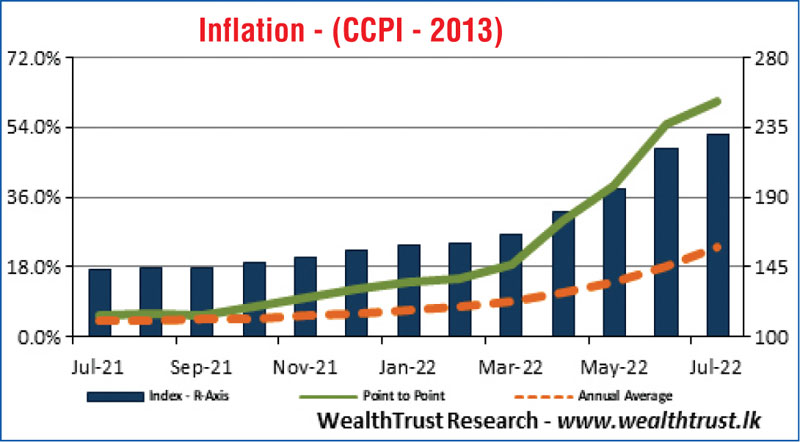

The Colombo Consumer Price Index (CCPI; Base 2013=100) for the month of July increased to 60.8% on its point to point against its previous month’s figure of 54.6%. The annual average also increased to 23.1% against 18.4%.

The foreign holding in rupee bonds increased marginally during the week ending 27 July by 0.24 billion to Rs. 4.16 billion while the daily secondary market Treasury bond/bill transacted volumes for the first four trading days of the week averaged Rs. 22.91 billion.

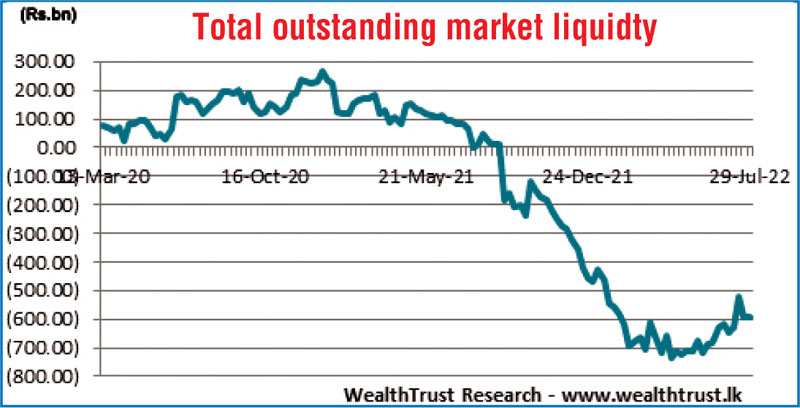

In money markets, the total outstanding liquidity deficit was registered at Rs. 595.39 billion by the end of the week against its previous weeks of Rs. 591.75 billion while the weighted average rates on call money and repo stood at 15.50% each for the week. The CBSL’s holding of Gov. Security’s stood at Rs. 2,261.36 billion against its previous weeks of Rs. 2,267.25 billion.

USD/LKR

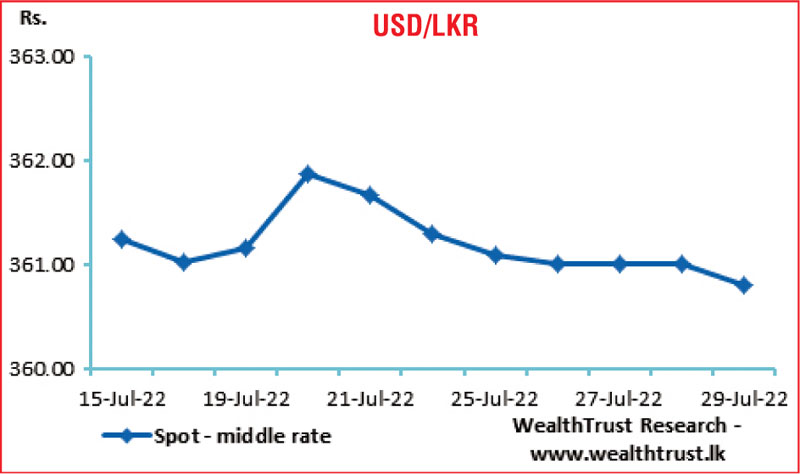

In the Forex market, the middle rate for USD/LKR spot contracts appreciated marginally to Rs. 360.80 against its previous weeks closing of Rs. 361.30.

The daily USD/LKR average traded volume for the first four trading days of the week stood at $ 40.86 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)