Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Friday, 22 April 2022 00:00 - - {{hitsCtrl.values.hits}}

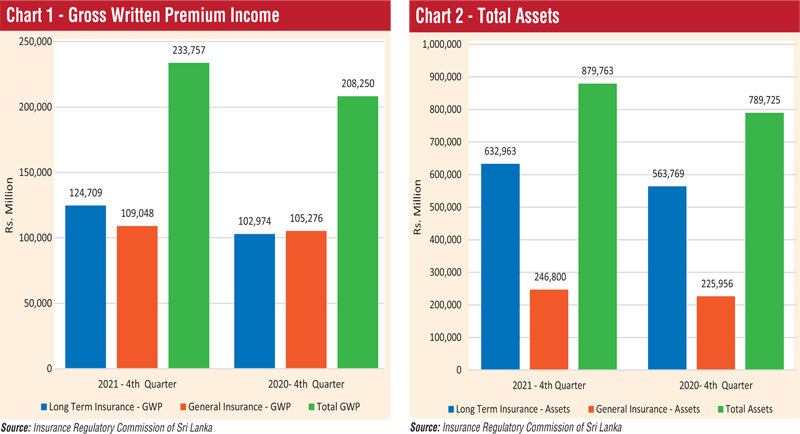

Gross Written Premium

The insurance industry had achieved a growth of 12.25% in terms of overall Gross Written Premium (GWP), during the 4th Quarter of 2021, recording a GWP increase of Rs. 25,507 million when compared to the same period in the year 2020. GWP of Long-Term Insurance and General Insurance Businesses was Rs. 233,757 million compared to the 4th Quarter of 2020, amounting to Rs. 208,250 million.

The GWP of Long-Term Insurance Business amounted to Rs. 124,709 million (Q4, 2020: Rs. 102,974 million) recording a growth of 21.11%. The GWP of General Insurance Business amounted to Rs. 109,048 million (Q4, 2020: Rs. 105,276 million) recording a growth of 3.58%.

Total assets

The value of the total assets of insurance companies have increased to Rs. 879,763 million at the end of 4th Quarter 2021, when compared to Rs. 789,725 million recorded as at the end of Q4 2020, reflecting a growth of 11.40%. The assets of Long-Term Insurance Business amounted to Rs. 632,963 million (Q4, 2020: Rs. 563,769 million) depicting a growth rate of 12.27%, mainly due to an increase in business volume which is represented by investments in government debt securities and corporate debts. The assets of General Insurance Business amounted to Rs. 246,800 million (Q4, 2020: Rs. 225,956 million) depicting a growth of 9.22%.

Investment in Government Securities

Investments in Government Debt Securities amounted to Rs. 262,588 million representing 46.12% (Q4, 2020: Rs. 243,561 million) of the total investments of Long-Term Insurance Business and increased by 7.81%, while such investment of the total investment of General Insurance Business amounted to Rs. 74,530 million representing 45.67% (Q4, 2020: Rs. 65,699 million) and increased by 13.44%. Accordingly, the total investment in Government Securities in the two businesses amounted to Rs. 337,118 million (Q4, 2020: Rs. 309,260 million), showing an overall increase of 9.01%.

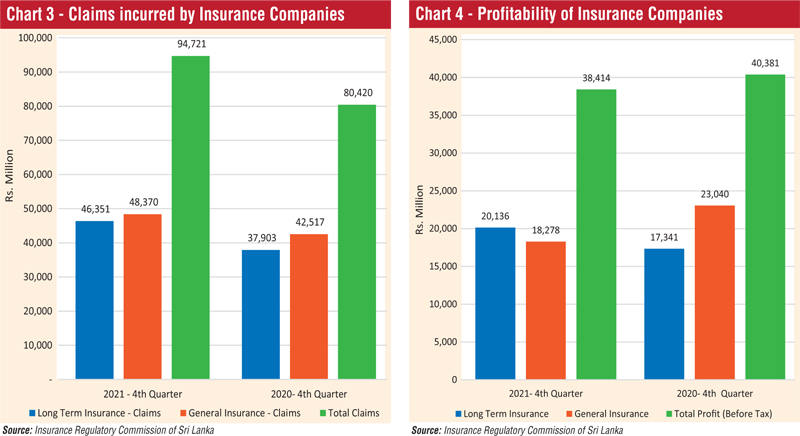

Claims incurred by insurance companies

The value of claims incurred by insurance companies in both Long-Term Insurance Business and General Insurance Business was Rs. 94,721 million (Q4, 2020: Rs. 80,420 million) showing an increase in total claims incurred amount by 17.78% year-on-year. The Long-Term Insurance claims, including maturity and death benefits, amounted to Rs. 46,351 million (Q4, 2020: Rs. 37,903 million). The claims incurred in the General Insurance Business, including Motor, Fire, Marine and other categories, amounted to Rs. 48,370 million (Q4, 2020: Rs. 42,517 million). Hence, during the 4th Quarter of 2021, there is an increase in claims incurred by 22.29% and 13.77% for Long Term Insurance and General Insurance Businesses respectively, when compared to the same period in 2020.

Profit (Before Tax) of insurance companies

The Profit Before Tax (PBT) of insurance companies as at the end of 4th Quarter 2021 in both Long-Term Insurance Business and General Insurance Business amounted to Rs. 38,414 million (Q4, 2020: Rs. 40,381 million) showing a slight decrease in total profit amount by 4.87%. The PBT of Long-Term Insurance Business amounted to Rs. 20,136 million (Q4, 2020: Rs. 17,341 million), an increase of 16.11% while the PBT of General Insurance Business amounted to Rs. 18,278 million (Q4, 2020: Rs. 23,040 million) a decrease of 20.67%.

Insurers

Out of 27 insurance companies (Insurers) in operation as at 31 December 2021, 13 companies are engaged in Long-Term (Life) Insurance Business, (12 companies are engaged in General Insurance Business and two companies function as composite companies (dealing in both Long Term and General Insurance Businesses). However, MBSL Insurance Company Ltd. has ceased to underwrite new Long-Term (Life) insurance business with effect from 1 June 2020.

Insurance brokers

Sixty-seven insurance brokering companies were registered with the Commission as at 31 December 2021. Total Assets of insurance brokering companies have increased to Rs. 8,592 million as at the end of 4th Quarter 2021, when compared to Rs. 7,143 million recorded at the same period of 2020, indicating a growth of 20.28%. However, the total assets of the insurance brokering companies for the 4th Quarter 2021 does not include the asset value of seven brokering companies due to non-submission of returns.

(Source: Insurance Regulatory Commission of Sri Lanka)