Friday Feb 20, 2026

Friday Feb 20, 2026

Monday, 31 May 2021 01:44 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

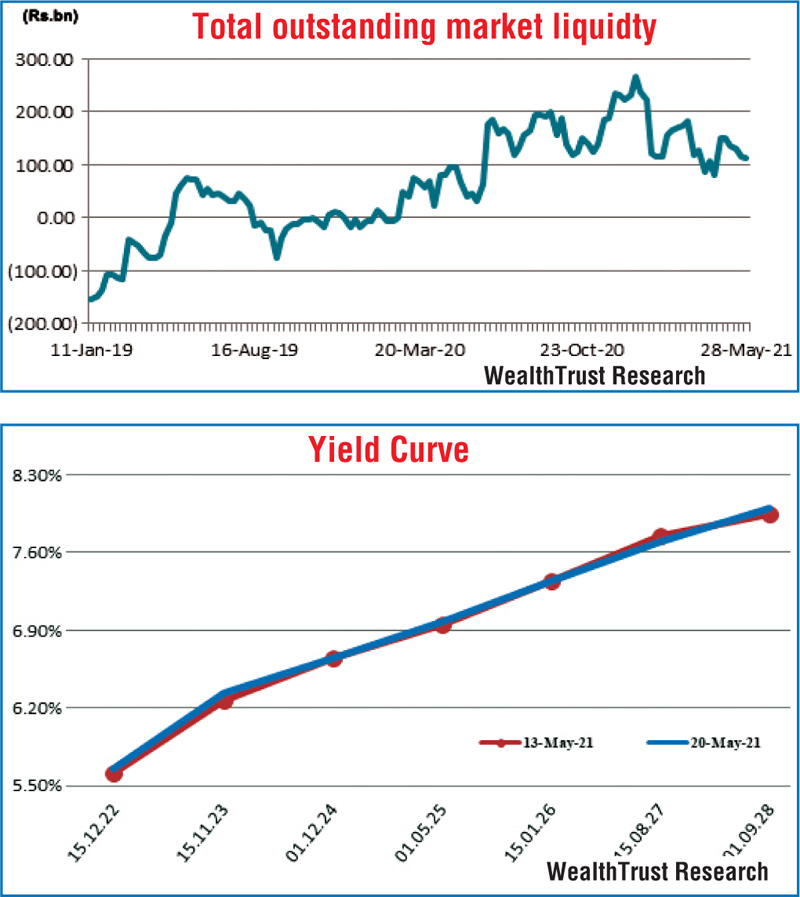

A lethargic sentiment was witnessed in the secondary bond market during the holiday shortened trading week ending 28 May, while yields increased marginally on the back moderate volumes changing hands.

The limited activity was seen on the most sorted maturities of 15.11.23, 01.12.24 and 01.05.25 at levels of 6.25% to 6.30%, 6.67% and 7.00% to 7.01% respectively against its previous weeks closing levels of 6.25/30, 6.60/65 and 6.92/00. In addition, 15.05.23, 15.07.23 and 01.08.26 were seen changing hands at levels of 6.05% to 6.06%, 6.15% and 7.50% respectively as well. In the secondary bill market, 20 and 27 August maturities traded at levels of 5.10% to 5.13%.

Nevertheless, the positive sentiment witnessed at the weekly Treasury bill auctions continued, as the total accepted volume increased to 96.38% of its total offered volume against its previous weeks 90.28%.

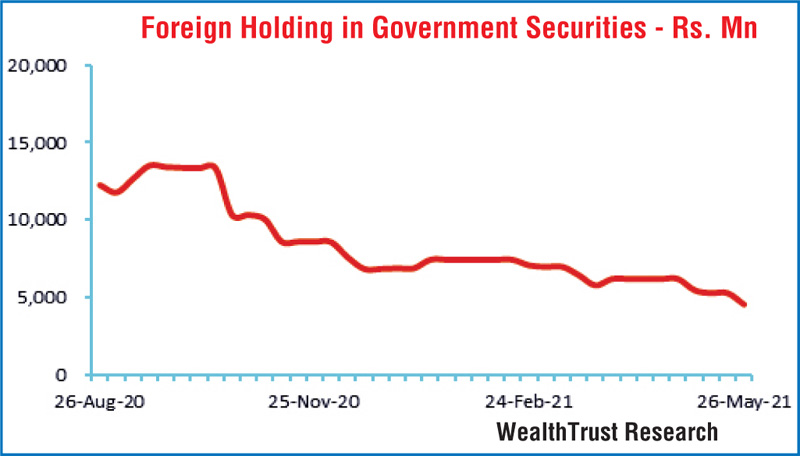

The foreign holding in rupee bonds recorded a decrease of Rs. 746.41 million for the week ending 25 May.

The daily secondary market Treasury bond/bill transacted volumes for the first two trading days of the week averaged Rs. 18.31 billion.

In money markets, weighted average rates on overnight call money and repo increased marginally to average 4.68% and 4.72% respectively for the week as the total outstanding liquidity surplus decreased further to Rs. 111.99 billion. The CBSL’s holding of Govt. Securities was recorded at Rs. 856.65 billion.

USD/LKR

In the Forex market, activity remained at a standstill during the week as bids for spot contracts continued to hover around Rs. 199.75.

The daily USD/LKR average traded volume for the first two trading days of the week stood at $ 61.81 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)