Saturday Feb 28, 2026

Saturday Feb 28, 2026

Friday, 9 November 2018 00:00 - - {{hitsCtrl.values.hits}}

HNB Assurance Group delivered striking financial results for nine months ended September 2018, posting a Profit After Tax (PAT) of Rs. 932 million.

HNB Assurance Group delivered striking financial results for nine months ended September 2018, posting a Profit After Tax (PAT) of Rs. 932 million.

This includes the regular profits for the period together with the one-off surplus which is resultant of the insurance industry valuation rule change and the first quarter valuation of the Life Insurance Fund under the new valuation method. The profit hence showcased a 230% growth in comparison to the corresponding period of 2017.

However, the aforementioned one-off surplus will only be applicable for the year 2018. The Group recorded a Gross Written Premium (GWP) of Rs. 6.5 billion against a GWP of Rs. 5.8 billion recoded in 2017.

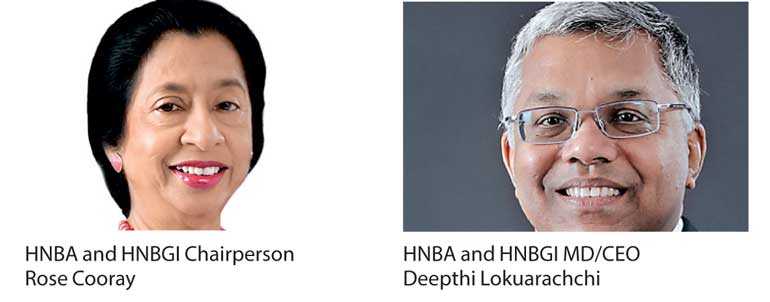

Sharing her views on the financial performance, HNB Assurance PLC and its fully owned subsidiary HNB General Insurance Ltd. (HNBGI) Chairperson Rose Cooray stated: “Amidst many challenging economic factors prevailing in the market, HNBA and HNBGI have delivered outstanding performance, yielding significant results and further consolidating our firm standing in the industry. These results are a testament to the Group’s steady growth and future outlook. The Group has taken several measures to improve its efficiency and processes to provide a superlative service to its clientele.”

Speaking on the Group’s steady performance, HNBA and HNBGI Managing Director/CEO Deepthi Lokuarachchi stated: “These financial results are reflective of the company’s continued commitment to grow profitable lines of business and affirm our standing in the market, delivering value to our customers and shareholders.” He further stated that the share price of HNB Assurance has remained stable since 2017, despite the challenging environment prevailing in the stock market. Lokuarachchi added: “Segments such as Motor and Fire of the General Insurance business depicted impressive results. The Life Insurance business reflected a growth on par with the market growth rates. The total assets of the Group reached a value of Rs. 20.6 billion and the investment in financial instruments surpassed a value of Rs. 17 billion. The Life and General Insurance Funds reached values of Rs. 12 billion and 2.6 billion respectively.”

HNB Assurance PLC (HNBA) is one of the fastest growing insurance companies in Sri Lanka with a network of 58 branches. HNBA is a Life Insurance company with a rating of A (lka) by Fitch Ratings Lanka for ‘National Insurer Financial Strength Rating’ and ‘National Long- term Rating’.

Following the introduction of the segregation rules by the Insurance Regulator, HNB General Insurance Ltd. (HNBGI) was created and commenced its operations in January 2015; HNBGI continues to specialise in motor, non-motor and Takaful insurance solutions and is a fully owned subsidiary of HNB Assurance PLC.

HNBA is rated within the Top 100 Brands and Top 100 companies in Sri Lanka by LMD and HNB Assurance has won international awards for brand excellence, digital marketing and HR excellence and also won many awards for its Annual Reports at the award ceremonies organised by the Institute of Chartered Accountants of Sri Lanka and SAFA (South Asian Federation of Accountants).