Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Tuesday, 2 March 2021 03:56 - - {{hitsCtrl.values.hits}}

By Ali Marikar-Bawa and Laisha Mirpuri

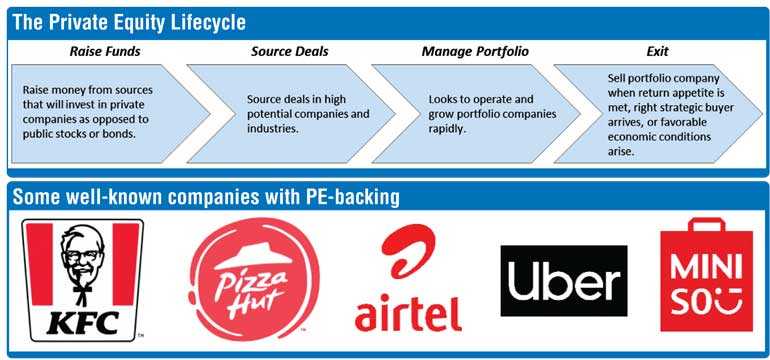

Private Equity (PE) is often defined as investments made into private companies. Similar to other investors, PEs follow the fundamental rule of ‘buy low, sell high’. PE capital is raised by institutional investors and high net worth individuals, looking to commit their money towards long term gain—a cycle that could last 10 years or more.

Private Equity (PE) is often defined as investments made into private companies. Similar to other investors, PEs follow the fundamental rule of ‘buy low, sell high’. PE capital is raised by institutional investors and high net worth individuals, looking to commit their money towards long term gain—a cycle that could last 10 years or more.

Funds invested through Private Equity are often used to finance new technologies, expand working capital, acquire companies (sometimes public companies which are then taken private) and strengthen a company’s balance sheet. PE is also used to transform an underperforming company with high potential to offer its investors a significant pay back on investment. PE typically invest in companies that are in the growth stage—i.e. companies that have seen two to three years of profitability.

What does the global PE landscape look like?

Global PE Assets Under Management – the total value of assets that PEs own and manage — was estimated at $ 4.5 trillion in 2019, and is expected to grow by 20% over 2025. In the US alone, it is estimated that the PE landscape is made up of 7,000+ investors with $ 900 b ready for investment, more than three times than that available to European investors.

Also, 19 of the largest 25 Private Equity firms are headquartered in the US — with examples including TPG Capital (which owns and controls Ducati Motorcycles and Del Monte Foods), and Advent International (an early investor in Lululemon). Firms such as Blackstone, KKR, and Carlyle Group stood at the top end, with their funds raised over the past five years at $ 96 billion, 62 billion and 55 billion, respectively. At the mid and smaller end of the spectrum are companies such as Insight Partners, Francisco Partners, and Partners Group with their five-year funds raised standing at $ 23 b, $ 19 b, and $ 18 b, respectively.

State of Private Equity in 2020

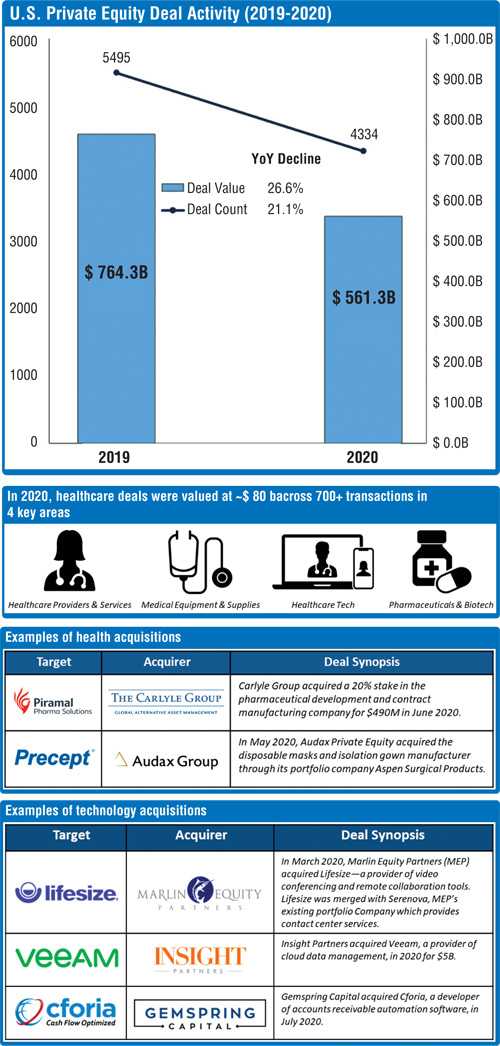

Despite the expected drop in deal counts and money spent, the average deal size stood at ~$130 m in 2020, only a 7% drop from the previous year. The average fund size stood at ~910 m, a 4% decline from 2019. Moreover, 2020 has seen a significant drop in sell offs, with PEs reassessing their pre-pandemic exit strategies, and adopting a wait-and-see approach rather than take a haircut on their returns. US exits in 2020 stood at 782, compared to 1,107 in 2019.

Impact of COVID-19 on Private Equity

COVID-19 has led to a surge in opportunistic deals driven by near term cash flow needs of businesses fostering immediate-term investing and rescue financing. Despite prevailing global economic uncertainty, Private Equity firms are adapting—trying to salvage and maintain adversely affected parts of their portfolios while searching for new opportunities that emerging trends could support.

Spotlight on healthcare and technology investments

Since 2009, PE investing in healthcare has outpaced broader PE deal activity as they often produce returns above the median. These deals have been driven by PEs seeking to capitalise on macro trends such as the aging global population, rise in per capita healthcare spending, etc. The onset of the global COVID-19 pandemic has led to continued proliferation of investments in healthcare.

Over the past decade, tech-focused PE funds have outperformed non-tech buyouts and growth equity strategies in terms of returns. The COVID-19 pandemic has made investment in technology more attractive due its high growth prospects and resiliency in today’s context.

Despite lower tech deal values and volumes compared to 2019, the US still holds a ~50% share of the PE technology deal value, totalling ~$ 134 b through 2020. As of the year end 2020, there were an estimated ~870 technology deals across key areas such as Software as a Service, cybersecurity, remote work technology, and automation.

Lessons to draw from Private Equity

PE growth fundamentals are centred on remaining dynamic in a continuously changing business environment, while maintaining profitability and mitigating risks. Although the PE landscape in Sri Lanka is still in its infancy, there are a number of lessons that any business can draw on:

Define the full potential of opportunities but only pursue a handful of well thought out initiatives: PE firms are very selective of their strategies, and conduct a thorough assessment of all factors including demand, competition, and trends. The execution of their planned strategies is meticulously mapped out from beginning to end, and progress is regularly monitored through a few measurable indicators.

Prepare for all scenarios and “be risk diverse, not risk averse”: PEs prepare for all scenarios by building well-rounded investment portfolios, which enables them to remain profitable despite adverse macroeconomic conditions. For instance, Apollo Global Management has invested 40% of its capital in distressed companies with low valuations during downturns, including its acquisition of Expedia Group—an online booking business—during the pandemic to capitalise on the potential substantial gains in the future.

Focus on broader themes to proactively capitalise on emerging trends: PE firms have pursued thematic approaches to investing, rather than limiting themselves to a particular company/sector. This involves identifying and selecting a few long-term themes to pursue based on strategic fit and building a portfolio around the theme. Benefits include having a better understanding of the types of deals to pursue and the size of the prize, a well-developed network of internal experts, and ability to create repeatable strategies to optimise results.

(Stax Inc. is Sri Lanka's leading management consulting firm, headquartered in Boston and offices in Chicago, New York, and Colombo. With more than 25 years of experience, Stax advises the world’s largest public and private corporations, private equity firms and their portfolio companies across a broad range of industries covering 40+ international markets. With a growing client base in Sri Lanka, including diversified conglomerates, blue-chip industry leaders, large family businesses, government organisations, and NGOs, Stax inspires organisations to dream big, think outside the box, and complement gut-based decision-making with fact-based research. For more information, please visit www.stax.com.)