Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 10 November 2020 00:55 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The dull sentiment in the secondary bond market continued at the start of a fresh trading week, as activity remained very moderate.

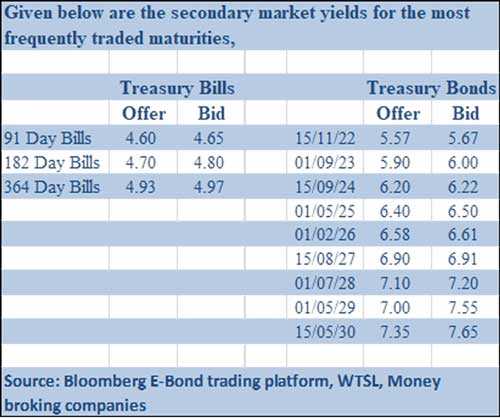

Limited trades were seen on the liquid maturities of 15.09.24, 01.02.26 and 15.08.27 at levels of 6.20%, 6.60% and 6.90% respectively. In addition, the shorter end maturities of 01.05.21, 01.08.21 and 15.12.21 were seen changing hands at levels of 4.73%, 4.82% and 5.10% respectively as well.

In secondary bills, 18 June 2021 maturity was seen changing hands at a level of 4.78%.

In the money market, the weighted average rates on overnight call money and repo were registered at 4.53% and 4.64% respectively as the overnight net surplus liquidity increased to Rs.157.45 billion yesterday.

LKR closes stronger

In the Forex market, USD/LKR rate on spot contracts was seen depreciating to an intraday low of Rs. 184.75 yesterday before bouncing back strongly to close the day mostly unchanged at Rs. 184.45/55.

The total USD/LKR traded volume for 6 November was $ 69.00 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)