Sunday Feb 22, 2026

Sunday Feb 22, 2026

Thursday, 16 August 2018 00:01 - - {{hitsCtrl.values.hits}}

Following is Fitch Ratings’ Report Card on Sri Lankan banks as of the first quarter of this year

Steady profiles; challenging environment: The performance of Sri Lankan banks under Fitch Ratings’ coverage remained fairly stable through 2017 and 1Q18, and Fitch expects their credit profiles to remain broadly intact. However, Fitch Ratings maintains a Negative banking-sector outlook for Sri Lanka in 2018 as it expects operating conditions to remain challenging. This is likely to put mild pressure on performance during the rest of 2018 and possibly 2019.

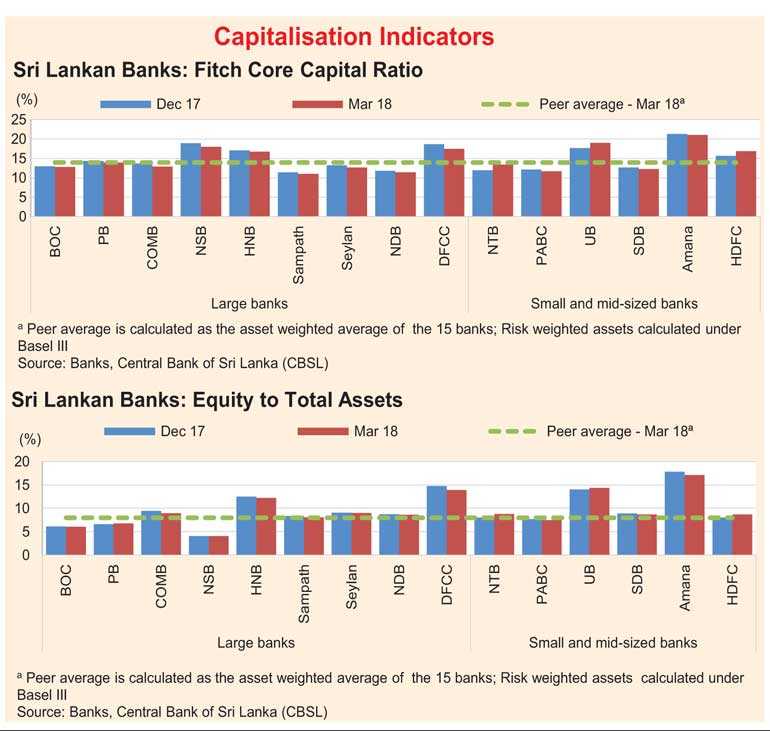

Capital raising to continue: The implementation of Basel III in 2017 prompted Sri Lankan banks to raise capital, leading to improved capitalisation across most banks. Fitch believes that large State commercial banks are the most likely to need further capital, as they are vulnerable to dividend demands from the state and their ability to raise capital may be constrained.

Sri Lankan banks have raised Tier 1 capital of Rs. 66 billion and Tier 2 capital of Rs. 45 billion since 2017 ahead of the full implementation of Basel III in 2019. This includes Rs. 10 billion of equity by the large state-licensed commercial banks. Further capital raising is likely in 2018 although much of the shortfall was bridged in 2017.

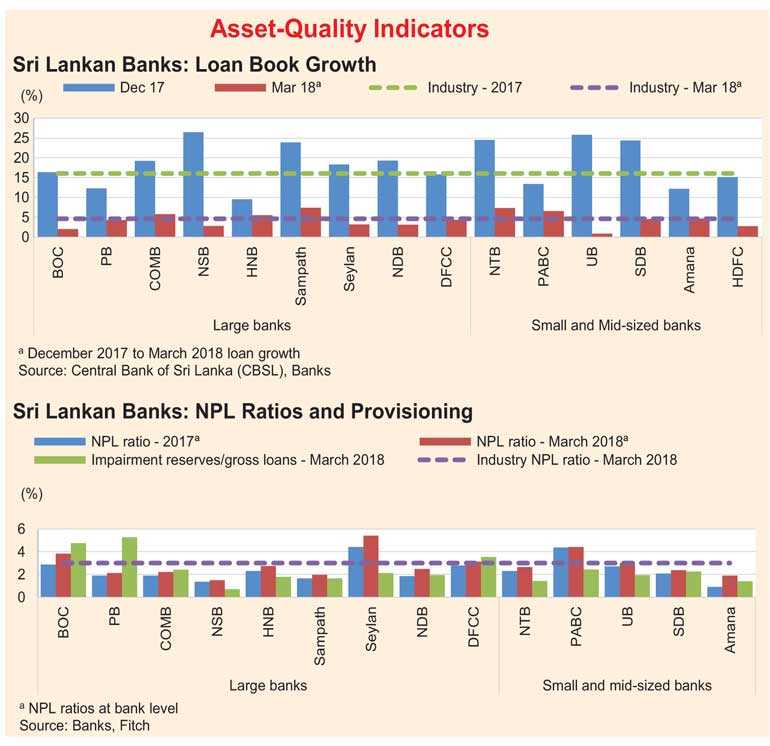

NPL risks remain: Absolute NPLs for the sector rose by 25% in 1Q18 on the back of difficult operating conditions, with relatively slow economic growth and pressure on disposable income. The gross NPL ratio for the sector had risen to 3.0% by 1Q18 from 2.5% at end-2017. There has also been an increase in rescheduled loans in 2017 and in 1Q18 across Fitch-rated banks, indicating ongoing pressure on asset quality. However, Fitch does not expect a significant increase in NPL ratios in 2018.

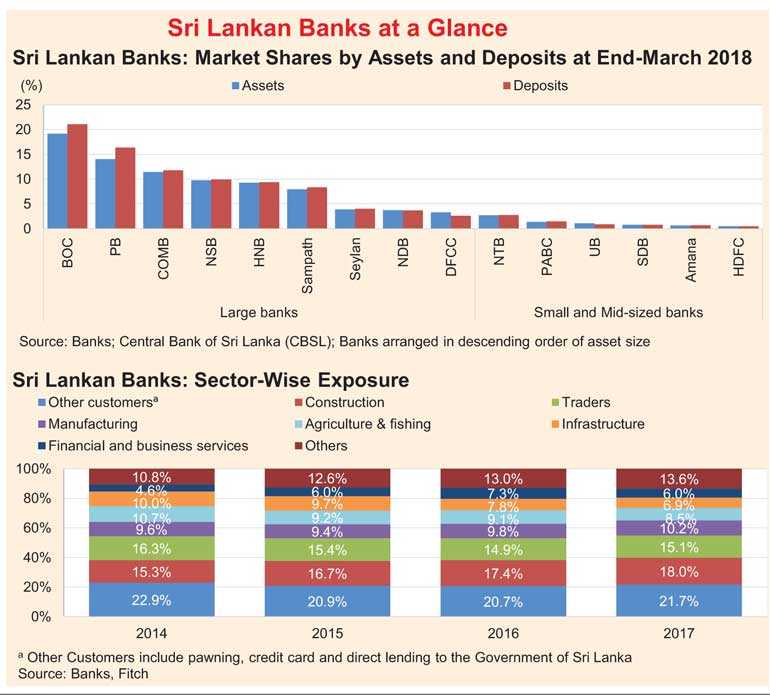

Moderate credit growth likely: Loan growth for the sector picked up to 4.6% in 1Q18, but Fitch expects credit expansion to be kept in check due to the authorities’ focus on managing inflationary pressure and risks from any fiscal slippages. Sector loan growth had also moderated in 2017 to 16.1% (2016: 17.5%, 2015: 21.1%), due mainly to the deceleration in private-sector credit demand as measures to tighten monetary policy in 2016 and 2017 took effect.

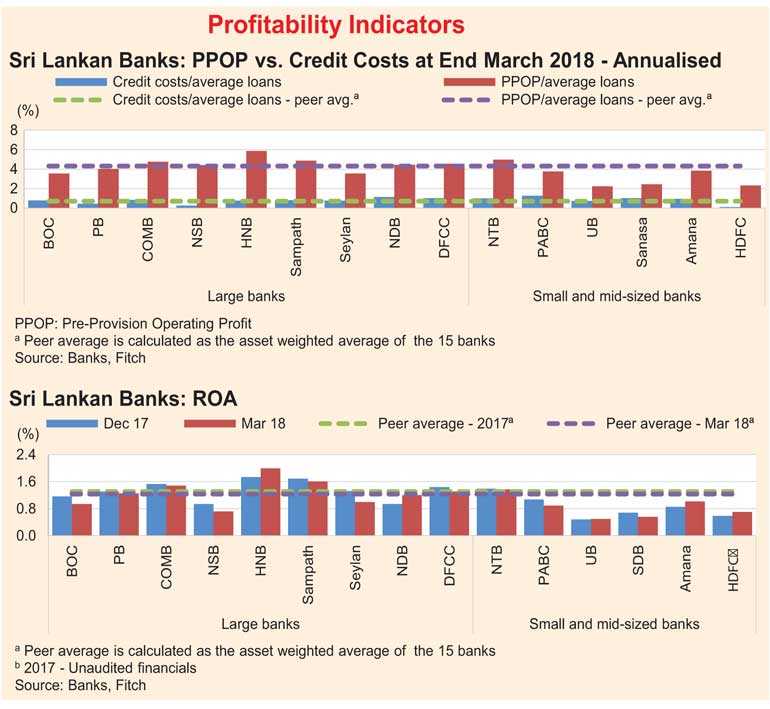

Moderate profit growth: The net profit growth for Fitch-rated banks in 2017 dropped to 10% from 25% in 2016 amid higher credit costs and taxes, although there was considerable improvement at the pre-impairment level. Higher credit costs could weigh on sector ROA in 2018.

Stable funding and liquidity: Deposits are likely to remain the main source of funding (83% of total funding at 1Q18) for Sri Lankan banks. The share of current and savings accounts (CASA) for the sector had decreased to 34% of total deposits from 37% at end-2016 due to the shift to term deposits on account of higher interest rates. The loans/deposit ratio for the sector had eased slightly to 87% by 1Q18.

SLFRS 9 Impact: The implementation of SLFRS 9 in 2018 presents an additional challenge for Sri Lankan banks. The shift could add more pressure to capitalisation through a possible significant one-off adjustment, and drive a structural increase in normalised credit costs.

The Basel III capital shortfall could widen through the impact of SLFRS 9, although the impact on regulatory capital ratios is likely to be spread out across several periods.