Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 12 January 2021 01:34 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The first Treasury bond auction for the year 2021 was fully subscribed yesterday at its first and second phases, kick starting the fresh trading week on a bullish note. This was the first instance since July 2020 that the total offered amount was fully subscribed at a bond auction. The 01.12.2024 and 01.05.2028 maturities were fully subscribed at the first phase of the auction while the new maturity of 15.01.2026 was fully subscribed in the second phase subsequent to Rs. 27.45 billion being taken up at its first phase of Rs. 40 billion.

The first Treasury bond auction for the year 2021 was fully subscribed yesterday at its first and second phases, kick starting the fresh trading week on a bullish note. This was the first instance since July 2020 that the total offered amount was fully subscribed at a bond auction. The 01.12.2024 and 01.05.2028 maturities were fully subscribed at the first phase of the auction while the new maturity of 15.01.2026 was fully subscribed in the second phase subsequent to Rs. 27.45 billion being taken up at its first phase of Rs. 40 billion.

The maturity of 01.12.2024 recorded a weighted average rate of 6.38%, similar to its pre-auction rate of 6.36/38 and marginally below its stipulated cut off rate of 6.39%. The maturity of 01.05.2028 registered a weighted average rate of 7.39%, below its stipulated cut off rate of 7.44%. The new maturity of 15.01.2026 fetched a weighted average rate of 6.72% against its stipulated cut off rate of 6.73. The bids to offer ratio stood at 1.99:1.

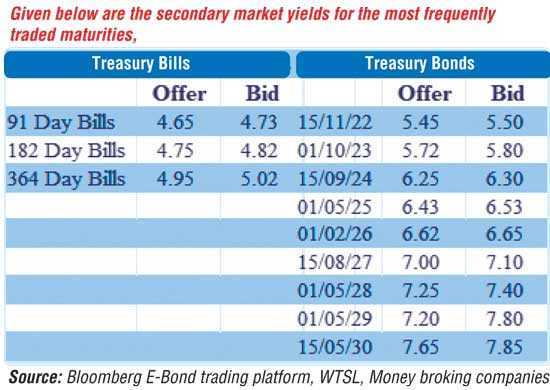

In the secondary bond market, subsequent to the release of the auction results, the decreasing trend in secondary market bond yields witnessed over the previous few days continued. Yields hit intraday lows of 5.20%, 5.30%, 5.45%, 5.50%, 5.80%, 6.27% and 6.33% on the more liquid maturities of 2022’s (15.03.22, 01.07.22, 15.11.22 and 15.12.22), 01.10.23 and 2024’s (15.09.24 and 01.12.24). In addition, maturities of 15.10.21, 15.12.23, 01.05.25 and 01.02.26 traded at levels of 4.90%, 5.87%, 6.50% and 6.65% respectively.

In secondary bills, April and October maturities changed hands at levels of 4.71% and 4.90% respectively.

Today’s bill auction will see Rs. 40 billion on offer, consisting of Rs. 12.5 billion on the 91-day, Rs. 5 billion on the 182-day and a further Rs. 22.5 billion on the 364-day maturities. The stipulated cut off rates was published at 4.71%, 4.80% and 5.05% on the 91, 182 and 364- day maturities respectively, unchanged from its previous week. The total secondary market Treasury bond/bill transacted volumes for 8 January was Rs. 7.83 billion.

In money markets, overnight call money and Repo averaged 4.54% and 4.55% respectively yesterday as overnight surplus liquidity stood at a high of Rs. 237.33 billion.

Rupee loses marginally

In the Forex market, the USD/LKR rate on the more active spot next contracts was seen depreciating marginally yesterday to close the day at Rs. 192/193 against its previous day’s closing level of Rs.190.50/192.50 on the back of buying interest by banks.

The total USD/LKR traded volume for 8 January was $ 70.75 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)