Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 2 March 2020 01:49 - - {{hitsCtrl.values.hits}}

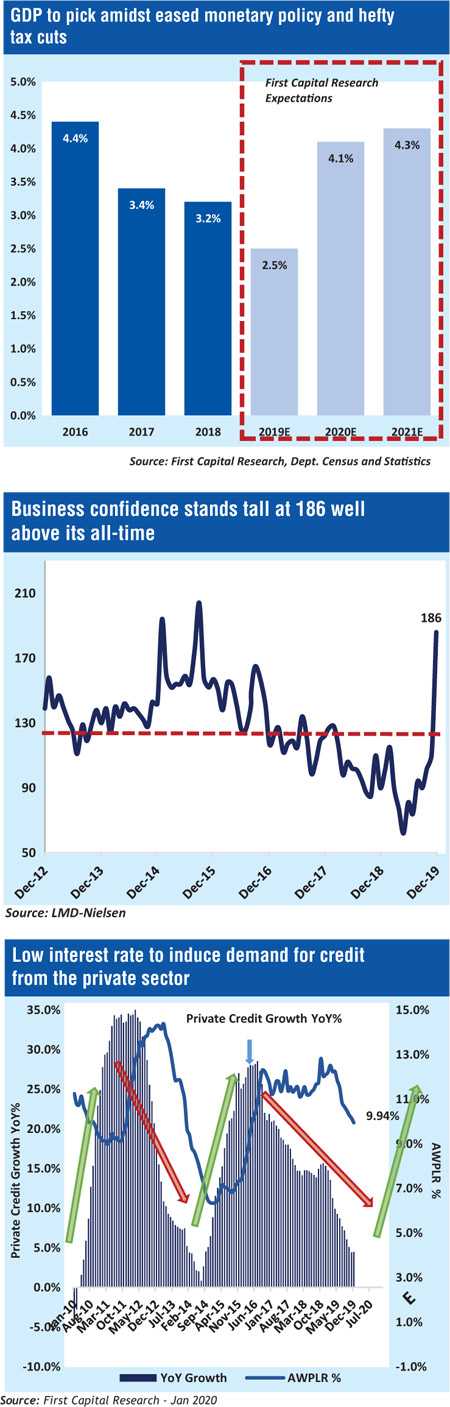

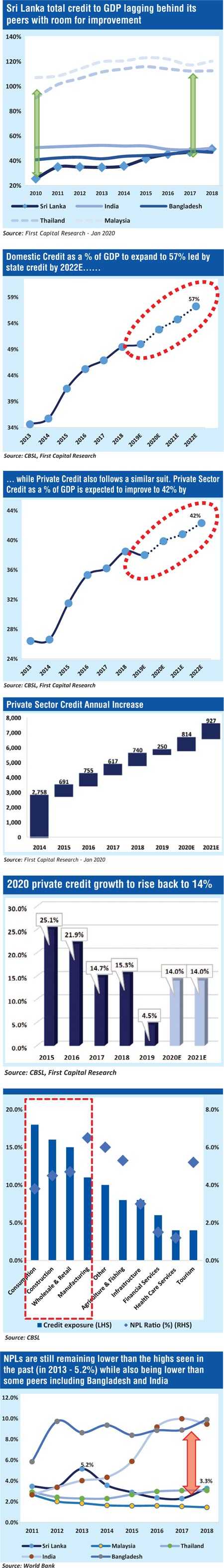

With the recovery in economic activity supported by monetary easing and fiscal stimulus, we expect to see an upward trend in the banking sector lending while providing breathing space after hefty taxes. Moreover, recently introduced CBSL regulation on capital adequacy is expected to provide more leeway for the mid to large banking segment supporting credit expansion. Furthermore, sector has a heavy focus on cost management via digitization and automation which is expected to reduce C/I ratio and enable to improve the bottom line. We expect the capital rich banks to capture market share with the support of new digital platforms and automation measures while the overall credit is expected to grow at a moderate pace of 14%. Accordingly, we expect overall earnings of the banking sector to grow at a CAGR of 19% in 2019E-21E.

|

|

|

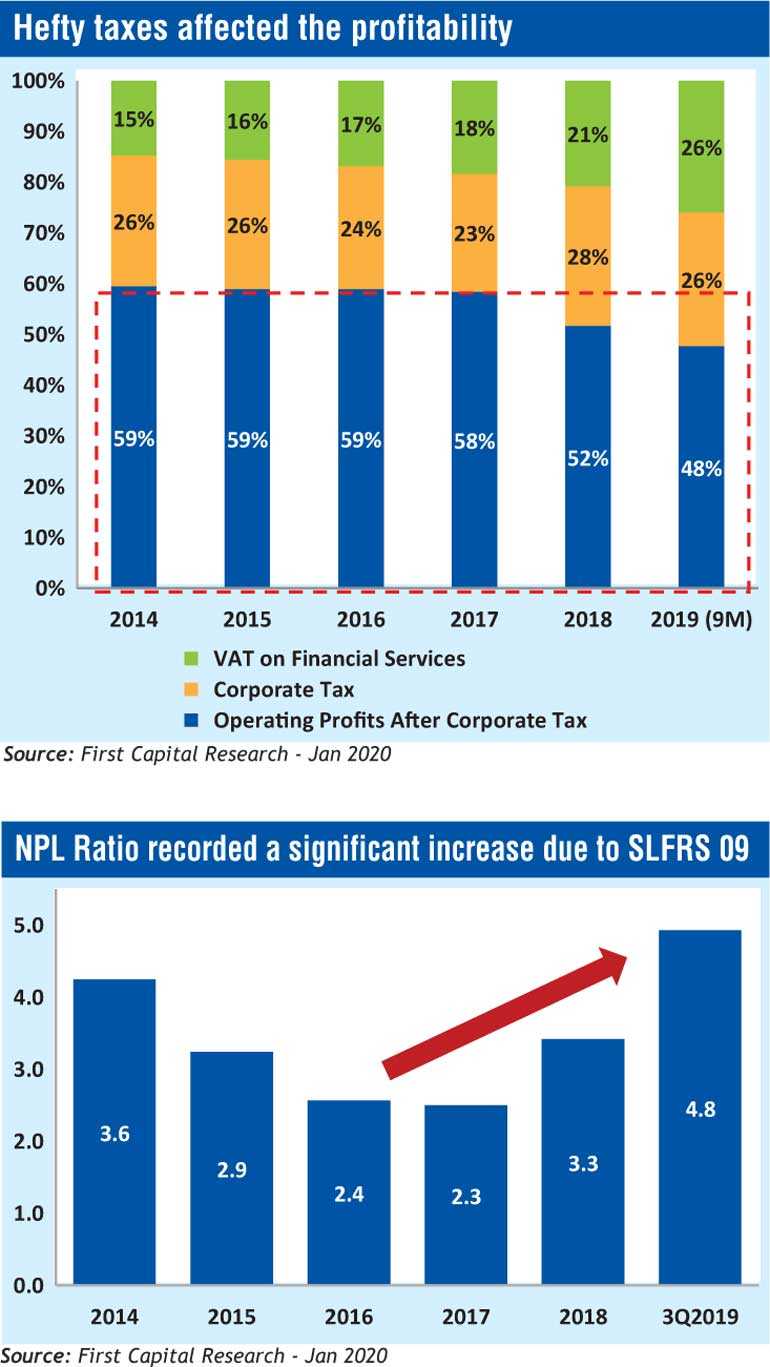

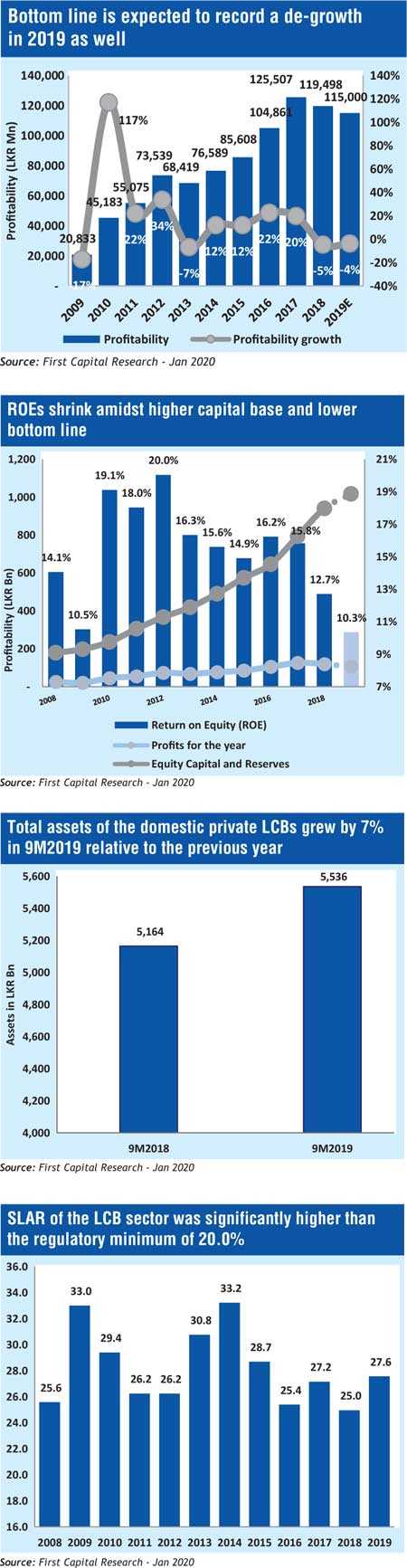

The profitability of banks were negatively impacted by the introduction of Debt Repayment Levy (DRL) since Oct 2018, adding on to the existing taxes, VAT of 15% and NBT of 2%. Moreover, the adoption of SLFRS 9 and implementation of Basel III though were expected to improve the asset quality of the banking sector in the long term, continued to be challenging for banks during this period with rising Non-Performing Loans further hampering profitability and reserves. The combined effect of the above-mentioned factors led to a decline in ROEs of banks in the backdrop of the new capital raised to meet regulatory requirements creating a base effect.

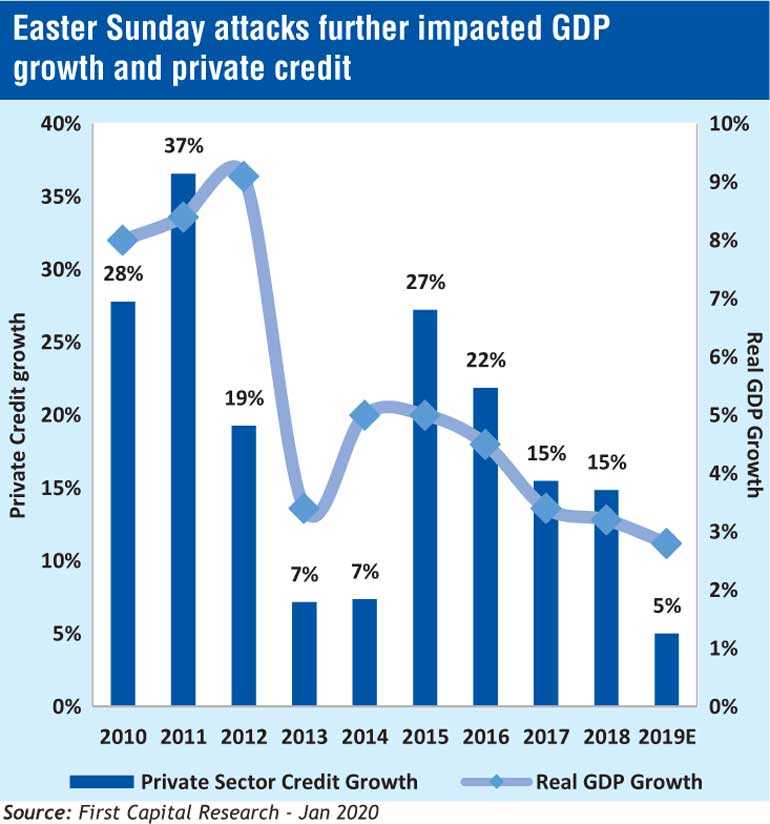

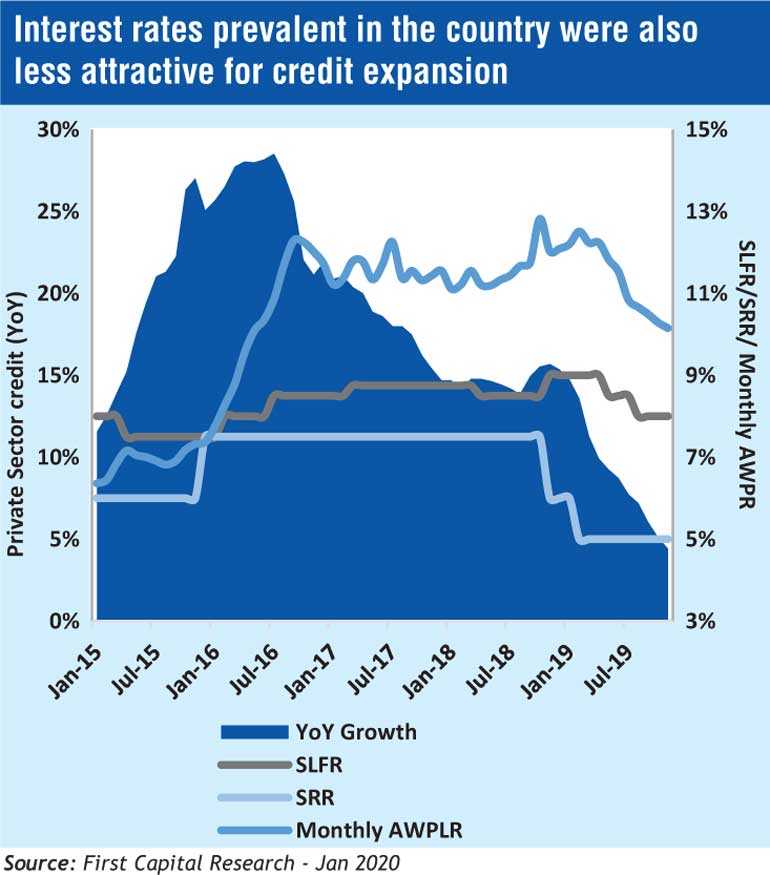

The growth in the economy during the first 6M of 2019 was hampered due to a combination of events; the spillover effects of the political turmoil experienced during the latter part of 2018 and the Easter attacks in April 2019, putting the growth trajectory of the economy on a slowdown as GDP growth reached a mere 2.6% in 1H2019 compared to 4.0% in the corresponding period in 2018. All subsectors of the economy witnessed significant slowdown in 2Q2019 compared to 1Q2019 as the events of April 2019 took a severe toll on economic activity of the country. The banking sector felt the economic slowdown, as private sector credit growth slowed down, and credit contraction was observed in some months over the period. This led to an industry wide slowdown in growth of loans and advances.

In order to circumvent these adverse developments, CBSL took prudent actions and followed an accommodative monetary policy stance during the period. The policy rates were reduced in 2 separate instances up to August 2019 with the intention of resolving liquidity shortages and boosting credit growth. Furthermore, CBSL imposed an interest rate limit on all deposits in April 2019 when intended results of policy reductions did not materialize. As interest rates still failed to come down to the required levels, CBSL took further measures by imposing a 200bps cut on lending rates in October 2019, while removing the previously imposed deposit cap.

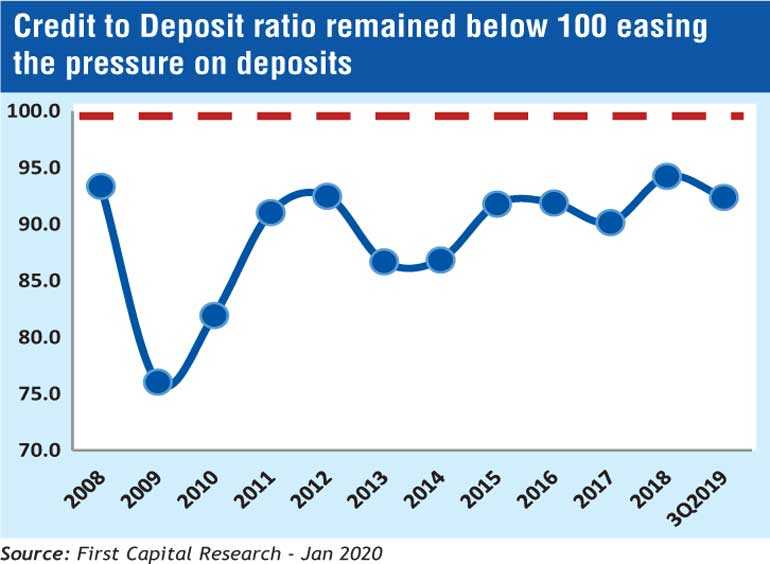

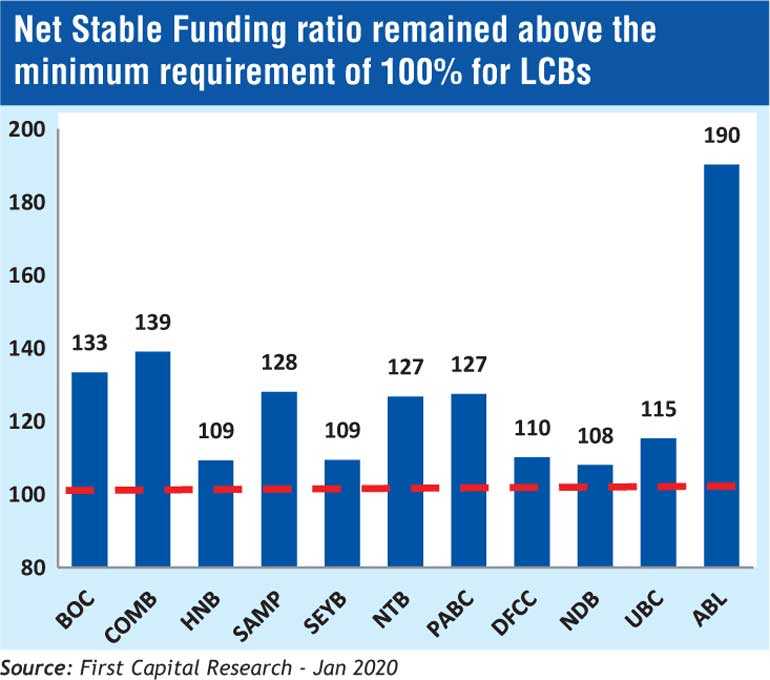

The banking sector continued with a healthy level of liquidity during 9M of 2019 and exhibited a higher resilience against liquidity risk. Statutory Liquid Asset Ratio (SLAR) of the banking sector which measures the adequacy of liquid assets against deposits and borrowings, remained well above the regulatory minimum requirement.

Safe haven among other sectors

Following the global financial crisis in 2007-2008, global standard-setters have been actively involved in strengthening the existing regulatory framework to enhance the resilience of the banking sector.

The banking industry will remain slightly challenging in the short to midterm due to the transition to higher capital standards under Basel III and adoption of SLFRS 9, although in the long run implementation of Basel III and SLFRS 9 will improve the resilience and stability of the banking sector.

Considering the important role played by the banking sector in the economy of the country, CBSL continues to introduce prudential policy measures and regulations based on internationally adopted regulations to further strengthen the stability of the banking sector.

In the aftermath of the global financial crisis, the Basel Committee on Banking Supervision further strengthened the capital and liquidity requirements under the Basel III framework in order to address a number of shortcomings in the pre-crisis regulatory framework and to provide a foundation for a resilient banking system.

CBSL has issued Banking Act Directions covering the above-mentioned capital and liquidity standards under the Basel III framework to banks in Sri Lanka and closely monitors their compliance in this regard.

Close Alignment to international regulatory standards may also help banks in obtaining better credit ratings, and less vulnerable to external pressures resulting the banking sector a safe haven among other sectors.

Economy in transition and poised for renewed growth

The asset quality for consumption linked sectors are likely to remain bullish on the account of recovery in household income with easing monetary policy, improved transmission of policy rates to bank lending rates and impact of recently announced fiscal measures on consumer sentiment.

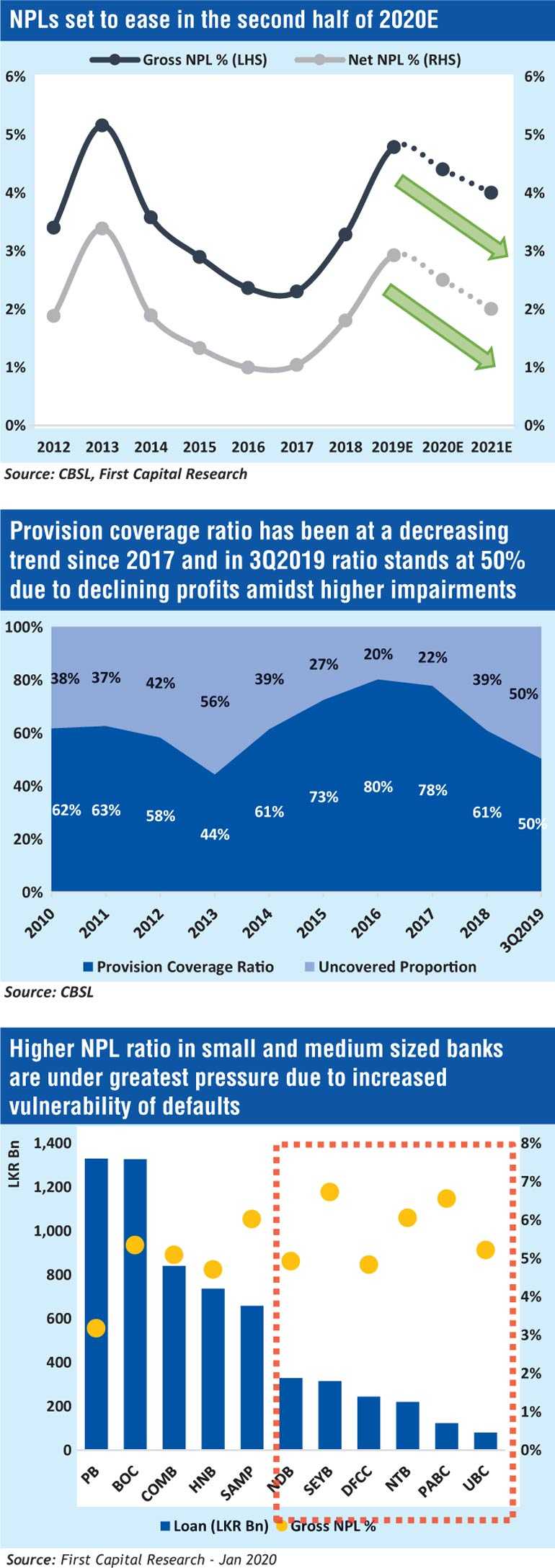

NPLs are still remaining lower than the highs seen in the past (in 2013 - 5.2%) while also being lower than some peers including Bangladesh and India. Provision coverage ratio has been at a decreasing trend since 2017 and in 3Q2019 ratio stands at 50% due to declining profits amidst higher impairments.

Revised CBSL regulations to ease pressure on banking sector capital ratios

Capital adequacy requirements were introduced by the CBSL under Basel III with effect from 1 July 2017. The implementation of BASEL III by 01 Jan 2019 has prompted banks to raise their capital base through raising fresh capital or via issuance of BASEL III compliant debt instruments. NDB exceeded the asset base of LKR 500.0Bn while Tier 1 capital ratio stood at 10.56%. SEYB Tier 1 stood at 9.71% as at end Sep 2019 and after the right issue it is expected to improve. As per the previous regulation by CBSL, NDB required additional capital to grow loan book at average expected market rate in 2020E.

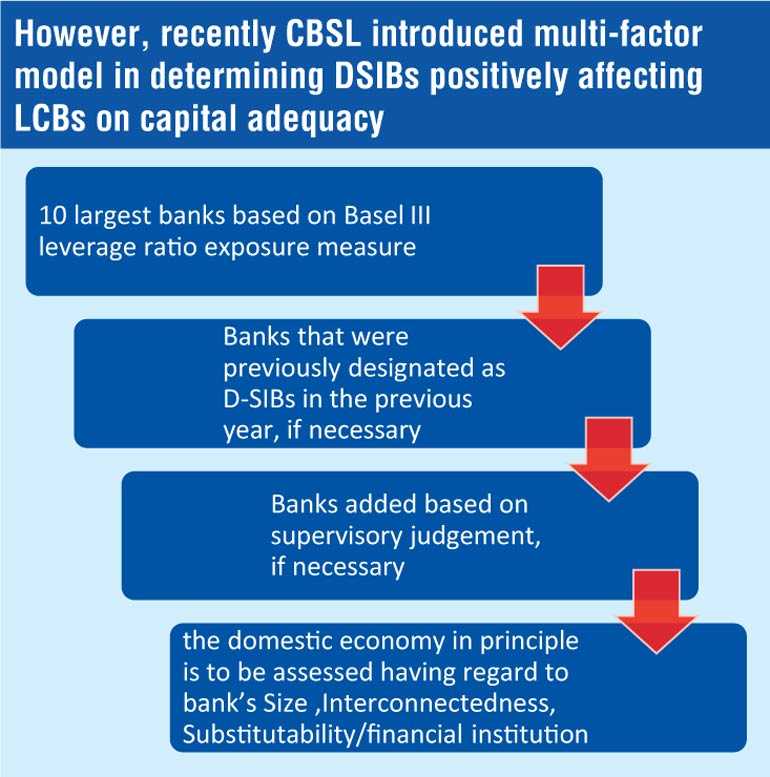

As per the new regulation by CBSL only four banks are designated as domestically Systematically important banks (DSIB) down from an earlier broad listing of six large banks.

The central bank named Bank of Ceylon and private Commercial Bank of Ceylon as the most important banks in the system, which require a higher loss absorbency (HLA) capital surcharge of 1.5 times of a broadly net assets number as Common Equity Tier I capital in ‘bucket 2’ category under BASEL rules.

Peoples’ Bank and privately owned Hatton National Bank have been named in a ‘bucket 01’ category with a HLA ratio of 1.

Meanwhile, Sampath Bank and Seylan Bank will have lower capital requirements, falling back to the normal regulations applicable for all other banks, which have remained unchanged.

Common Equity Tier 1 capital requirement is 7 percent for all non D-SIB banks, while Total Tier 1 capital buffer is 8.5 percent and Total Capital Requirement is 12.5 percent.

Revised CBSL regulations eases pressure on regulatory ratios providing room for credit growth while easing pressure on banks which faced tight capital requirements.

Digitalization and Fintech the game changer of the banking industry

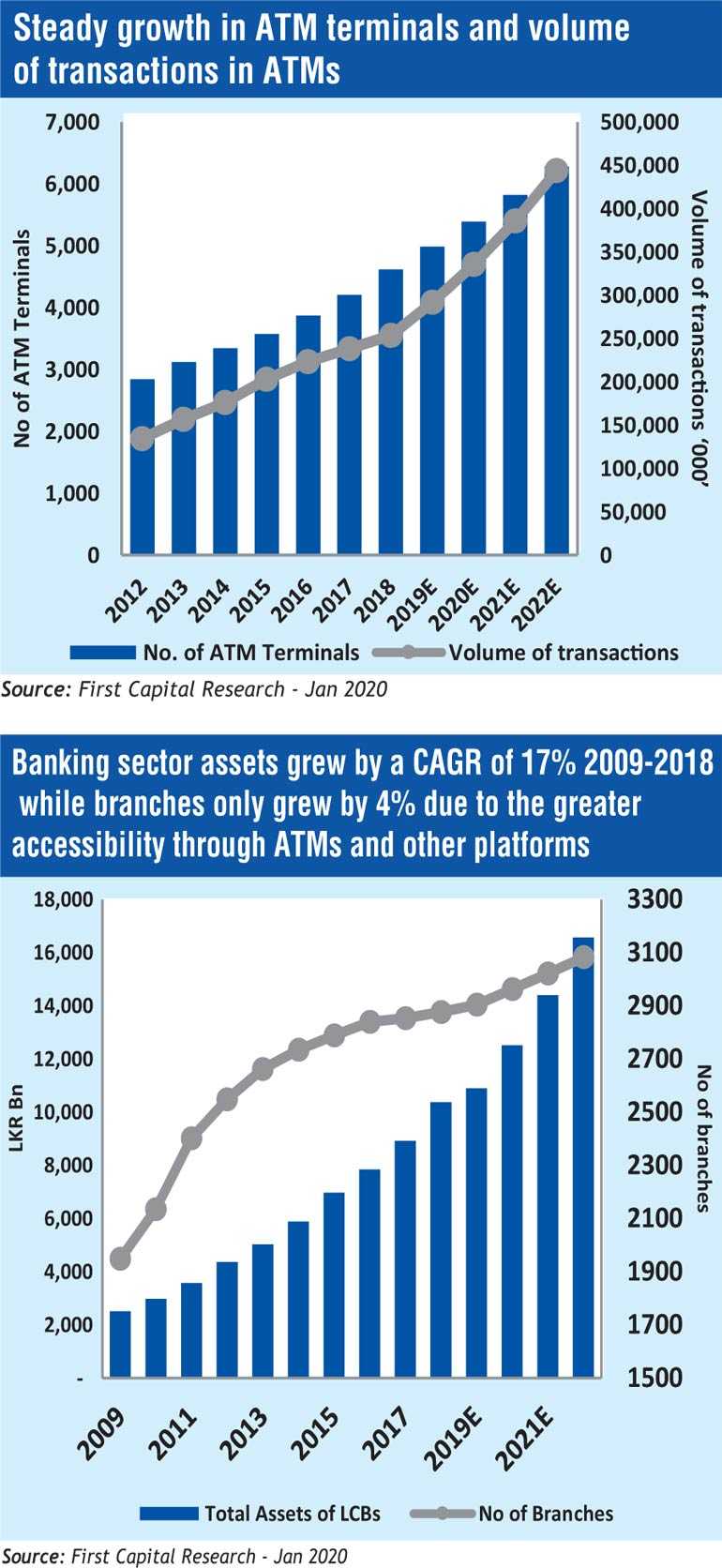

Assets of LCBs has increased by 17% CAGR since 2009, although branch network has only grown by 4% attributable to the accessibility via other modes such as ATMs and increased usage of digital platforms. Total number of ATM terminals posted an 8% CAGR while volumes of transactions posted through ATMs have nearly doubled in 2018 relative to 2012. Banks have concentrated on digital banking whilst consolidating its physical branch network which has eased the C/I ratio for most banks. Front office of banks is in the process of being automated with advanced ATMs multi-tasking by handling bulk of the front office services. We expect the process of front office automation to be implemented at an accelerated pace during the 2020E-2022E.

SL’s commercial bank branch density for 100,000 people is much greater than its peers demonstrating that SL population still opt for physical banking. However developed countries have a deeper reach to people through virtual banking over the traditional banking.

Sri Lanka has entered a phase which is dominated by mobile applications. The figures attest to the degree to which digital banking has become a viable alternative to brick and mortar banking. The growth of the internet, mobile, and communication technology suggest that Sri Lanka has enormous opportunities for digitalization of its processes.

Banks were seen freezing recruitments which is reflected by only 2% CAGR in staff recruitments after 2013. Further with certain positions within the banks falling redundant amidst the digitalization and automation process, all banks have taken initiatives reorganizing banks around the needs of the customers and to make the customer service units more marketing oriented. Accordingly, total income per employee has shown a considerable increase.

C/I ratio to decline and stabilize around 44%.

We expect C/I ratio to range between 46%-44% over 2019E-22E with pressure on NIMs as competition intensifies in the banking sector. C/I ratio has recorded a major dip over the last 5 years to 45% from 51% in 2014, but tough economic conditions are likely to increase competition resulting in pressure on NIMs. However, banking sector has embraced a trend of process digitalization and front office automation to manage costs while introducing innovative fintech products to enhance customer service and improve customer accessibility. A stronger focus was also noticed in increasing fee-based income amidst the rise in online retail transactions via new fintech solutions. The improvements are likely slightly reduce and stabilize C/I ratio despite higher competition within the sector

First Capital Research upgrades Banking Sector to BUY from HOLD with a 42% return over 1 Year.