Wednesday Mar 04, 2026

Wednesday Mar 04, 2026

Friday, 7 December 2018 00:00 - - {{hitsCtrl.values.hits}}

By Charumini de Silva

Top financial experts on Wednesday said that financial inclusion not only entails providing affordable access to financial services and products, but it also requires the need for increasing financial literacy and awareness to ensure that people can utilise the financing effectively.

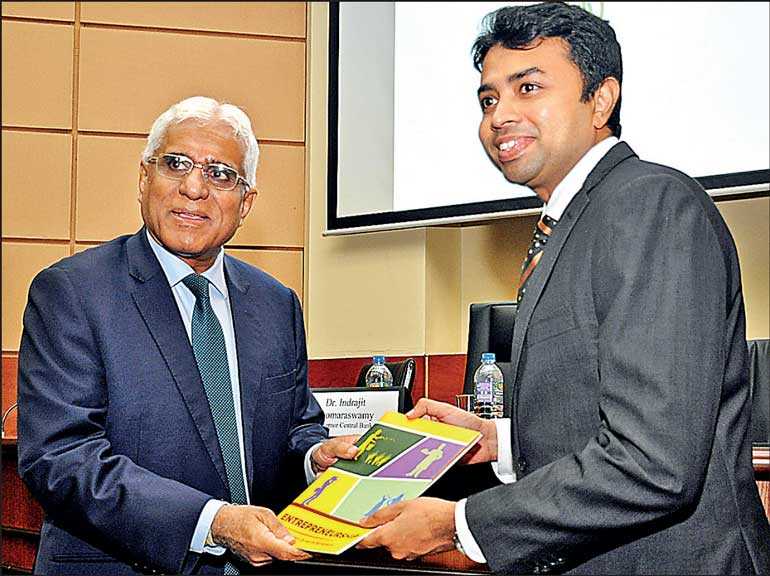

In an effort to support the Central Bank’s National Financial Inclusion Strategy (NFIS), CFA Society Sri Lanka in collaboration with the Central Bank yesterday launched ‘Financial Literacy’ and ‘Entrepreneurship’ guide books focused at improving public awareness and education in the financial industry.

CFA Society Sri Lanka Advocacy Chair Ravi Abeysuriya had written a book on ‘Financial Literacy to Achieve Your Financial Wellbeing’ to promote financial literacy, while CFA Society Sri Lanka Advocacy Co-Chair Sidath Kalyanaratne wrote a book on ‘Entrepreneurship’ which is available for download free from the CFA website. The two guide books would soon be translated to Sinhalese and Tamil.

Delivering the opening remarks CFA Society Sri Lanka President Zafar Jeevunjee said higher financial literacy will help more people make the right choice in their financial journey and encourage them to enter the formal regulated financial system, which in turn will enable greater access to capital and efficient allocation of capital supporting growth, reducing poverty and increasing future savings.

He said pursuing financial literacy and public education programs are part of CFA Institute’s mission to lead the investment profession globally by promoting the highest standards of ethics, education and professional excellence for the ultimate benefit of society.

“We believe a well-functioning, efficient system depends on the trust of the participants. It also depends on the basic knowledge and the awareness of the participants about the products and services being offered and their relative risks and rewards. We believe we have a responsibility and a role to play in building a stronger and accountable financial industry,” Jeevunjee added.

Chief Guest of the event Central Bank Governor Dr. Indrajit Coomaraswamy highlighted the need to move beyond the platform of access to bank accounts and have people to use their bank account in a way that supports their livelihoods and helps them to raise their living standards.

“The Central Bank has attached a very high priority to financial inclusion and for entrepreneurship development. These are two themes on which CFA has assisted us by producing these two booklets, which has the potential to have a significant impact in an area where we are striving to make progress for many years now,” he said.

According to him, the branch density in Sri Lanka amounts to 18.6% branches for 100,000 adults and bank branches are spread throughout the country. This is reflected by the fact that 83% of the adults have bank accounts at some financial institution. In addition, there is gender parity with 83% of adult women also having an account at a formal financial institution, which is significantly higher than amongst regional countries.

Dr. Coomaraswamy also noted that fostering MSMEs is essential for achieving equitable and regionally balanced growth and development. “There has also been a special focus on youth and grass-root level entrepreneurs. The highest priority must be attached to cultivating an eco-system that is conducive for entrepreneurs targeting the development of MSMEs. The booklets target aspiring new entrepreneurs, with the aim to increase the success rate of their entrepreneurial ventures,” he added.He said the Central Bank has been conducting awareness and capacity building programs covering financial literacy, financial management, entrepreneurship development and skills development for the new segments of the population.

However, the Governor pointed out that the progress has been mixed, partly because it has not always had a holistic approach to address the financial inclusion and for entrepreneurship development elements and issues.

“The question arises whether our approaches have been comprehensive enough and whether we have had the coordination that is necessary across Government, Ministries and Departments to run the maximum impact in terms of the initiatives that have been launched in the past,” he added.

CFA Society Sri Lanka Advocacy Chair Ravi Abeysuriya said dishonest organisations and individuals who operate outside the regulatory purview thrive on exploiting financially illiterate citizens that get carried away with high returns offered neglecting the risks.

“There are many individuals and dishonest organisations mobilising high interest paying deposits which are actually pyramid schemes. Loan sharks on various irresponsible credit schemes charge very high interest rates sometimes as high as 225%. They thrive on exploiting poorest of the poor who cannot reach out or obtain finances from the regulated financial system. These are the most vulnerable set of people that get into deep debt traps,” he pointed out.

He said Sri Lanka’s financial literacy was low despite the country boasting of high levels of literacy. “Evidence is showing that this was seen not just among the poor or less educated, but also among doctors, lawyers and other professionals. I had personal knowledge of people like judges who went for illegal deposit schemes due to ignorance and lack of awareness of risks. They do not understand that rewards go with risks,” he pointed out.

Abeysuriya said a survey by Standard and Poor’s found that South Asia had the lowest share of financial literacy, while in advanced economies on average about 65% of adults are financially literate. In Sri Lanka it was about 35% according to this study.

CFA Society Sri Lanka Advocacy Co-Chair Sidath Kalyanaratne said one main reason why Sri Lanka could not elevate its small island economy to the next phase of growth over the last decade was the lack of development in the entrepreneurial culture in this country.

“The journey of an entrepreneur is never an easy one, but the challenges an entrepreneur has to face in Sri Lanka are far greater than elsewhere in the world due to three key reasons that include, no culture supports entrepreneurship, no conducive ecosystem for the development of entrepreneurship and no proper education system that supports the development of an ecosystem,” he added.

Considering the employment numbers, Kalyanaratne stressed that only 7% are entrepreneurs, whereas 30% is the global average.

Pix by Lasantha Kumara