Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Tuesday, 3 March 2020 00:00 - - {{hitsCtrl.values.hits}}

Fitch Ratings yesterday warned that the finance and leasing sector would face added pressure for consolidation as deadlines for the implementation of tougher capitalisation requirements approach in 2021.

“We view further consolidation of the sector as positive for financial sector stability in Sri Lanka, but the process could be impeded by a challenging operating environment,” Fitch said.

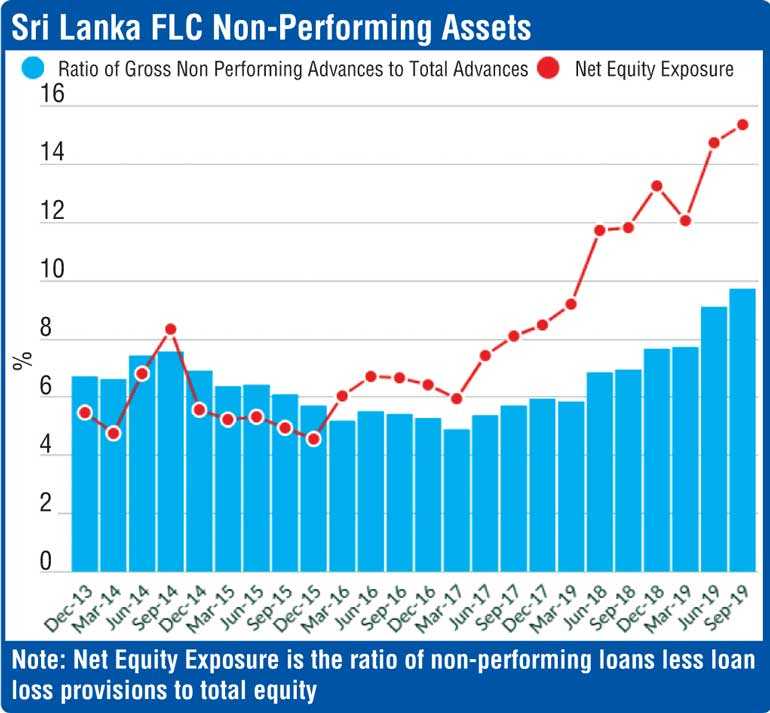

Gross loan growth for Sri Lanka’s finance and leasing companies (FLCs) has slowed sharply in a sluggish economy, coming in at only 0.5% YoY at end-September 2019 against 12.9% on average between end-2015 and end-2018.

The capacity of some of smaller FLCs to withstand asset-quality pressures stemming from this more challenging environment has been weak, owing in part to thin capital buffers.

Figures from the Central Bank of Sri Lanka (CBSL) indicate that FLCs accounted for 7.6% of total financial system assets at end-2018, so developments in the sector are significant for the overall stability of the financial sector.

The top 10 FLCs accounted for 69% of sector assets at end-September 2019, with 33 smaller FLCs representing the remaining 31%.

The CBSL has sought to reduce risks by raising capital thresholds to encourage consolidation.

FLCs are required to meet an enhanced Rs. 2.5 billion ($ 14 million) absolute capital requirement by 1 January 2021, up from Rs. 2 billion at present. The minimum Tier 1 capital ratio for FLCs will also rise from 6.5% to 7% on 1 July 2020, before increasing further to 8.5% from 1 July 2021.

“We believe the CBSL is unlikely to delay the deadlines for raising capital thresholds,” Fitch said.

It has already taken action against several FLCs that failed to meet capital requirements. In 2019, the regulator cancelled licences held by TKS Finance and issued a notice of cancellation for the licence held by The Finance Company and Sinhaputhra Finance (the CBSL has provided the latter with an opportunity to implement a capital augmentation plan within a stipulated timeframe, despite the notice of cancellation).

Among Fitch-rated finance and leasing companies, the regulator has also imposed a deposit cap on Dialog Finance (AA(lka)/Stable), Bimputh Finance (BB-(lka)/Stable), Ideal Finance (B+(lka)/RWP) and Abans Finance (BB+(lka)/Stable) due to their non-compliance with the interim thresholds.

“FLCs may face difficulty improving their profitability, as we expect economic growth to remain subdued. This could impede efforts to meet enhanced regulatory capital requirements by generating capital internally or by raising capital externally. We believe this risk will be higher for smaller standalone finance companies,” Fitch said.

Those FLCs that have raised external capital recently, as part of efforts to meet the higher capitalisation standards, have benefited mainly from support from their major shareholders.

The tough operating environment may also impede consolidation, as asset-quality issues and limited near-term growth prospects for the sector could make M&A less attractive.

“We estimate that Fitch-rated FLCs will require additional equity capital of around Rs. 5.5 billion ($ 30 million) to meet the absolute regulatory capital thresholds by 1 January 2021. We believe that generating this internally through profits may be difficult and therefore might require additional external capital raising. Capitalisation factors are likely to remain a prominent rating sensitivity for most of our rated standalone FLCs,” Fitch added.