Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Monday, 9 April 2018 00:00 - - {{hitsCtrl.values.hits}}

The Government expects the Small and Medium Enterprises (SMEs) sector to be the backbone of the economy. However, the lack of capital or rather the difficulty in accessing capital, due to both the cost of capital and the requirement of collateral, have been the main impediments in the development of SMEs and start-ups. Debt capital has been always an issue for many entrepreneurs. Therefore, they lag behind on new investments and expansions. ‘Enterprising Sri Lanka’ focuses on access to finance with low cost of funding and fixed terms, enabling entrepreneurs to take a long-term view in their investments. People’s Bank empowers such entrepreneurs, nurturing them through a dedicated customer relationship management model.

One of the main proposals of the Government budget, “Enterprising Sri Lanka”, a program to empower Sri Lankan entrepreneurs, is already in process. Among various initiatives under ‘Enterprising Sri Lanka’, loans with interest concessions are the key proposal, with more than 15 such loan schemes featuring different categories of interest subsidies. People’s Bank, being the ‘People’s Service Brand of the Year’ for 12 consecutive years, joins with the Government of Sri Lanka in implementing these schemes across the country.

People’s Bank, being the pioneer in SME Lending since its inception in 1961, has assisted micro-enterprises and SMEs in not only facilitating debt capital, but also inculcating savings habits, developing financial discipline, establishing good governance and improving managerial competencies of the targeted SMEs. The strategy of the Bank is to develop and maintain a very strong customer relationship through a dedicated branch network across the country. This endeavour is well backed up by the dedicated SME centres established, covering all administrative districts in the country. The role of the SME centre is to identify, nurture and develop potential business customers whose contribution to the GDP is immense and essential. Despite the risk in start-ups, People’s Bank has the passion of identifying and nurturing them, similar to the role of incubators.

The advantages of beginning a business relationship with People’s Bank are many, including availability of any type of credit facilities, flexible terms and conditions, competitive or concessional rates of interests, structuring facilities on the basis of customers’ needs, no hidden charges, latest state-of- the-art technology for banking transactions, very efficient foreign trade and trade finance facilities, friendly customer relations, and more. Recently, the Bank digitalised most of its operations into virtual banking.

Below are the success stories of some young enthusiastic and energetic entrepreneurs identified from all corners of the country. Having been identified at the micro level, they have methodically migrated to the upper levels of their businesses through People’s Bank’s meticulous customer relationship management.

P.G. Chaminda, sole proprietor of Orian Terra Lak Steel in Habarana, was employed in a steel factory in South Korea. Upon his return to the motherland, he started a small-scale steel doors assembling plant. He was approached by the Bank’s Habarana Branch and scaled up to a medium-size steel door manufacturer equipped with the latest technology, supplying job opportunities for over 25 employees. This factory is environment-friendly, and as the product is a substitute for wood-based doors, helps conserve trees as well. His competitive advantage is in pioneering the adaptation to the latest technology.

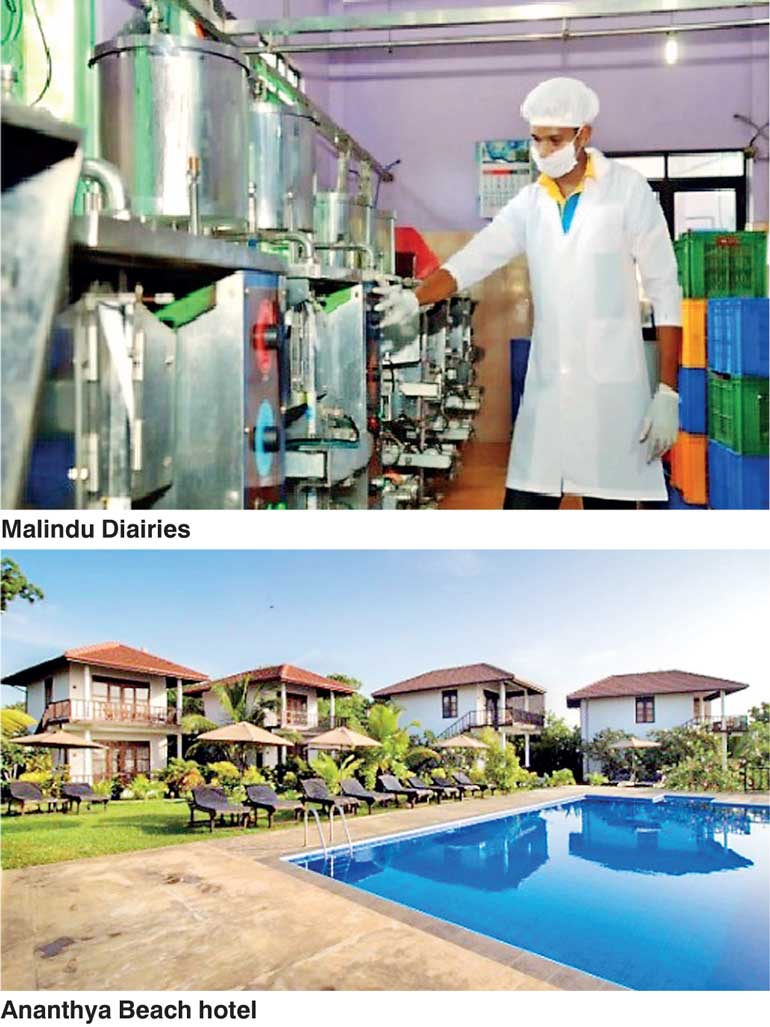

Malindu Dairies Ltd Managing Director Manjula Nishantha is a young entrepreneur who won the best Eco Friendly Entrepreneur of Southern Province 2018. He started his business with Rs. 5000 from People’s Bank in 1992, and now is a popular dairy brand in the Southern Province. His factory not only procures 4000 litres of fresh milk for processing on a daily basis from the farmers in the area, but has also provided more than 220 employment opportunities. He has gradually diversified into other businesses, such as processing spices; a recent diversification is baked products.

D. Sampath Perera, sole proprietor of Deshakthi E-Solutions, is another young entrepreneur who has initiated a totally environmental-friendly polythene factory in Dankotuwa. He recycles used polythene and manufactures bio-degradable polythene as a solution for the prevailing polythene issue in Sri Lanka. People’s Bank was able to assist him to procure a processing plant and machinery with comfortable terms and conditions. People’s Bank continuously maintains its relationship with this young entrepreneur in scaling up his business.

Gayan Jayawickrama is a classic young entrepreneur who owns two tourist hotels, Ananthaya Beach Hotel and Ananya Beach Hotel in Tangalle. He started his first hotel with financing from People’s Bank, and then elevated into high quality service focused on foreign tourists. People’s Bank’s first Jaya Isura Loan was granted to him for the construction of the second hotel, now a highly successful operation.