Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Tuesday, 25 September 2018 00:00 - - {{hitsCtrl.values.hits}}

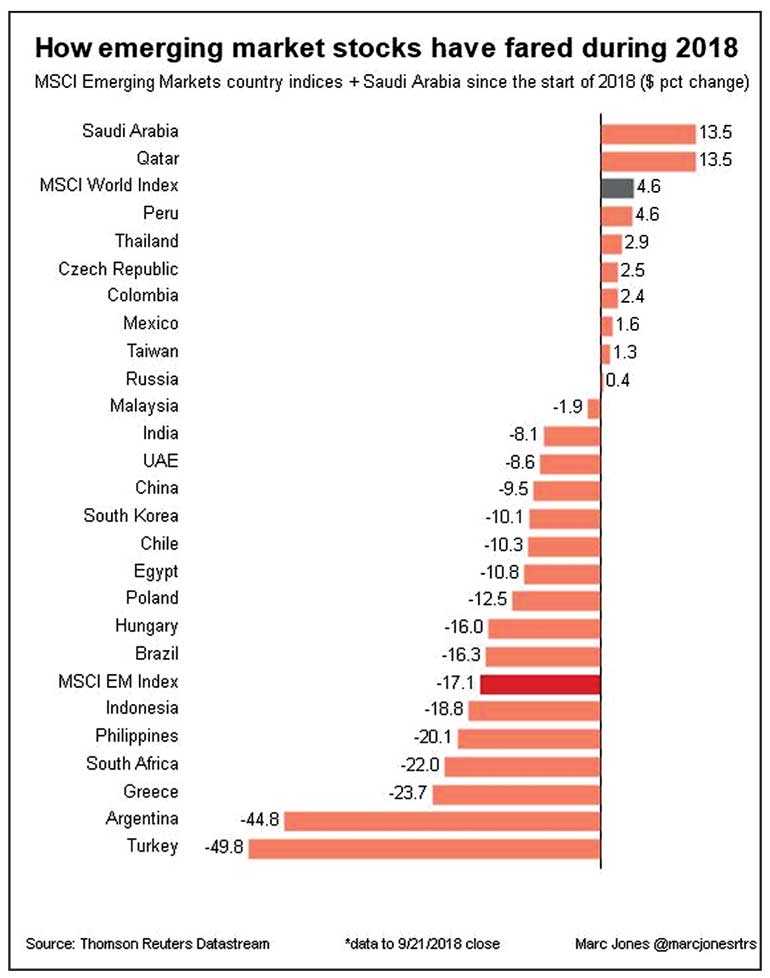

London (Reuters): Emerging markets sobered up on Monday after last week’s mini bounce, with the significant drags of an escalating Sino-US trade war and another US interest rate hike this week causing a pullback.

A 2% jump in oil prices did support markets blessed with the black stuff, such as Russia, but for most others it was tough going.

Stock markets in China and South Korea had been shut in Asia, but the near 2% drop in Hong Kong’s Hang Seng index and the first fall in five sessions for MSCI’s pan-emerging market index was testimony to the mood of the new week.

Ten percent US tariffs on some $200 billion of Chinese goods as well as $60 billion of retaliatory Chinese levies were kicking in and there were reports that China had cancelled mid-level trade talks with Washington.

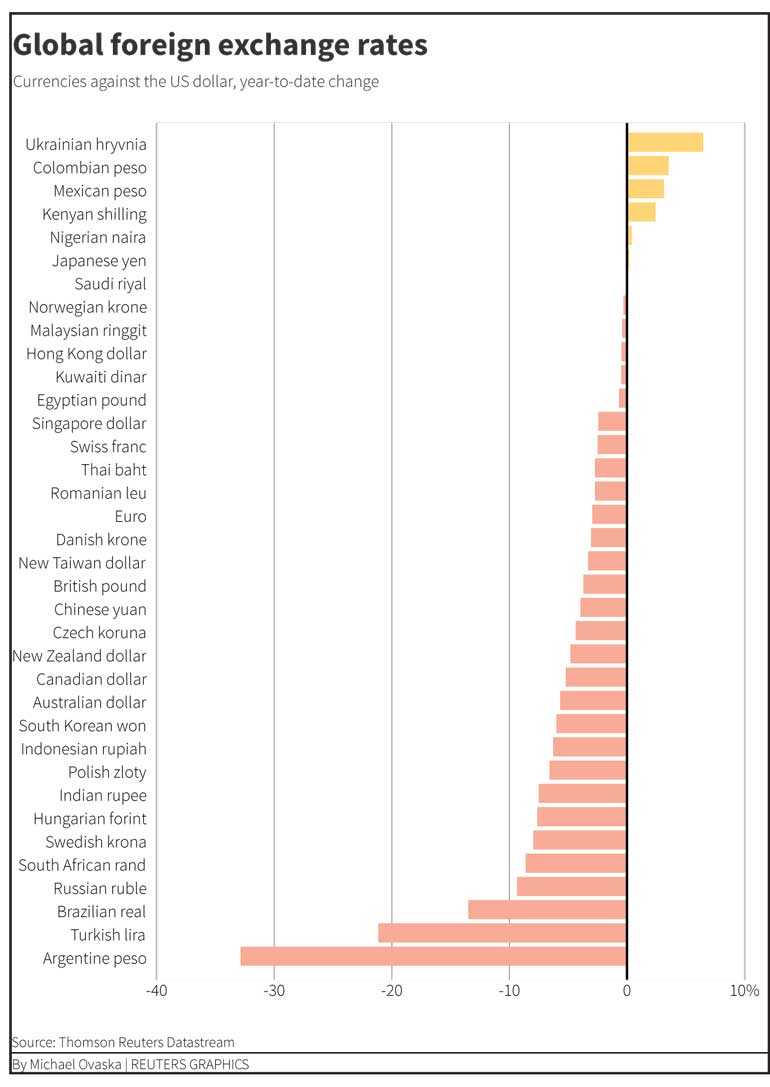

There was also the sight of South Africa’s rand backsliding after its best week in over two years and Turkey’s lira and India rupee both struggled again as the rising in oil theoretically increased their import bills.

“There was the China news about the trade negotiations which is not good news for Asian FX and EM FX in general,” said TD Securities’ senior emerging markets strategist Paul Fage.

Mexico’s peso was subdued ahead of NAFTA talks this week, though its top performance this year shows investors are helpful a deal can be struck.

The latest report from the Bank for International Settlements, dubbed the Central Bank to the world’s Central Banks, over the weekend had warned though that emerging markets were likely to remain under pressure for a while.

It underscored how there has been a more than doubling of dollar-denominated debt over the last decade and with US interest rates likely to go up again on Wednesday, the worry is that servicing that debt will soon get painful.

The BIS also published a study on the exposure of economies and banks around the world to Turkey, which has been one of the focal points of the emerging market stress this year.

Data covering the period to the end of March this year, showed foreign banks had $223 billion in outstanding loans, securities holdings and other claims vis-à-vis Turkey residents.

That overall exposure may not be the key measure though. Belgian banks’ claims on Turkey at less than $1 billion, for example, were much smaller than those of German banks at nearly $13 billion. But relative to total capital, the two banking systems had similar exposures at 2.3% and 2.4% respectively.

The lira was at 6.25 per dollar on Monday and stocks in Istanbul were a fraction lower.

On a brighter note, analysts at Goldman Sachs said on Monday that they thought a “tradable bounce” in EM was now likely following the confidence-boosting hike in Turkey’s interest rates, softer US inflation and signs that China could start stimulating its economy again.

“We still prefer equity as the best positioned asset class for a ‘bounce-back’ and find Brazil, Chile, Peru, Korea, and China offer a good combination,” they said.

Across EM currencies, “value signals (are) most supportive for the South African rand, Brazilian real and the Russian rouble as well.”

Poland got a lift too as global index provider FTSE Russell promoted 37 of the country’s top stocks from its emerging market index to its larger developed market one.

Warsaw’s WIG20 was up 1% on the day taking its gains since June to almost 8%.