Wednesday Feb 18, 2026

Wednesday Feb 18, 2026

Thursday, 19 December 2019 00:56 - - {{hitsCtrl.values.hits}}

Ernst & Young (EY) Sri Lanka conducted an in-depth workshop for the Insurance Sector on IFRS 17 – Insurance Contracts, which are due to come into effect from January 2022. The session was organised to provide insights from explaining the fundamentals of IFRS 17 to practical implementation of the standard. The workshop attracted many finance and actuarial professionals working on implementation of IFRS 17 in their respective companies.

IFRS 17 is set to change the way insurers around the world explain their bottom lines to its shareholders and all other stakeholders. It is also set to fundamentally change insurers for the better, with closer links between actuarial teams and finance. In certain parts of the world, it would also result in changes to the products sold so that they are better aligned with the new accounting standard.

Opening the session, EY Sri Lanka Partner Hiranthi Fonseka indicated that the International Accounting Standards Board (IASB) issued IFRS 17 in 2017 after 20 years in the making. While acknowledging that implementation of IFRS 17 will be a challenging task for insurers, she was confident that it would lead to improved accounting practices, transparency and comparability.

Speaking on the impact for General Insurers (GI), Fonseka mentioned that although a considerable portion of insurance contracts are expected to be eligible for the simplified measurement approach (Premium allocation approach), there would be a number of areas that would still impact the GIs which would require considerable time and effort than anticipated.

Accounting flow and configuration of chart of accounts, treatment of bundled products, identification and measurement of investment components (Cashback, premium refunds), treatment for acquisition expenses and presentation were a few of the highlighted areas.

Commencing the technical session, Fonseka explained the requirements of separation and disaggregation of Investment components with the use of a number of local examples. She highlighted that with IFRS 17 requiring Insurers to exclude investment components from the Insurance revenue, Life insurers are expected to have a significant impact at the top level, considering many life insurance policies sold in the local market contain features that would meet the definition of an investment component.

She also explained that there could be certain features in policies sold by GIs that may require separation and accounting under SLFRS 15. She further pointed out that it would be advantageous for insurers to carry out a thorough product analysis in line with the IFRS 17 requirements in order to understand the impact of the existing policies sold of an insurance entity in its IFRS 17 financial statements.

EY Sri Lanka Senior Manager – Financial Accounting Advisory Services Sahan Gooneratne enlightened the audience on a number of key elements of IFRS 17 which included, level of aggregation decisions, identification of onerous contracts, methods on establishing a discount factor and risk adjustment.

He emphasised that the dynamics of IFRS 17 will not only have implications on the financial statements of an insurer but also have considerable operational impact on the organisation in terms of systems, policies and processes, making C-suite engagement and sponsorship critical for a successful transformation.

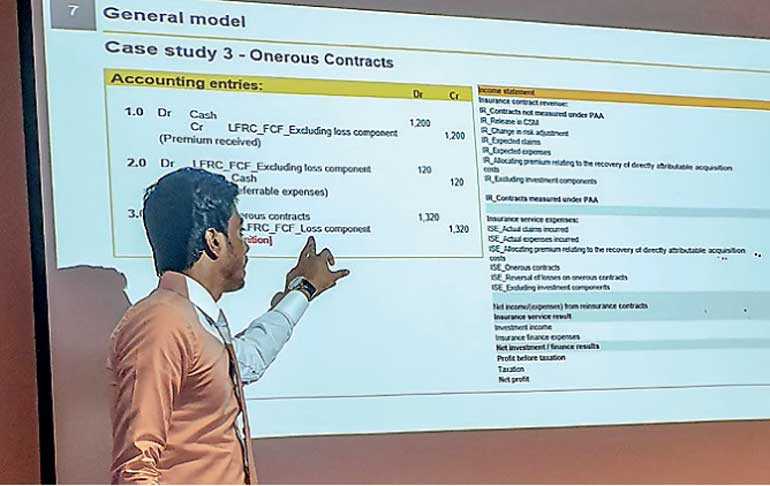

The second half of the session was focused on calculations under the three measurement models, which was led by EY Sri Lanka Manager – Financial Accounting Advisory Services Elamaran Jegadeeswaran. This was seen as the highlight of the program as participants were involved in CSM calculations, journal entry postings and presentation of financial statements under IFRS 17 as case studies.

Towards the latter part of the session the transition approaches were discussed along with the challenges involved in adopting either of the three approaches. Gooneratne also highlighted that life insurance companies that have active policies issued decades back will be required to extract policy inception data if they are to adopt a fully retrospective approach.

He also added that from a business and strategic perspective, entities would have to strike a balance between operational efforts for transition and profitability after transition. The workshop was concluded with an interactive Q&A session.