Tuesday Feb 17, 2026

Tuesday Feb 17, 2026

Friday, 4 October 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

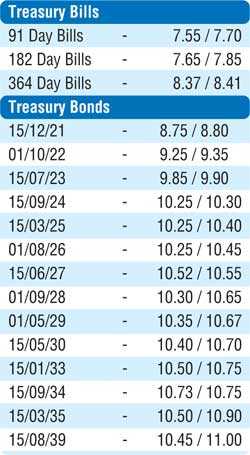

The lethargic sentiment in the secondary bond market continued yesterday with limited trades seen on the two 2021 (i.e. 01.03.21 & 15.12.21), 01.10.22, 15.06.27 and 15.09.34 maturities at levels of 8.60%, 8.79%, 9.30%, 10.55% and 10.74% to 10.77% respectively.

The total secondary market Treasury bond/bill transacted volume for 2 October 2019 was Rs. 9.05 billion.

In the money market, the overnight call money and repo rates averaged 7.46% and 7.51% respectively as the overnight net liquidity surplus increased to Rs. 33.06 billion yesterday.

Rupee appreciates further

In the Forex market, the USD/LKR rate on the spot contract was seen appreciating further yesterday to close the day at Rs. 181.45/65 against its previous day’s closing level of Rs. 181.80/95 on the back of selling interest by banks and export conversions.

The total USD/LKR traded volume for 2 October was $ 35.84 million

Some of the forward USD/LKR rates that prevailed in the market were one month - 182.05/20; three months - 183.25/40 and six months - 184.85/00