Wednesday Mar 04, 2026

Wednesday Mar 04, 2026

Monday, 23 December 2019 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

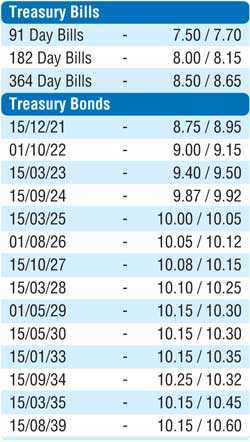

The overall activity in the secondary bond market continued to be dull during the week ending 20 December as yields were seen fluctuating within a narrow range on the back of thin volumes. The limited activity centred on the 15.09.24 and 15.10.27 maturities as its yields were seen increasing to weekly highs of 9.95% and 10.22%, respectively, against its previous weeks closing levels of 9.84/90 and 10.10/15.

However, yields pulled back on Friday, trimming its weeklong increases. In addition, 2023’s (i.e.15.03.23 & 15.07.23), 01.01.24, 15.03.25 and two 2026’s (i.e. 01.06.26 & 01.08.26) were seen changing hands at levels of 9.45% to 9.60%, 9.95% to 10%, 10.05% to 10.10% and 10.12% to 10.14%, respectively, as well.

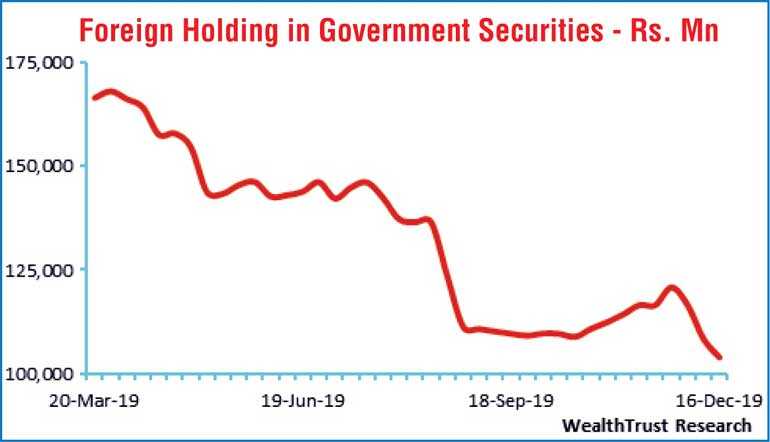

Foreign exodus from rupee bonds for a third consecutive week to the tune of Rs. 4.48 billion for the week ending 18 December, accumulating a total outflow of Rs. 16.86 billion over the past three weeks.

The daily secondary market Treasury bond/bills transacted volume for the first four days of the week averaged Rs. 3.98 billion.

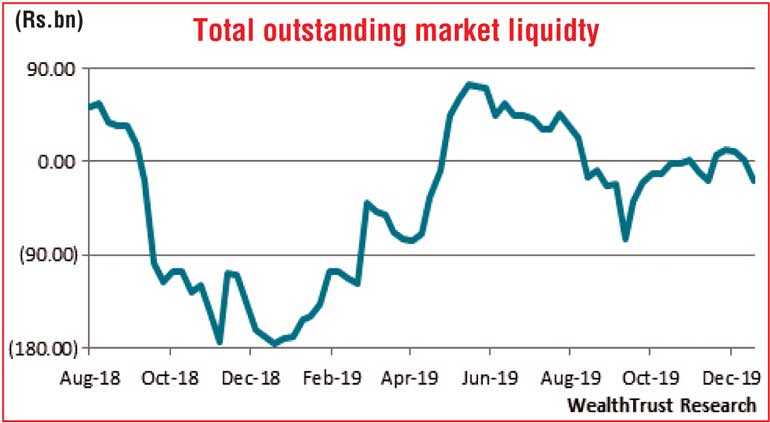

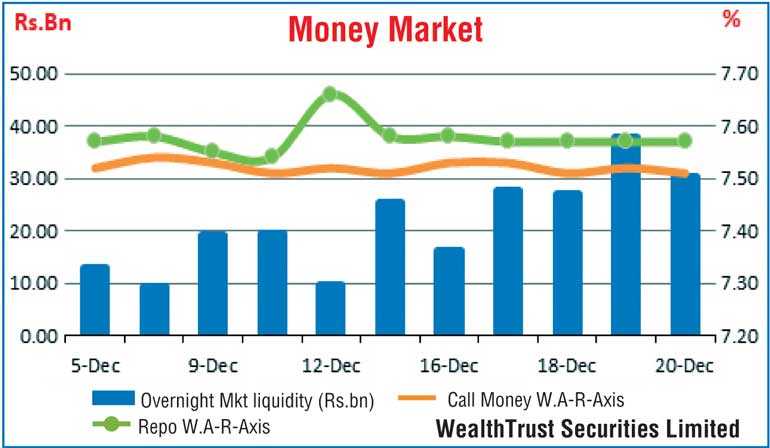

In money markets, the overall liquidity in the system reversed to a deficit of Rs. 18.92 billion against its previous week’s surplus of Rs. 0.82 billion as the Central Bank Open Market Operations (OMO) Department injected liquidity during the week by way of overnight, seven- and 14-day reverse repo auctions at weighted average yields ranging from of 7.48% to 7.56%. Call money and repo rates averaged at 7.52% and 7.57% respectively for the week.

Rupee closes higher

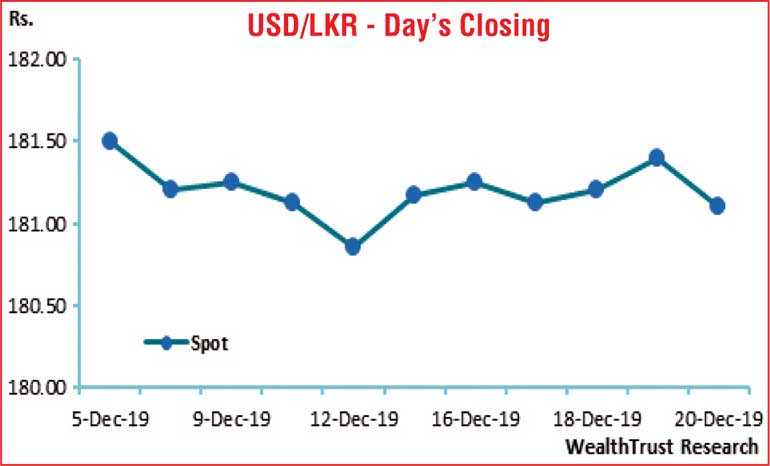

The USD/LKR rate in the Forex market was seen closing the week higher at Rs. 181.05/15 subsequent to dipping to a weekly low of Rs. 181.70 on the back of demand/supply dynamics.

The daily USD/LKR average traded volume for the first four days of the week stood at $ 53.23 million.

Some of the forward dollar rates that prevailed in the market were 1 month – 181.50/65; 3 months – 182.40/60, and 6 months – 184.20/50.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)