Monday Mar 02, 2026

Monday Mar 02, 2026

Thursday, 3 June 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

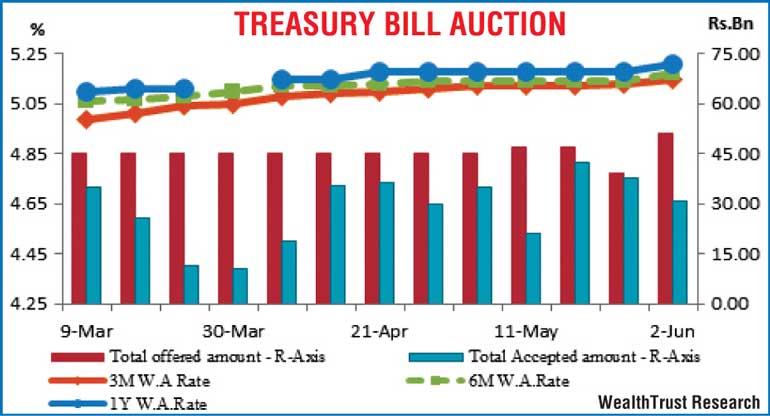

The weekly Treasury bill auction conducted yesterday saw only 60.24% of its total offered volume been accepted against its previous weeks 96.38% as the bids to offer ratio decreased to 1.39:1. The 91 day bill continued to dominate the auction, reflecting 64.18% of the total accepted amount or Rs.19.72 billion followed by the 182 day bill at 35.50%.

The weekly Treasury bill auction conducted yesterday saw only 60.24% of its total offered volume been accepted against its previous weeks 96.38% as the bids to offer ratio decreased to 1.39:1. The 91 day bill continued to dominate the auction, reflecting 64.18% of the total accepted amount or Rs.19.72 billion followed by the 182 day bill at 35.50%.

The demand for the 364 day bill remained at a bare minimum while its weighted average increased by 03 basis points to its new cut off of 5.21%. The weighted average rates on the 91 day and 182 day maturities increased by 02 and 03 basis points respectively as well to 5.15% and 5.17%.

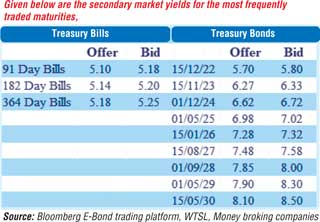

Activity in the secondary bond market increased marginally yesterday as the maturities of 2022’s (i.e. 15.11.22 and 15.12.22), 2023’s (i.e. 15.03.23 & 15.07.23), 01.05.25, 2026’s (i.e. 15.01.26 and 01.02.26) and 15.08.27 changed hands at levels of 5.67% to 5.70%, 5.80%, 6.00%, 6.14%, 7.00%, 7.30% each and 7.53% respectively.

The total secondary market Treasury bond/bill transacted volume for 1 June was Rs. 0.7 billion.

In money markets, the net liquidity surplus was recorded at Rs. 96.96 billion with an amount of Rs. 129.96 billion been deposited at Central Banks SDFR of 4.50% against an amount of Rs. 33.00 billion withdrawn from Central Banks SLFR of 5.50%. The weighted average rates on call money and repo was at 4.72%.

USD/LKR

The Forex market continued to remain inactive yesterday. The USD/LKR rate on cash contracts traded at a level of Rs. 199.99 yesterday.

The total USD/LKR traded volume for 1 June was $ 36.80 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)