Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Tuesday, 28 August 2018 00:00 - - {{hitsCtrl.values.hits}}

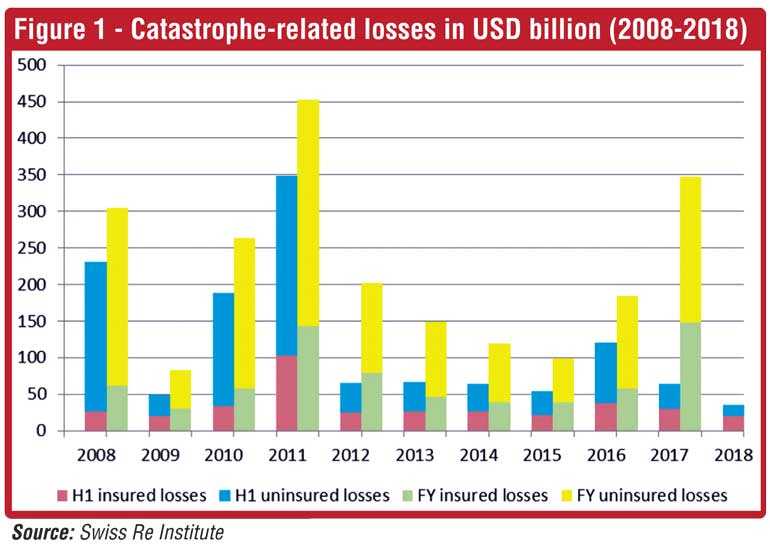

According to Swiss Re Institute’s preliminary sigma estimates, global economic losses from natural catastrophes and man-made disasters in the first half of 2018 were $ 36 billion.

This figure is well below the ten-year average of $ 125 billion in economic losses and significantly lower than the losses reported for the same period a year earlier. Of the total global economic losses in the first half of 2018, $ 20 billion were covered by insurance. A series of winter storms in Europe and in the US caused the largest losses in the first half of 2018. Globally, around 3 900 people lost their lives or went missing in disaster events during the first six months of 2018, compared to approximately 4 600 for the same period in 2017.

Of the $ 36 billion in total global economic losses, natural catastrophes accounted for the majority, or $ 34 billion in the first half of 2018, compared to $ 58 billion in H1 2017. The remaining $ 2 billion of losses were caused by man-made disasters. Global insured losses from natural catastrophes fell to $ 18 billion, from $ 25 billion the year before, while insured losses from man-made disasters decreased to $ 2 billion from $ 5 billion in the first half of 2017. Nearly 56% of all global economic losses were insured as most disastrous events occurred in areas with high insurance penetration.

From a loss perspective, winter storm Friederike in Europe was the costliest event in the first half of 2018. The storm caused significant losses in Germany and the Netherlands, although France, Belgium and the UK were also impacted. Swiss Re Institute’s sigma estimates the total economic losses at $ 2.7 billion. Approximately $ 2.1 billion of these losses were insured.

A series of winter storms in the US, including the “Nor’easter” storm in March, brought heavy snow, ice, freezing rains, and flooding from snowmelt and coastal flooding to large parts of the US, causing total economic losses of $ 4 billion, including $ 2.9 billion in insured losses. The March Nor’easter storm was the largest loss for the insurance industry in the US during the first six months of 2018, with claims of $ 1.6 billion.

A series of convective storms, including thunderstorms, tornadoes and hailstorms hit the US, Europe, and other parts of the world. The costliest event for the insurance industry was a four day spring storm that affected the south eastern states of the US with tornadoes and large hail, resulting in combined insured losses of over $ 1.1 billion.

In addition, major volcanic eruptions in Hawaii and Guatemala, and earthquakes in Japan, Taiwan, and Papua New Guinea have caused damage and not yet fully determined insured losses.

Higher losses may still lie ahead for 2018

Already in the first half of 2018, several parts of the world have been in the grip of heatwaves and severe dry weather conditions, triggering major wildfire outbreaks in California and Greece, and causing widespread drought across Europe and southern Australia. Numerous regions are exposed to above average temperatures and drier weather conditions. Southern Australia, for example, is experiencing its second-driest autumn on record according to the Australian Bureau of Meteorology. Losses from droughts in the agriculture sector and from wildfires are yet to be determined.

Swiss Re’s Head of Catastrophe Perils Martin Bertogg said: “We expect to see more extreme weather conditions such as intense heatwaves and dry spells of the like we’ve seen over the last few weeks. This may well become the new normal. According to scientific climate models, temperature, and atmospheric humidity will increase in many parts of the world, and at the same time also become more volatile.”

“We will experience more variable rain patterns and severe droughts and in consequence raging wildfires. Accelerating urbanisation and the ongoing expansion of dwellings in natural forest areas will considerably exacerbate this loss potential. Society will need to adapt and prepare for these increasing occurrences,” he added.