Wednesday Feb 25, 2026

Wednesday Feb 25, 2026

Friday, 3 March 2023 00:25 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

The bullish rally in the secondary bond market continued yesterday as yields took a nose dive. This was ahead of the 2nd monitory policy announcement for the year 2023 due today at 4.30 pm. The monetary board of the Central Bank of Sri Lanka kept policy rates unchanged at 14.50% and 15.50% on its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) respectively at its previous announcement on the 25th of January 2023.

The bullish rally in the secondary bond market continued yesterday as yields took a nose dive. This was ahead of the 2nd monitory policy announcement for the year 2023 due today at 4.30 pm. The monetary board of the Central Bank of Sri Lanka kept policy rates unchanged at 14.50% and 15.50% on its Standing Deposit Facility Rate (SDFR) and Standing Lending Facility Rate (SLFR) respectively at its previous announcement on the 25th of January 2023.

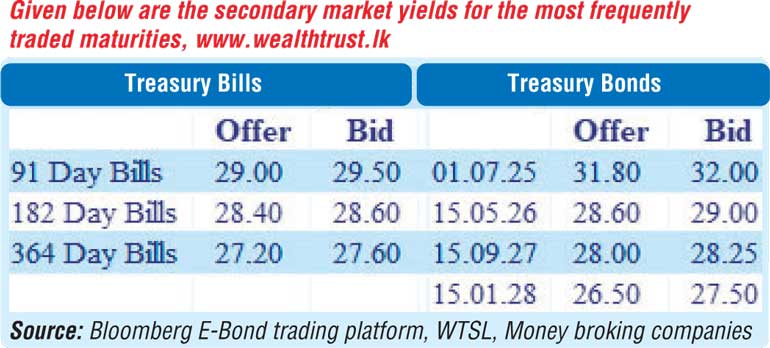

The liquid maturities of 15.05.26 and two 2027’s (i.e. 01.05.27 & 15.09.27) decreased considerably during the day to lows of 29.00% and 28.00% respectively against its previous day’s closing level of 29.30/60 and 28.75/90. In addition, the maturity of 01.07.25 changed hands at a level of 32.00% as well.

In money markets, the weighted average rates on overnight call money and REPO stood at 15.49% and 15.50% respectively while an amount of Rs. 109.85 billion was withdrawn from Central Banks SLFR (Standard Lending Facility Rate) of 15.50%.

Forex Market

In the Forex market, the USD/LKR on cash to spot contracts were traded within the range of Rs. 346.15 to Rs. 347.00 yesterday while the middle rate for USD/LKR spot contracts appreciated further to Rs. 353.6543 against its previous days of Rs. 358.4593.

The total USD/LKR traded volume for 01st March was

$ 113.30 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)