Monday Feb 16, 2026

Monday Feb 16, 2026

Monday, 20 April 2020 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

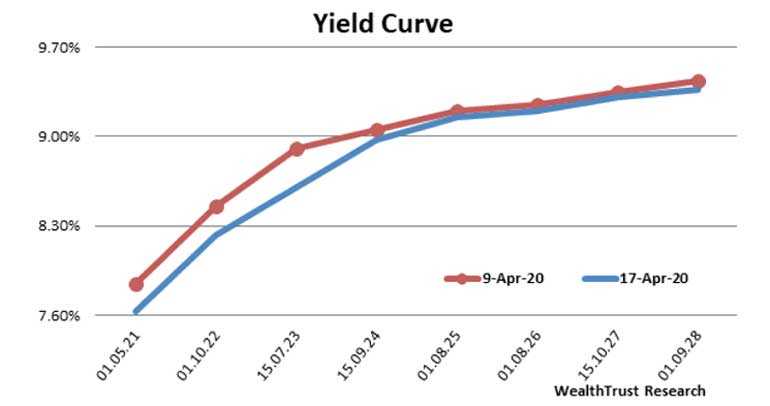

The secondary bond market yields continued its positive momentum during the week ending 17 April as well, to reflect a downward shift of the overall yield curve for a second consecutive week.

The secondary bond market yields continued its positive momentum during the week ending 17 April as well, to reflect a downward shift of the overall yield curve for a second consecutive week.

Aggressive buying interest by local market participants following the news of talks between the Government of Sri Lanka and the International Monetary Fund (IMF) for a Rapid Credit Facility was seen as the main driving factor for the sharp drop in yields.

Activity was centred on the liquid maturities of 01.01.22, 2023s (i.e. 15.03.23, 15.07.23, 01.09.23 and 15.12.23), 2024s (i.e. 15.03.24, 15.06.24, 01.08.24 and 15.09.24), 2025s (i.e. 15.30.25 and 01.08.25) and 15.10.27 with its yields dipping to intraweek lows of 8.28%, 8.51%, 8.58%, 8.63% each, 8.90% each, 9.00%, 8.85%, 9.03%, 9.05% and 9.18% respectively against its previous weeks closing levels of 8.35/55, 8.80/95, 8.85/95, 8.90/00, 8.95/10, 8.95/10, 9.00/10, 9.05/15, 9.00/10, 9.10/25, 9.10/30 and 9.30/40.

However, the week-long drop in yields was trimmed on Friday following Moody’s report on placing Sri Lanka’s B2 ratings on review for downgrades, as yields edged up marginally to hit highs of 9.00%, 9.02%, 9.15% and 9.35% respectively on the maturities of 15.06.24, 15.09.24, 15.03.25 and 15.10.27.

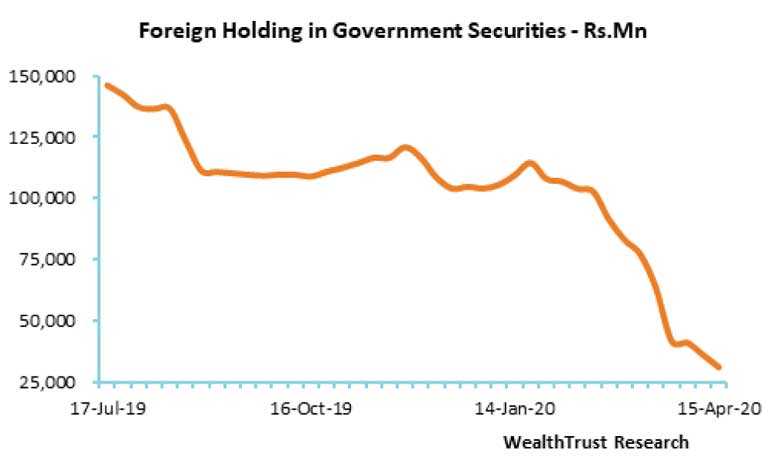

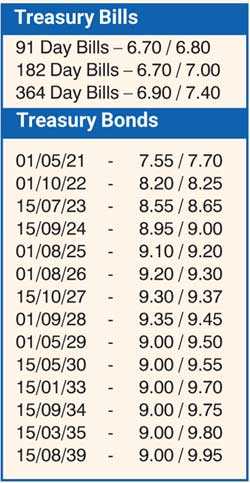

Meanwhile, the weighted average yields at the weekly Treasury bill auctions remained broadly steady in comparison to its previous week’s averages while foreign selling in Rupee bonds continued with an outflow of Rs. 4.96 billion for the week ending 15 April. The overall holding stood at Rs. 31.12 billion.

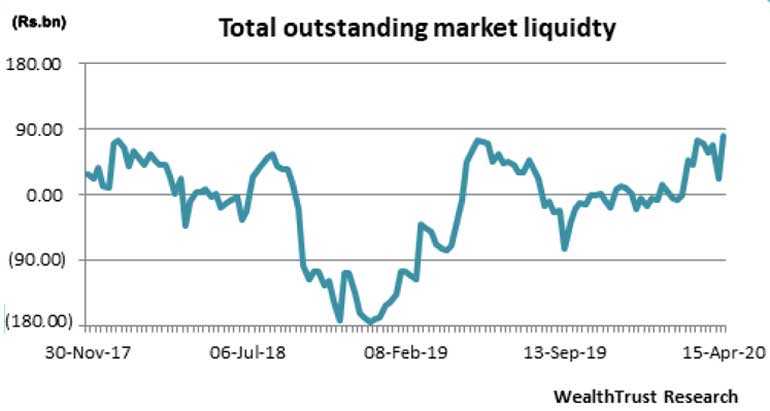

In money markets, the overall net liquidity surplus was seen increasing to Rs. 80.09 billion by the end of the week against its previous weeks of Rs. 21.44 billion. The DOD (Domestic operations Department) of Central Bank injected liquidity during the week by way of (overnight, 13 days and 14 days) reverse repo auctions at weighted average yields ranging from of 6.50% to 7.01%. The overnight call money and repo rates averaged at 6.50% and 6.57% respectively for the week.

USD/LKR

In the Forex market, the USD/LKR rate on spot contracts traded within a steady range of Rs. 191 to Rs. 192 during the week.

The daily USD/LKR average traded volume for the first two days of the week stood at $ 44.43 million.

(References: Central Bank of Sri Lanka, Bloomberg e-bond trading platform, money broking companies)