Monday Feb 16, 2026

Monday Feb 16, 2026

Tuesday, 5 January 2021 00:50 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

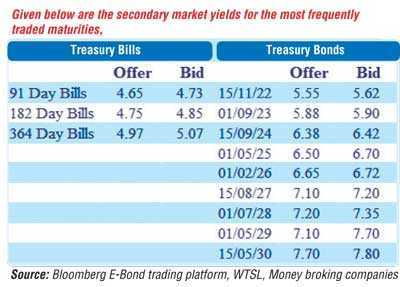

The new trading week commenced on a dull note as activity in the secondary market moderated yesterday. Limited trades were witnessed on the maturities of 01.10.23 and 15.09.24 at levels of 5.93% to 5.95% and 6.38% respectively, while the short-dated bonds and bills, 01.08.21, February, June and September 2021 changed hands at levels 4.80%, 4.68%, 4.74% and 4.75% respectively. The total secondary market Treasury bond/bill transacted volumes for 1 January was Rs. 6.14 billion.

The new trading week commenced on a dull note as activity in the secondary market moderated yesterday. Limited trades were witnessed on the maturities of 01.10.23 and 15.09.24 at levels of 5.93% to 5.95% and 6.38% respectively, while the short-dated bonds and bills, 01.08.21, February, June and September 2021 changed hands at levels 4.80%, 4.68%, 4.74% and 4.75% respectively. The total secondary market Treasury bond/bill transacted volumes for 1 January was Rs. 6.14 billion.

In the money market, overnight call money and repo averaged 4.54% and 4.58% respectively yesterday, while the surplus liquidity stood at Rs. 244.60 billion.

Rupee dips

In the Forex market, activity continued on one-month forward contracts yesterday, as it was seen closing the day at Rs. 191.50/192.50 against its previous day’s closing of Rs. 188.50/189.50, on the back of buying interest by banks.

The total USD/LKR traded volume for 1 January was $ 84.60 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)