Friday Feb 20, 2026

Friday Feb 20, 2026

Wednesday, 19 May 2021 00:00 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities Ltd.

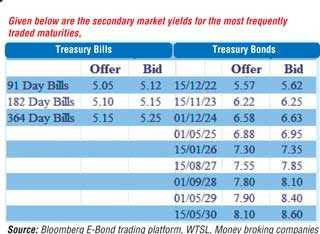

The secondary bond market remained active yesterday as the maturities of 2022’s (i.e. 01.10.22, 15.11.22 & 15.12.22), 2023’s (i.e. 15.05.23, 15.07.23 & 15.11.23) and 2024’s (i.e. 15.09.24 & 01.12.24) changed hands at levels of 5.57%, 5.60%, 5.59% to 5.60%, 6.05%, 6.12% to 6.15%, 6.22%, 6.50% to 6.52% and 6.60% respectively. In addition, maturities of 01.08.25, 2026’s (i.e.15.01.26, 01.02.26 & 01.08.26) changed hands at level of 7.04%, 7.30%, 7.32% and 7.50% as well. Meanwhile in secondary market bills, 30 July 2021 and 1 October 2021 changed hands at levels of 5.01% and 5.13% to 5.15% respectively.

6.05%, 6.12% to 6.15%, 6.22%, 6.50% to 6.52% and 6.60% respectively. In addition, maturities of 01.08.25, 2026’s (i.e.15.01.26, 01.02.26 & 01.08.26) changed hands at level of 7.04%, 7.30%, 7.32% and 7.50% as well. Meanwhile in secondary market bills, 30 July 2021 and 1 October 2021 changed hands at levels of 5.01% and 5.13% to 5.15% respectively.

Today’s bill auction will have on offer a total amount of Rs. 47 billion, consisting of Rs. 12 billion on the 91-day, Rs. 16 billion on the 182-day and Rs. 19 billion on the 364-day maturities. The stipulated cut off rate on the 364-day maturity remained steady at 5.18% for a fifth consecutive week while the maximum yield rates of the 91-day and 182-day maturities will be decided below the level of the 364-day maturity at the auction. At last week’s auction, weighted average rates on all three maturities remained steady at 5.12%, 5.14% and 5.18% respectively.

The total secondary market Treasury bond/bill transacted volume for 17 May was Rs. 7.73 billion.

In the money market, weighted average rates on overnight call money and repo remained mostly unchanged at 4.67% and 4.69% respectively as the overnight surplus liquidity increased marginally to Rs. 116.149 billion yesterday.

USD/LKR

The Forex market continued to remain inactive yesterday while one-month forward contracts saw buying interest at Rs. 199.90.

The total USD/LKR traded volume for 17 May was $ 98.65 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, Money broking companies)