Monday Mar 09, 2026

Monday Mar 09, 2026

Friday, 25 June 2021 02:28 - - {{hitsCtrl.values.hits}}

By Wealth Trust Securities

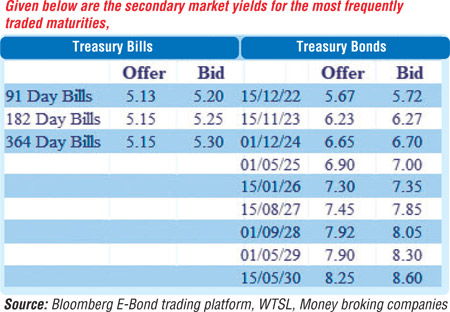

The secondary bond market yields remained mostly unchanged on Wednesday as trading continued at a slow pace. Limited trades were seen on the maturities of 15.12.22 and two 2023s (i.e. 15.03.23 and 15.11.23) at levels of 5.69%, 5.90% and 6.25% respectively. In secondary bills, August, September and December 2021 maturities changed hands at levels of 5.00% to 5.11%, 5.16% to 5.18% and 5.16% to 5.17% respectively.

The secondary bond market yields remained mostly unchanged on Wednesday as trading continued at a slow pace. Limited trades were seen on the maturities of 15.12.22 and two 2023s (i.e. 15.03.23 and 15.11.23) at levels of 5.69%, 5.90% and 6.25% respectively. In secondary bills, August, September and December 2021 maturities changed hands at levels of 5.00% to 5.11%, 5.16% to 5.18% and 5.16% to 5.17% respectively.

The total secondary market Treasury bond/bill transacted volume for 22 June was Rs. 3.6 billion.

In money markets, the overnight net liquidity surplus was seen decreasing to over a two month low of Rs. 77.81 billion as an amount of Rs. 50.06 billion was withdrawn from Central Banks SLFR of 5.50% against an amount of Rs. 127.87 billion deposited at Central Banks SLDR of 4.50%. The weighted average rates on overnight call money and repo was registered at 4.85% and 4.90% respectively.

USD/LKR

In Forex markets, the overall market continued to remain inactive yesterday.

The total USD/LKR traded volume for 22 June was $ 72.15 million.

(References: Central Bank of Sri Lanka, Bloomberg E-Bond trading platform, money broking companies)